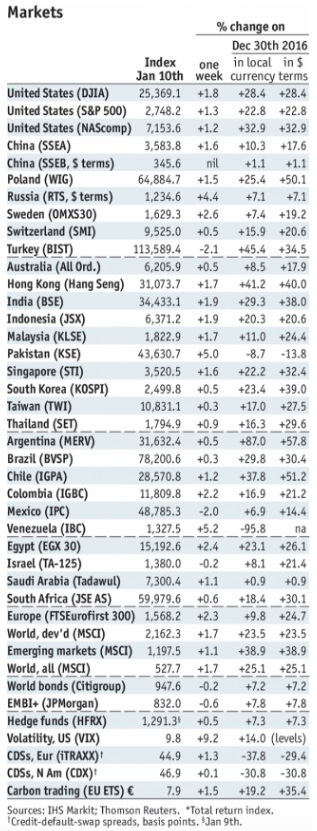

Stock Markets EM FX continues to rally as the dollar remains on its back foot. With no obvious drivers this week that might help the dollar, we believe EM FX can extend the recent gains. Still, we continue to advise caution when investing in EM, as differentiation should again become evident as idiosyncratic risks remain in play. Stock Markets Emerging Markets, January 10 Source: economist.com - Click to enlarge Indonesia Indonesia reports December trade data Monday. Exports are expected to rise 13.7% y/y and imports by 18.0% y/y. Bank Indonesia then meets Thursday and is expected to keep rates steady at 4.25%. CPI rose 3.6% y/y in December, below the 4% target but within the 3-5% target range. Price pressures

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX continues to rally as the dollar remains on its back foot. With no obvious drivers this week that might help the dollar, we believe EM FX can extend the recent gains. Still, we continue to advise caution when investing in EM, as differentiation should again become evident as idiosyncratic risks remain in play. |

Stock Markets Emerging Markets, January 10 Source: economist.com - Click to enlarge |

IndonesiaIndonesia reports December trade data Monday. Exports are expected to rise 13.7% y/y and imports by 18.0% y/y. Bank Indonesia then meets Thursday and is expected to keep rates steady at 4.25%. CPI rose 3.6% y/y in December, below the 4% target but within the 3-5% target range. Price pressures are rising, however, and should keep BI on hold for now. IndiaIndia reports December WPI Monday, which is expected to rise 4.0% y/y vs. 3.93% in November. Last Friday, CPI came in at 5.2% y/y vs. 5.1% expected. This is the highest rate since July 2016 and further above the 4% target, though still within the 2-6% range. We think markets should forget about any more RBI easing for the time being. Next policy meeting is February 7, no changes expected. BrazilBrazil reports November GDP proxy Monday. It is expected to rise 2.5% y/y vs. 2.9% in October. The recovery continues, but price pressures are rising. COPOM signaled a willingness to ease further, and so markets are looking for a 25 bp cut to 6.75% at the next policy meeting February 7. PolandPoland reports November trade and current account data Monday. It then reports December industrial and construction output, real retail sales, and PPI Friday. All are expected to slow significantly from November. Inflation eased in December, and so recent data support the central bank’s forward guidance of no rate hikes in 2018. Next policy meeting is February 7, no change is expected. IsraelIsrael reports December CPI Monday, which is expected to rise 0.4% y/y vs. 0.3% in November. The central bank just left rates steady last week, as the bar for further easing is very high. Instead, Governor Flug complained about the strong shekel. A weaker currency is the central bank’s only lever right now to stimulate the economy and so continued intervention is likely. SingaporeSingapore reports December trade Wednesday. NODX are expected to rise 9.4% y/y vs. 9.1% in November. CPI rose only 0.6% y/y in November. While the MAS does not have an explicit inflation target, low price pressures should allow it to maintain steady policy at its April meeting. Still, the economic data has been strong and so there is a chance of a hawkish surprise. South AfricaSouth Africa reports November retail sales Wednesday, which are expected to rise 3.8% y/y vs. 3.2% in October. SARB meets Thursday and is expected to keep rates steady at 6.75%. A couple of analysts look for 25-50 bp of easing. CPI rose 4.6% y/y in November, well within the 3-6% target range. We see risk of a dovish surprise, especially if the rand remains firm. RussiaRussia reports November trade and Q4 current account data Wednesday. The external accounts are in solid shape and should improve further as oil prices rise. A stronger ruble would likely give the central bank more confidence in easing further. Next policy meeting is February 9, and another 25 bp cut to 7.5% is likely. ChinaChina reports Q4 GDP Thursday, which is expected to grow 6.7% y/y vs. 6.8% in Q3. It also reports December IP and retail sales, which are expected to grow 6.1% y/y and 10.2% y/y, respectively. Markets remain comfortable with China’s macro outlook, and should not be concerned about the recent tweak to the CNY fix mechanism. KoreaBank of Korea meets Thursday and is expected to keep rates steady at 1.5%. CPI rose 1.5% y/y in December, well below the 2% target. Yet that didn’t stop the BOK from hiking 25 bp at its November meeting. Next policy meeting is January 18, no change is expected then. TurkeyCentral Bank of Turkey meets Thursday and is expected to keep all rates steady. CPI rose 11.9% y/y in December, down from the peak but still way above the 3-7% target range. However, the firmer lira will likely give the bank confidence to hold off on another hike this month. ColombiaColombia reports November IP and retail sales Thursday. IP is expected to contract -2.6% y/y vs. -0.3% in October. With the economy so weak and the peso so strong, we think the central bank will continue easing. Next policy meeting is January 29, and another 25 bp cut to 4.5% seems likely after it paused in December. |

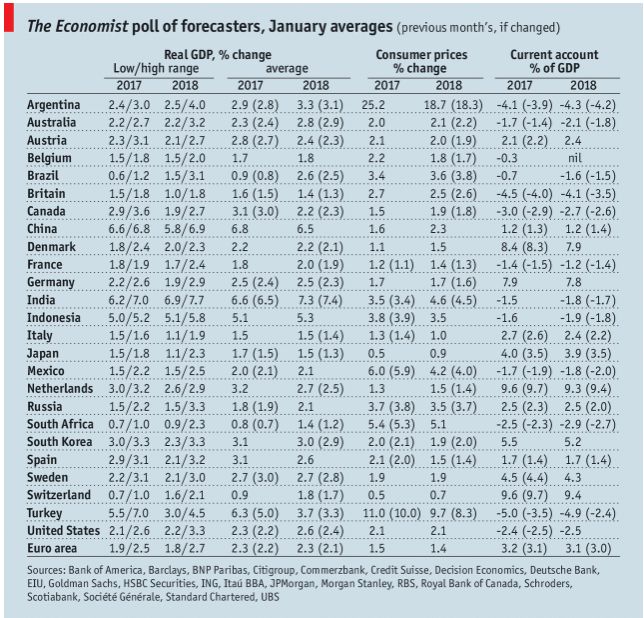

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, January 2018 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin