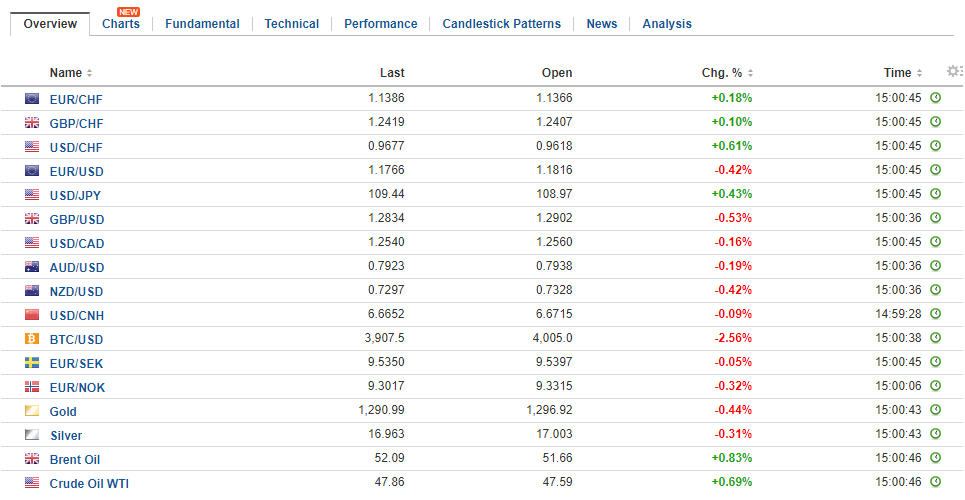

Swiss Franc The Euro has risen by 0.11% to 1.1375 CHF. EUR/CHF and USD/CHF, August 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar has recouped most of yesterday’s declines. However, as we have seen over the past couple of sessions, he North American market appears more dollar negative than Europe or Asia. The dollar’s rise through the European morning has left the intraday technical indicators a bit stretched, warning that this short-term pattern continues today. The euro stalled in front of the .1825 level today which is where a 660 mln euro option expiring today is struck. There is a large 2.3 bln euro strike of .1850 also expiring today, but

Topics:

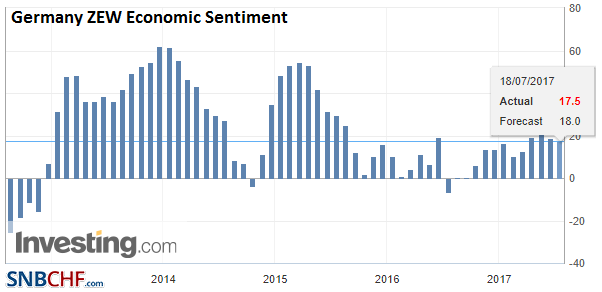

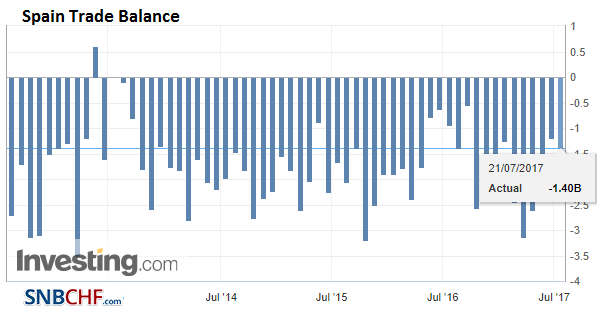

Marc Chandler considers the following as important: AUD, CAD, EUR, EUR/CHF, Eurozone ZEW Economic Sentiment, Featured, FX Trends, GBP, Germany ZEW Economic Sentiment, JPY, newsletter, Spain Trade Balance, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

Swiss FrancThe Euro has risen by 0.11% to 1.1375 CHF. |

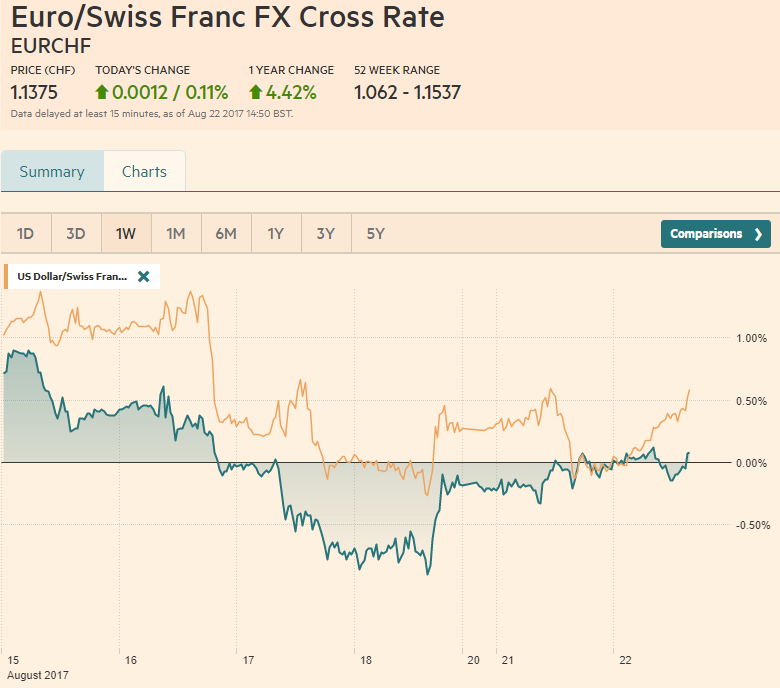

EUR/CHF and USD/CHF, August 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar has recouped most of yesterday’s declines. However, as we have seen over the past couple of sessions, he North American market appears more dollar negative than Europe or Asia. The dollar’s rise through the European morning has left the intraday technical indicators a bit stretched, warning that this short-term pattern continues today.

The euro stalled in front of the $1.1825 level today which is where a 660 mln euro option expiring today is struck. There is a large 2.3 bln euro strike of $1.1850 also expiring today, but does not seem to be in play. The $1.1815 level was a retracement of the euro’s downside correction this month. The direction of a break of yesterday’s near one-cent range (~$1.1730-$1.1830) will likely identify the next move.

|

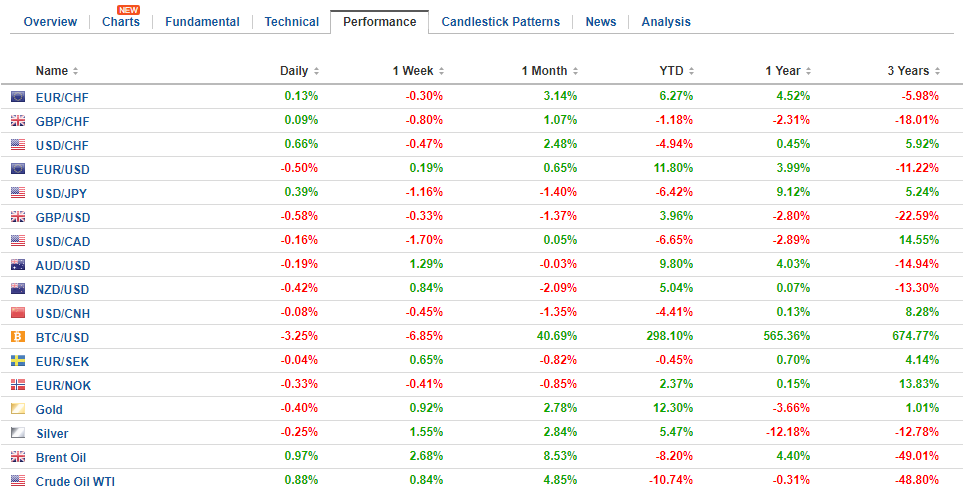

FX Daily Rates, 22 August |

|

The dollar is inside yesterday’s range against the yen as well. Initial resistance is seen near JPY109.60. There is a reasonably good chance that the high for the day has been approached or is already in place. A nearly $800 mln option struck at JPY109 that expires today.

Sterling dropped four cents from its high on August 3 near $1.3265 to a little below $1.2850 on August 15. It has since chopped between $1.2830 and $1.2920. It is toying with the bottom of that range in the European morning. The intraday technical indicators suggest that even if some extension of the range takes place, it is likely to be minor. There is a modest option for GBP265 mln struck at $1.28 that could be a factor.

The dollar-bloc currencies are also heavy today. The US dollar met retracement levels on its recent pullback, off which it is bouncing. For the Canadian dollar, the level was CAD1.2550. There is a $550 mln option struck at CAD1.26 that is in play now. A move above CAD1.26 could spur a move toward CAD1.27 in the coming days. The Australian dollar peaked last week near $0.7965, in front of the $0.7970 retracement objective. A break now of $0.7870-$0.7980 would likely signal the beginning of another leg down.

|

FX Performance, 22 August |

EurozoneEuropean shares are advancing as well. The Dow Jones Stoxx 600 is moving higher for the first time in four sessions. The recovery is being ledby materials, healthcare, and energy. We note that the France CAC gapped higher and has now filled the gain. Since peaking in May, the CAC has surrendered nearly the entire gain scored in the wake of Macron’s initial victory in the first round of the French election back in late April.

Benchmark 10-year bond yields are mostly a little firmer (around a single basis point). Greek bonds are still basking in the recent upgrade by Fitch (B- from CCC, with a positive outlook) and the yield is off another six bp to 5.46%. The other exception is Italy. It is moving in the other direction. The 10-year yield is seven basis points higher at 2.09%. Some reports suggest that there is a focus on next week’s scheduled supply and unwinding of carry positions ahead of Draghi’s speech tomorrow (before going to Jackson Hole).

There also may be interest stemming from a weekend interview with Berlusconi, who is enjoying a bit of a revival in the Italian political scene. He supports the idea of a parallel currency, which in itself may not be so surprising, but in the current context, it is troublesome for many investors who see next year’s Italian election as the next significant political risk in Europe.

|

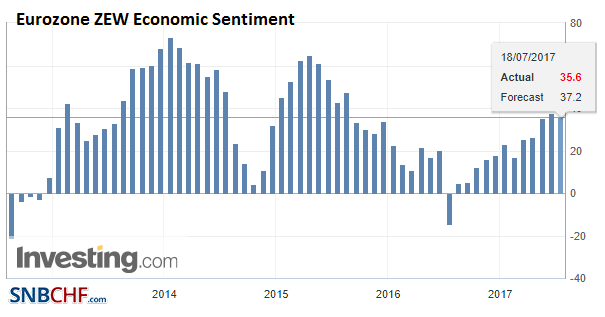

Eurozone ZEW Economic Sentiment, 2013-2017(see more posts on Eurozone ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

GermanyThe economic calendar remains light. The German IFO showed strong assessment of current conditions and easing future expectations. It can be filed as this is the best it may get. Canada reports June retail sales today. A 0.2% rise is expected after a 0.6% gain in May. Canada has been reporting strong retail sales. The monthly average in the first five months has been 0.8%. Last year, the average monthly increase was 0.5%. In comparison, through July US retail sales have risen by an average of 0.2% a month. Last year, they rose 0.3% on average. The US calendar is devoid of market moving data.

|

Germany ZEW Economic Sentiment, 2013-2017(see more posts on Germany ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

Spain |

Spain Trade Balance, Jul 2013-2017(see more posts on Spain Trade Balance, ) Source: Investing.com - Click to enlarge |

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,EUR/CHF,Eurozone ZEW Economic Sentiment,Featured,Germany ZEW Economic Sentiment,newsletter,Spain Trade Balance,USD/CHF