The Vote Buying Mirror Our readers are probably aware of the influence the US election cycle has on the stock market. After Donald Trump was elected president, a particularly strong rally in stock prices ensued. Contrary to what many market participants seem to believe, trends in the stock market depend only to a negligible extent on whether a Republican or a Democrat wins the presidency. The market was e.g. just as...

Read More »UBS-Präsident Axel Weber wird sein blaues Wunder erleben – mit der Zahlungsunfähigkeit der SNB

- Click to enlarge Axel Weber hat zwei Seelen in seiner Brust: eine als Ex-Notenbanker, eine als UBS-Präsident. Als Präsident der Deutschen Bundesbank hatte der Deutsche Weber gesagt, es gäbe keine Einlösungsverpflichtung der Deutschen Bundesbank für eine Banknote. „Wirtschaftlich gesehen sind unsere Banknoten eine Verbindlichkeit des Eurosystems. Dabei handelt es sich aber eher um eine abstrakte Verpflichtung. Wer...

Read More »FX Daily, January 10: Yen Short Squeeze Extended

Swiss Franc The Euro has risen by 0.31% to 1.1725 CHF. EUR/CHF and USD/CHF, January 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Sparked by fears that the BOJ took a step toward the monetary exit by reducing the amount of long-term bonds it is buying, there is an apparent scramble to cover previously sold yen positions. The dollar finished last week near JPY113.00....

Read More »Trade Unions Call for Fewer Hours, More Gender Equality

Employees should also benefit from increased productivity, say trade unions. Pictured here is the dishwasher assembly line at the V-ZUG factory in Zug, Switzerland. (© KEYSTONE / GAETAN BALLY) The Swiss Trade Union Federation is demanding shorter work weeks, compensation for pension losses and enforcement of equal pay for men and women. At its annual media conference in Bern on Thursday, the Swiss Trade Union...

Read More »10 Reasons Why You Should Add To Your Gold Holdings

10 Reasons Why You Should Add To Your Gold Holdings – Gold currently undervalued– Since 2000, the gold price has beaten the S&P 500 Index– A ‘a once-in-a-decade opportunity’ as gold-to-S&P 500 ratio is at its lowest point in 10 years.– Reached ‘peak gold’ as exploration budgets continue to tighten– $80 trillion sits in global equities, a ‘ticking time bomb’ – Gold remains an appealing diversifier in the current...

Read More »The Reluctant Labor Force Is Reluctant For A Reason (and it’s not booming growth)

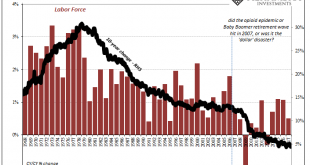

In 2017, the BLS estimates that just 861k Americans were added to the official labor force, the denominator, of course, for the unemployment rate. That’s out of an increase of 1.4 million in the Civilian Non-Institutional Population, the overall prospective pool of workers. Both of those rises were about half the rate experienced in 2016. While population growth slowed last year, it produced, apparently, an almost...

Read More »Switzerland: Inflation at a seven-year high

According to the Swiss Federal Statistical Office (FSO), consumer prices in Switzerland remained broadly stable at 0.8% y-o-y in December, in line with consensus expectations, meaning that Swiss inflation stayed at its highest rate in almost seven years at the end of 2017. Core inflation (headline CPI excluding food, beverages, tobacco, seasonal products, energy and fuels) rose slightly from 0.6% y-o-y in November to...

Read More »Swiss National Bank expects annual profit of CHF 54 billion

- Click to enlarge Confederation and cantons to receive distribution of at least CHF 2 billion According to provisional calculations, the Swiss National Bank (SNB) will report a profit in the order of CHF 54 billion for the 2017 financial year. The profit on foreign currency positions amounted to CHF 49 billion. A valuation gain of CHF 3 billion was recorded on gold holdings. The net result on Swiss franc positions...

Read More »FX Daily, January 09: Dollar Correction Extended

Swiss Franc The Euro has risen by 0.31% to 1.1725 CHF. EUR/CHF and USD/CHF, January 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar’s upside correction that began before the weekend has been extended in Asia and Europe today. The main exception is the Japanese yen. The yen’s modest gains have been registered despite the firmness in US rates and continued...

Read More »Quantum Change in Gold Demand Continues – Precious Metals Supply-Demand Report

Beginning of Post: See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Fundamental Developments In this New Year’s holiday shortened week, the price of gold moved up again, another $16 and silver another 29 cents. Or we should rather say the dollar moved down 0.03mg gold and 0.03 grams silver. It will make those who borrow to short the dollar happy… Let’s take a look at...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org