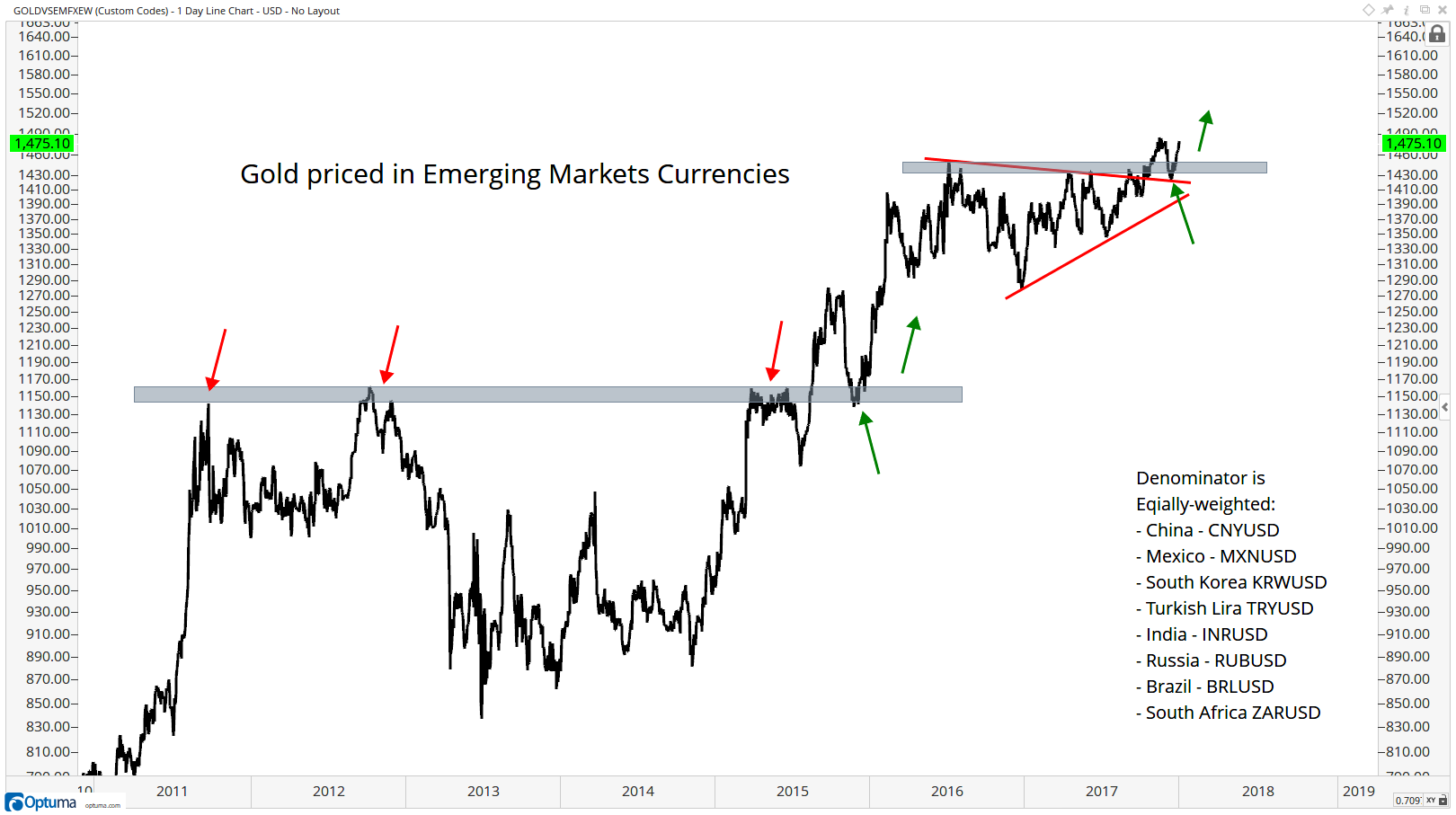

Gold Hits All-Time Highs Priced In Emerging Market Currencies – Gold at all time in eight major emerging market currencies– A stronger performance than seen when priced in USD, EUR or GBP– As world steps away from US dollar hegemony expect new gold highs in $, € and £ – Gold is a hedge against currency debasement and depreciation of fiat currencies Gold Prices in Emerging Markets Currencies, 2010 - 2018(see more posts on Gold prices, )Source: allstarcharts.com h/t @DominicFrisby - Click to enlarge When we talk about the gold price we all too often focus on it priced in US dollars, with some frequent glances to Sterling and Euro as well. This is understandable, after all these are the currencies the majority of

Topics:

Jan Skoyles considers the following as important: Bitcoin, Daily Market Update, Featured, gold prices, GoldCore, newsletter, S&P 500, S&P 500

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Gold Hits All-Time Highs Priced In Emerging Market Currencies

– Gold at all time in eight major emerging market currencies |

Gold Prices in Emerging Markets Currencies, 2010 - 2018(see more posts on Gold prices, ) |

| When we talk about the gold price we all too often focus on it priced in US dollars, with some frequent glances to Sterling and Euro as well. This is understandable, after all these are the currencies the majority of readers buy and sell in. The US dollar price is also the one which is most universally quoted.

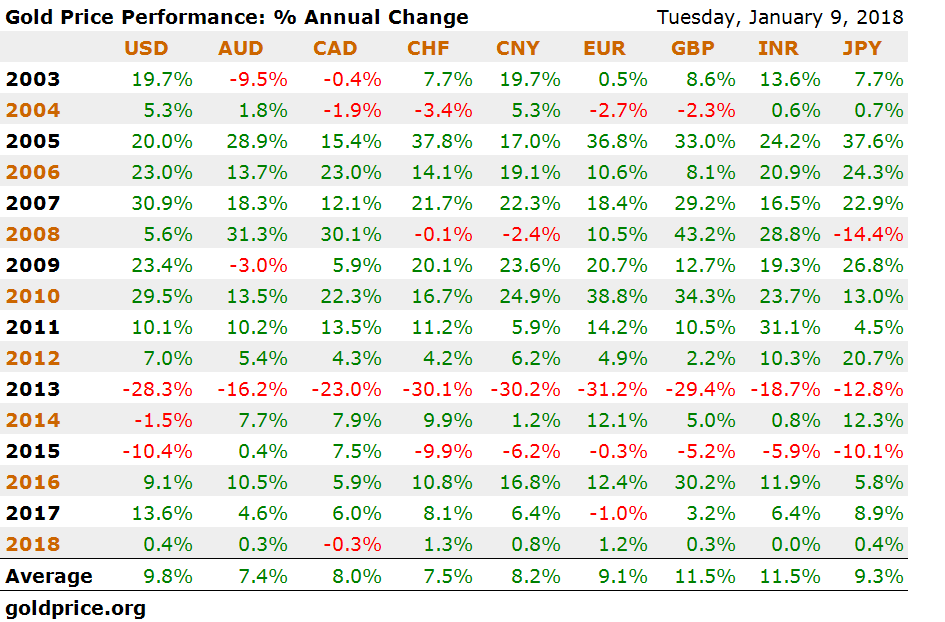

However this approach ends up giving us a very skewed perspective of the gold market and price behaviour.It is arguably an old fashioned approach in a very globalised world. The relationship between gold and the US dollar is one which is rooted in the Bretton Woods agreement, something which was scrapped in 1971. Today the gold price and the gold market is international, with far more interest in physical gold being paid by the emerging markets. One just has to look at the gold buying policies of Russia and China to see this. In the long term, gold has performed very well in dollar, sterling, euro and all fiat currencies with gains of between 7% and 12% per annum over a 15 year period. Gains in emerging market currencies have been even greater. |

Gold Price Performance, 2003 - 2018(see more posts on Gold prices, ) |

| Very often a change in the price of gold is a reflection in the change of the value of the currency in which you are choosing the quote the price. This has certainly be the case in the last year or so when it comes to gold bullion priced in the US dollar.

In 2017, gold’s dollar price was far more reflective of the dominant world currency’s perceived value than it was of other global events such as inflation, the threat of nuclear war etc. So when the price of gold changes it is how it is perceived in relation to that currency and (more importantly) how that currency is behaving against other currencies. Gold is a currency and clearly one of the most important safe havens and alternatives to the greenback. We see this with other currencies such as the Yen and the euro. So whilst gold might be a bet against the value of the US dollar it is also a safe haven against global risks and a hedge against currency devaluation. This is of particular interest when we consider the above chart. Eight emerging market currencies and currently experiencing all time high gold prices. This gives a perspective of the gold market through a lens that we don’t usually see from a Western perspective. This perspective shows a totally different gold market – one which is at all time highs. Is this a gold market that is perhaps reflecting the true risk in the global system? The above chart was created by allstarcharts.com and was accompanied by this analysis:

The above chart and table show us what the bigger picture is telling us. rather than the gold price in just one currency. Gold has had an excellent twelve months when priced in the dollar and it has protected those with dollar assets from the further depreciation of the dollar seen in 2017. However, gold’s hedging benefits were more clearly seen in emerging market currencies which continued to lose value in 2017. That picture is perhaps suggesting that emerging markets and those interested in their currencies do not see a world which is in an American led so called recovery. The emerging market gold chart shows a picture of a world which is far more diverse and takes gold’s role as both a currency and safe haven more seriously and gold is acting as a hedge against currency devaluation again. Western investors and savers would be prudent to follow the diversification lead of Indian housewives and the People’s Bank of China and own physical gold. The charade of US dollar hegemony is not going to continue for much longer and all currencies including the euro and the pound are vulnerable to further debasement and depreciation in the coming months and years. |

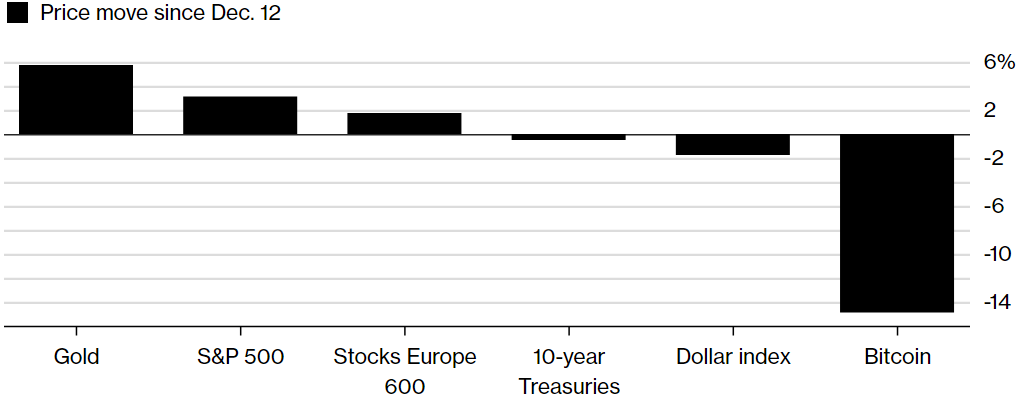

Gold Price, S&P 500, Stocks Europe 600, Treasuries, Dollar Index and Bitcoin price(see more posts on Bitcoin, Gold prices, S&P 500, ) |

Tags: Bitcoin,Daily Market Update,Featured,Gold prices,newsletter,S&P 500