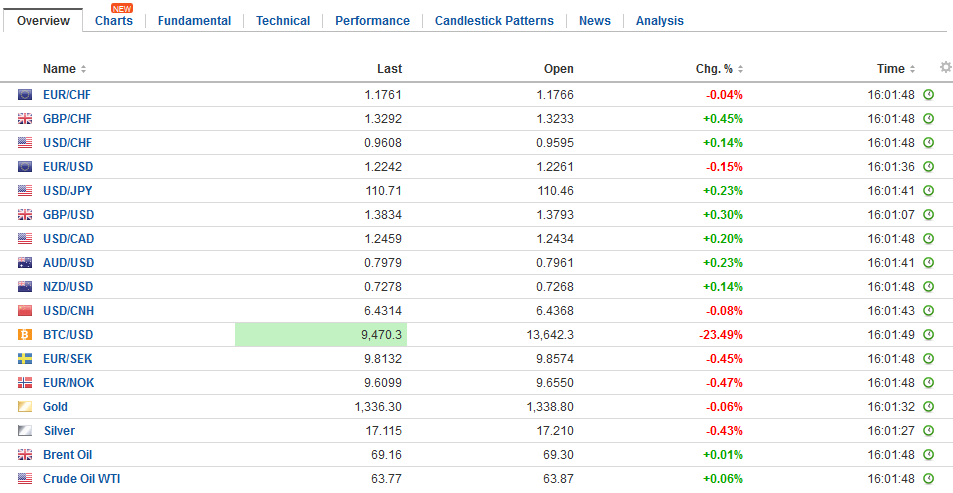

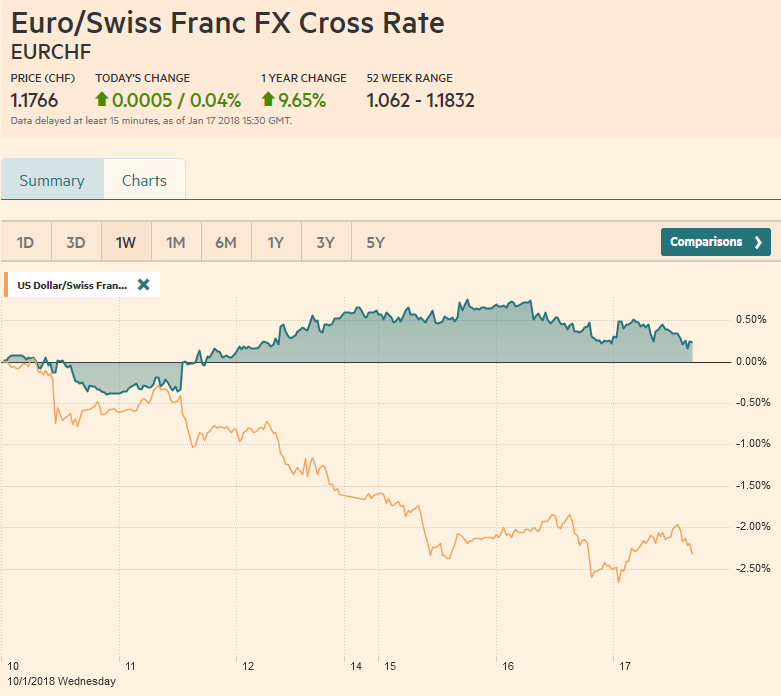

Swiss Franc The Euro has risen by 0.04% to 1.1766 CHF. EUR/CHF and USD/CHF, January 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After a shallow bounce in Asia and Europe yesterday, the dollar slipped lower in North American yesterday. Asia was happy to extend those dollar losses, and the greenback was pushed to marginal new lower in Asia, but has come back in the European session. The next result is a choppy but flattish consolidation compared with last week’s closing prices. There does seem to be a risk-off impulse today. US S&P 500 and NASDAQ gapped higher yesterday, but proceeded to fill the gap and continued to retreat. Asian equities slipped, with the

Topics:

Marc Chandler considers the following as important: CAD, EUR, Eurozone Consumer Price Index, Eurozone Core Consumer Price Index, Featured, FX Trends, GBP, Japan Core Machinery Orders, JPY, newsletter, Oil, SPY, U.S. Capacity Utilization Rate, U.S. Industrial Production, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.04% to 1.1766 CHF. |

EUR/CHF and USD/CHF, January 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

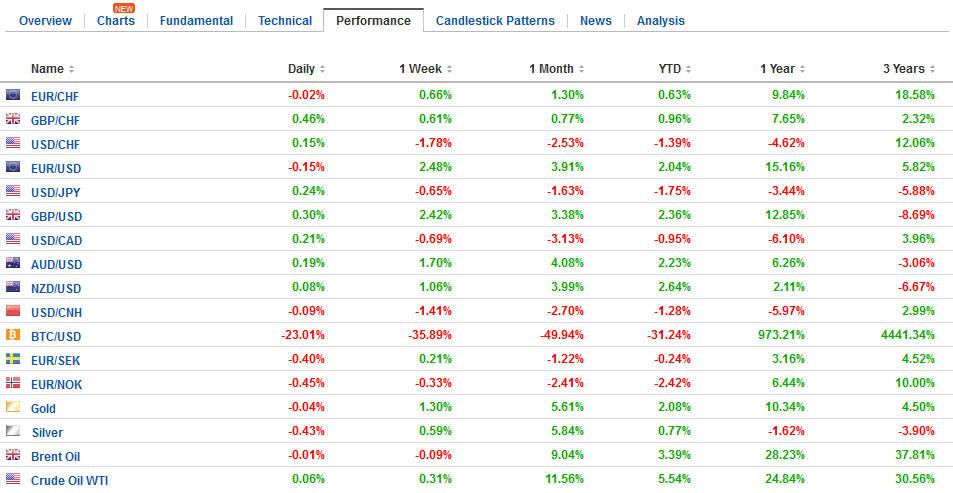

FX RatesAfter a shallow bounce in Asia and Europe yesterday, the dollar slipped lower in North American yesterday. Asia was happy to extend those dollar losses, and the greenback was pushed to marginal new lower in Asia, but has come back in the European session. The next result is a choppy but flattish consolidation compared with last week’s closing prices. There does seem to be a risk-off impulse today. US S&P 500 and NASDAQ gapped higher yesterday, but proceeded to fill the gap and continued to retreat. Asian equities slipped, with the MSCI Asia Pacific Index posting a minor loss for only the second time since January 2. Of note, the index of Chinese shares that trade in Hong Kong extended their winning streak to a 14th session. It has not posted a losing session since December 27. In Europe, the Dow Jones Stoxx 600 is off 0.2%, giving back a little more than yesterday’s gains. Also in keeping with the risk-off tone, the leading digital tokens (crypto-currencies) have seen a significant drop in price, ostensibly spurred by the apparently growing resistance by Chinese and South Korean officials. Another cautionary sign was that the VIX (S&P volatility) moved higher at the end of last week and earlier yesterday despite gains in the index. This seemed to suggest that more investors were buying puts ostensibly as insurance. That said, we would not want to exaggerate the risk-off mood and note that the MSCI Emerging Market Index is slightly ahead today, and a positive close would be extend the streak to a fourth session. |

FX Daily Rates, January 17 |

| There does not seem to a specific trigger for the price action. In the foreign exchange market, we note that since the end of last week, several ECB officials have tried to guide market expectations away from the particularly hawkish spin on the record of last month’s ECB meeting. The sense is that the euro’s rise is becoming a greater source of concern for officials. It could, if sustained, act as a drag on inflation and tightened financial conditions before the ECB thinks is appropriate.

Moreover, among those leading the charge, is the uber-hawk Weidmann. He still sticks to preferring a clear end date to the asset purchases, and seemed to endorse expectations of a rate hike in the middle of next year. In recent days, the EONIA forward strip seemed to imply about around a 40%-50% chance of a hike later this year, of which we have been quite skeptical. France’s Villroy de Galhau and ECB Vice President Constancio delivered similar messages today. The US dollar slumped 4.35% against the Canadian dollar from around mid-December to Jan 5, when it briefly traded through CAD1.2390, the 61.8% retracement of the US dollar rally from early September. It has chopped around between that CAD1.2390 and CAD1.2600 for the better part of past two weeks. Our reading of the technical indicators also suggest the US dollar is trying to turn higher. US oil inventories may attract attention. They are expected to have slipped (~3 mln barrels) for the ninth consecutive week. WTI for February delivered reached almost $64.90 yesterday, a marginal new high, but finished lower on the day. It is off another 0.5% today. A break of $63 would help spur ideas of that a near-term top is in place. |

FX Performance, January 17 |

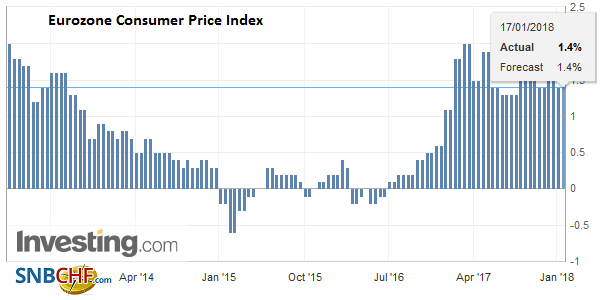

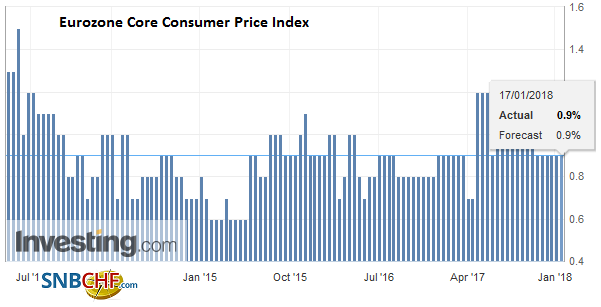

EurozoneConstancio expressed concern about the risk of an unwarranted euro rise and suggested that while the forward guidance will change as the economy evolves in the coming months, the change is unlikely to be immediate. This sounds like a warning ahead of next week’s ECB meeting. Separately, the preliminary CPI readings for December were confirmed. |

Eurozone Consumer Price Index (CPI) YoY, December 2017(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| The core rate has been at 0.9% throughout Q4 after averaging closer to 1.15% in the previous four months. The headline rate slipped to 1.4% from 1.5% in November. In H2 17 eurozone inflation averaged 1.4%. In H1 17, it had averaged 1.6%. |

Eurozone Core Consumer Price Index (CPI) YoY, December 2017(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

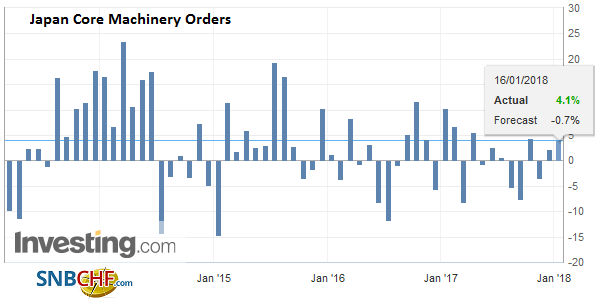

JapanYesterday, Japanese Finance Minister Aso expressed some mild concern about excessive volatility in the currency market. These comments, like the ECB officials, seems to be carefully trying to avoid antagonizing the mercurial US Administration. The dollar is stabilizing against the yen. It slipped to JPY110.20 in Asia after holding below JPY111.00 yesterday, and perhaps helped by a 5.7% jump in November core machinery orders (the median Bloomberg survey forecast was for a 1.4% decline after 5.0% rise in October). This is seen as a good sign for capital investment plans and the continued expansion of the world’s third largest economy. An important technical signal may be generated today if the euro closes below $1.2185-$1.2195. Similarly, if the dollar finishes above JPY111.00, and ideally JPY111.20, it would improve the technical tone. Sterling is holding up better, and it is the fifth session that a higher low is being recorded. A break of $1.3740 is needed to encourage ideas of a top. |

Japan Core Machinery Orders YoY, November 2017(see more posts on Japan Core Machinery Orders, ) Source: Investing.com - Click to enlarge |

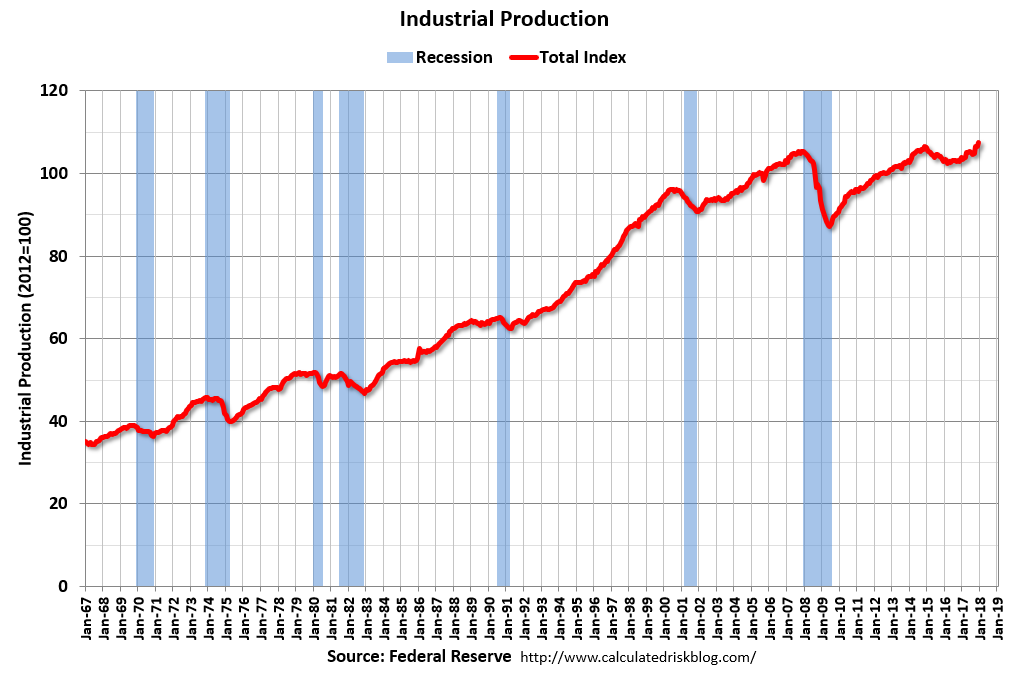

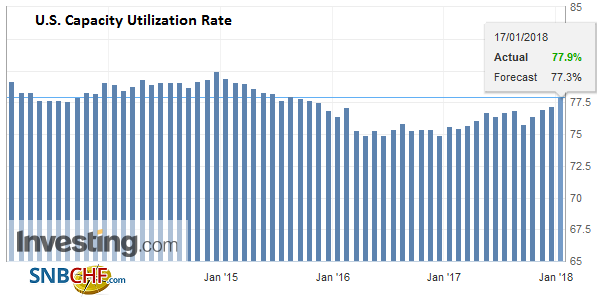

United StatesAlthough the US reports industrial output and TIC data, while the Fed releases its Beige Book ahead of the January 31 FOMC meeting, the focus is on the Bank of Canada. Strong jobs data and the closing of the output gap, while signals from the central bank indicate that it wants to remove more accommodation, has fanned rate hike expectations. Interpolating from the OIS, there appears to be a nearly 90% chance of a hike discounted. We have cautioned that there is risk of either “buy the rumor sell the fact” kind of post-meeting activity or outright disappointment. The market seems too aggressive in pricing in three hikes this year. While a dovish hike seems to be a likely scenario, there are some that anticipate a hawkish hold. |

U.S. Industrial Production, December 2017(see more posts on U.S. Industrial Production, ) Source: macro.economicblogs.org - Click to enlarge |

U.S. Capacity Utilization Rate, December 2017(see more posts on U.S. Capacity Utilization Rate, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$CAD,$EUR,$JPY,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Featured,Japan Core Machinery Orders,newsletter,OIL,SPY,U.S. Capacity Utilization Rate,U.S. Industrial Production