It is not easy to recall another week in which there were so many potential changes to the broad investment climate. The relatively light economic calendar in the week ahead may allow investors to continue to ruminate about some of those developments. Here we provide thumbnail assessments of the main drivers. China The PBOC modified the way the reference rate is set. Currencies are allowed to trade in a band around...

Read More »Emerging Markets: Preview of the Week Ahead

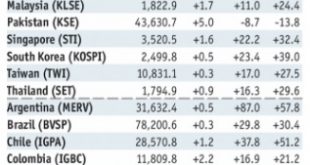

Stock Markets EM FX continues to rally as the dollar remains on its back foot. With no obvious drivers this week that might help the dollar, we believe EM FX can extend the recent gains. Still, we continue to advise caution when investing in EM, as differentiation should again become evident as idiosyncratic risks remain in play. Stock Markets Emerging Markets, January 10 Source: economist.com - Click to enlarge...

Read More »Chinese bitcoin mining giant sets up Swiss hub

One of the world’s largest bitcoin miners is setting up a hub for European operations in Switzerland, a person familiar with company has confirmed to swissinfo.ch. The Chinese firm Bitmain Technologies is setting up in Zug just as the Chinese authorities move to shut down cryptocurrency miners. Bitmain Technologies builds and supplies machines for bitcoin mining and runs its super-scale mine in China. The company set...

Read More »The number of people on welfare continues to rise in Switzerland

In 2016, around 273,000 people, 3.3% of the population, received welfare in Switzerland. The number (not the rate) was 2.9% higher than the year before and 15.7% higher than 5 years earlier when the rate was 3.0%. Neuchâtel, the canton with the highest rate of beneficiaries © Olga Demchishina | Dreamstime.com - Click to enlarge Rates of those receiving government aid varied significantly by canton, ranging from 0.8% in...

Read More »Swiss want only five bilateral treaties under EU framework agreement

Switzerland recently suffered a setback in the negotiations when the EU decided to restrict Swiss stock exchange access to the EU market for a year (Keystone) - Click to enlarge According to an unpublished list that was revealed in some Swiss papers, Switzerland wants only five of around 120 bilateral treaties with the European Union to figure in a future institutional framework agreement. A reportexternal...

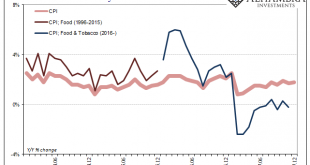

Read More »Inflation Correlations and China’s Brief, Disappointing Porcine Nightmare

Two years ago, China was gripped by what was described as an epic pig problem. For most Chinese people, pork is a main staple so rapidly rising pig prices could have presented a serious challenge to an economy already at that time besieged by massive negative forces. It was another headache officials in that country really didn’t need. For economists and the media, however, China’s possible porcine nightmare was...

Read More »Emerging Markets: What Changed

Summary China State Administration of Foreign Exchange (SAFE) disputed press reports that it was slowing or halting purchases of US Treasury bonds. Korean officials warned that it will take stern steps to prevent one-sided currency moves. Bulgaria is talking “intensively” with the ECB and other EU representatives about entering the Exchange Rate Mechanism by mid-year. Hungary announced general elections on April 8....

Read More »Swiss companies leaking executives abroad

The Ammann Group is one of many Swiss companies to recently announce it will be moving jobs abroad (Keystone) Multinational companies based in Switzerland are increasingly moving experienced executives abroad to run production sites in lower-cost countries, according to a jobs placement company. The trend has been blamed on regulatory uncertainty in the Swiss marketplace. There have been concerns at Swiss companies...

Read More »Great Graphic: Euro Monthly

The euro peaked in July 2008 near $1.6040. It was a record. The euro has trended choppily lower through the end of 2016 as this Great Graphic, created on Bloomberg, illustrates. We drew in the downtrend line on the month bar chart. The trend line comes in a little below $1.27 now and is falling at about a quarter cent a week, and comes in near $1.26 at the end of February. The $1.26 area also corresponds to a 61.8%...

Read More »Gold Hits All-Time Highs Priced In Emerging Market Currencies

Gold Hits All-Time Highs Priced In Emerging Market Currencies – Gold at all time in eight major emerging market currencies– A stronger performance than seen when priced in USD, EUR or GBP– As world steps away from US dollar hegemony expect new gold highs in $, € and £ – Gold is a hedge against currency debasement and depreciation of fiat currencies Gold Prices in Emerging Markets Currencies, 2010 - 2018(see more posts...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org