Gold bullion tends to rise January and February before Chinese New Year (see table) Gold is nearly 8% and $100 higher since Fed raised rates one month ago Options traders are bullish and suggest gold has room to run (see chart) Nervous in short term, positive in medium term – gold at $1,500 in 2018 From Bloomberg: Gold’s breakneck rally eased this week, but tailwinds in both physical and paper markets suggest it’s...

Read More »The Blatant Dishonesty of the ‘Boom’

Why do humans tend to behave in herds? It’s a fundamental question that only recently have researchers been able to better understand. On the one hand, it doesn’t take an advanced degree in some neurological science to see the basis behind it; survival for our ancestors often meant getting along with the crowd. There are times when that very trait applies still. In 2009, neurologists in the UK conducted function...

Read More »U.S. Unemployment: The Dissonance Book

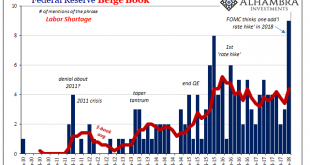

I’ve found the word “dissonance” has become more common in regular usage beyond just my own. Whether that’s a function of my limited observational capacities or something more meaningful than personal bias isn’t at all clear. Still, the word does seem to fit in economic terms more and more as we carry on uncorrected by meaningful context. The Buffalo News reported this week the results of M&T Bank’s survey of...

Read More »Punch-Drunk Investors & Extinct Bears, Part 2

Rydex Ratios Go Bonkers, Bears Are Dying Off For many years we have heard that the poor polar bears were in danger of dying out due to global warming. A fake photograph of one of the magnificent creatures drifting aimlessly in the ocean on a break-away ice floe was reproduced thousands of times all over the internet. In the meantime it has turned out that polar bears are doing so well, they are considered a quite...

Read More »SNB Rejects Vollgeld and Questions ‘Reserves for All’

In the NZZ, Peter Fischer reports that SNB president Thomas Jordan rejects the Vollgeld initiative and stops short of endorsing the ‘reserves for all’ proposal. … wehrt sich die Nationalbank auch gegen Vorschläge aus akademischen Kreisen, die von der Nationalbank fordern, nicht mehr nur Banken, sondern auch direkt den Schweizer Bürgern elektronisches Zentralbankgeld zur Verfügung zu stellen. Am einfachsten ginge dies,...

Read More »FX Daily, January 17: Dollar Stabilizes After Marginal New Lows

Swiss Franc The Euro has risen by 0.04% to 1.1766 CHF. EUR/CHF and USD/CHF, January 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After a shallow bounce in Asia and Europe yesterday, the dollar slipped lower in North American yesterday. Asia was happy to extend those dollar losses, and the greenback was pushed to marginal new lower in Asia, but has come back in the...

Read More »Great Graphic: Treasury Holdings

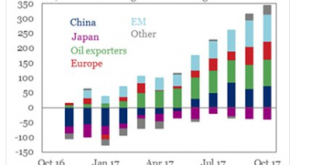

The combination of a falling dollar and rising US interest rates has sparked a concern never far from the surface about the foreign demand for US Treasuries. Moreover, as the Fed’s balance sheet shrinks, investors will have to step up their purchases. This Great Graphic was created by the Institute of International Finance (IIF). It is drawn from the US TIC data that tracks foreign holdings of US Treasuries. The most...

Read More »Punch-Drunk Investors & Extinct Bears, Part 1

The Mother of All Blow-Offs We didn’t really plan on writing about investor sentiment again so soon, but last week a few articles in the financial press caught our eye and after reviewing the data, we thought it would be a good idea to post a brief update. When positioning and sentiment reach levels that were never seen before after the market has gone through a blow-off move for more than a year, it may well be that...

Read More »Retail Sales, Consumer Sentiment, And The Aftermath Of Hurricanes

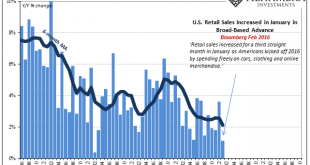

Consumer confidence has been sky-high for some time now, with the major indices tracking various definitions of it at or just near highs not seen since the dot-com era. Economists place a lot of emphasis on confidence in all its forms, including that of consumers, and there is good reason for them to do so; or there was in the past. Spending and consumer sentiment used to track each other very closely and in terms of...

Read More »The Dea(r)th of Economic Momentum

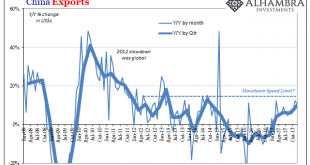

For the fourth quarter as a whole, Chinese exports rose by just less than 10% year-over-year. That’s the highest quarterly rate in more than three years, up from 6.3% and 6.0% in Q2 2017 and Q3, respectively. That acceleration is, predictably, being celebrated as a meaningful leap in global economic fortunes. Instead, it highlights China’s grand predicament, one that country just cannot seem to escape. China Exports,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org