Consumer confidence has been sky-high for some time now, with the major indices tracking various definitions of it at or just near highs not seen since the dot-com era. Economists place a lot of emphasis on confidence in all its forms, including that of consumers, and there is good reason for them to do so; or there was in the past. Spending and consumer sentiment used to track each other very closely and in terms of more general conditions there was a clear and obvious relationship; when they told whichever survey they were happy they also in the aggregate tended to act with fewer inhibitions about their purchasing behavior. The correlation was intuitive as well as mathematical. Looking more closely at these

Topics:

Jeffrey P. Snider considers the following as important: Consumer Confidence, consumer spending, currencies, economy, Featured, Federal Reserve/Monetary Policy, hurricanes, Markets, newsletter, personal savings rate, real personal income excluding transfer receipts, Retail sales, The United States, U.S. Personal Income, U.S. Retail Sales, U.S. Savings Rate, university of michigan surveys of consumers, uofm

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Consumer confidence has been sky-high for some time now, with the major indices tracking various definitions of it at or just near highs not seen since the dot-com era. Economists place a lot of emphasis on confidence in all its forms, including that of consumers, and there is good reason for them to do so; or there was in the past.

Spending and consumer sentiment used to track each other very closely and in terms of more general conditions there was a clear and obvious relationship; when they told whichever survey they were happy they also in the aggregate tended to act with fewer inhibitions about their purchasing behavior. The correlation was intuitive as well as mathematical.

Looking more closely at these sentiment indications, however, you get the sense that they like inflation expectations (market as well as survey-based) have become increasingly unanchored. There is a palpable dissonance more and more embedded in the numbers that hasn’t been factored out of them by serious analysis (instead each index purveyor continues to assume by their regressions that consumers today are exactly like consumers ten, twenty, or thirty years ago).

Take, for instance, the University of Michigan’s Surveys of Consumers. Its measure of confidence registered a sublime 100.7 in October. It was the highest since a brief spike in early 2004, closing in on levels that in the nineties used to be the norm.

Though the index is lower in both November and December, some of the reasons for that slight downtrend should give you pause. From the December estimate:

Tax reform was spontaneously mentioned by 29% of all respondents, with nearly an equal split between positive and negative impacts on economic prospects. Party affiliation was the dominant correlate of people’s assessments of the tax legislation, with the long term economic outlook the most negatively affected.

If you are a Democrat, you are unhappy about the tax reform law; a Republican, quite pleased. It doesn’t tell us what the tax cuts might actually do, instead the survey results reveal biases (that are always present) based on what people are told they will do.

This is not new, of course, particularly related to political factors, but it does suggest in a period like the last five or ten years perhaps more susceptibility to narrative than data. In the case of general economic conditions, it hasn’t been surprising that what the majority of Americans have been told about the US economy was a highly subjective view colored by ideology over honest assessment.

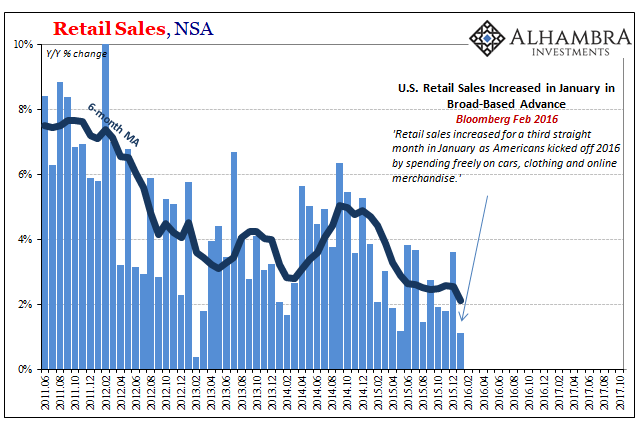

| Nowhere has that difference been stretched more than in the various faces of consumer spending. Time and again the media says the economy remains “strong” and “robust” because consumers are “spending freely.” They even do so, as I noted a few months back, in cases where circumstances are clearly the opposite: |

US Retail Sales in Feb 2016(see more posts on U.S. Retail Sales, ) |

| I think it helps explain, in part, why Americans say they feel good about the economy even though they don’t act like it is good. Throw the unemployment rate into the mix, and it’s a recipe for unanchored, and unwarranted, optimism. |

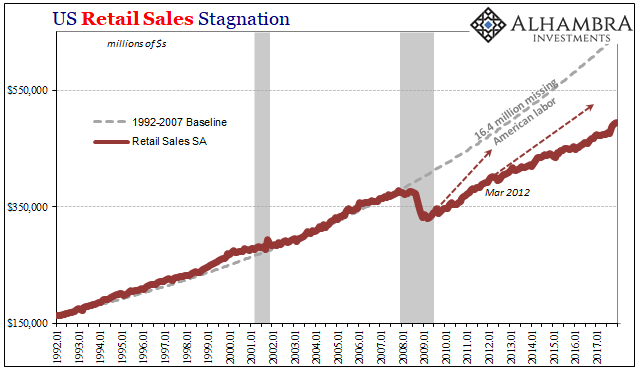

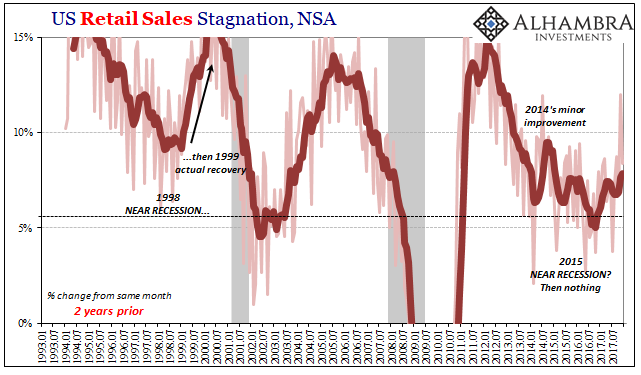

US Retail Sales Stagnation, Jan 1992 - Jan 2018(see more posts on U.S. Retail Sales, ) |

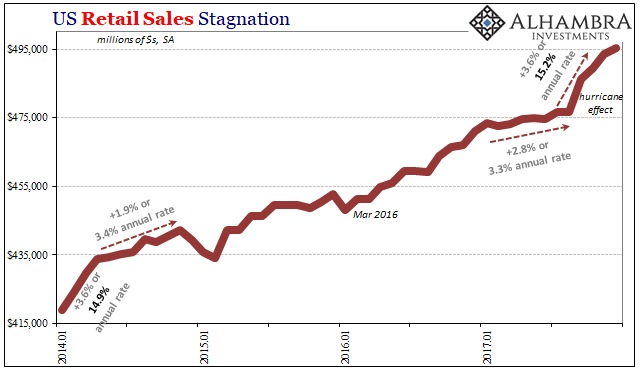

| For a couple months after the Texas and Florida hurricanes, retail sales did appear that they might finally match the survey results. According to the Census Bureau, retail sales surged in September and then to a lesser degree (but still strong) in October and November. For that three-month period alone, sales were up (seasonally-adjusted) by an astounding 3.6% (revised upward), an annual rate of 15.2%. |

US Retail Sales Stagnation in Jan 2014 - Jan 2018(see more posts on U.S. Retail Sales, ) |

| Despite that huge jump, in year-over-year unadjusted terms sales were less ridiculous. Rising at best 6.7% in November, that would have qualified for a weak and even concerning month in the nineties. In other words, it took the aftereffects of two very disruptive storms just to produce, for one month only, the lower end of normal. Consumers can tell budding economist researchers at the University of Michigan they think the economy is good, and they may actually believe that it is because it’s been so very long since it was nobody can really tell the difference.

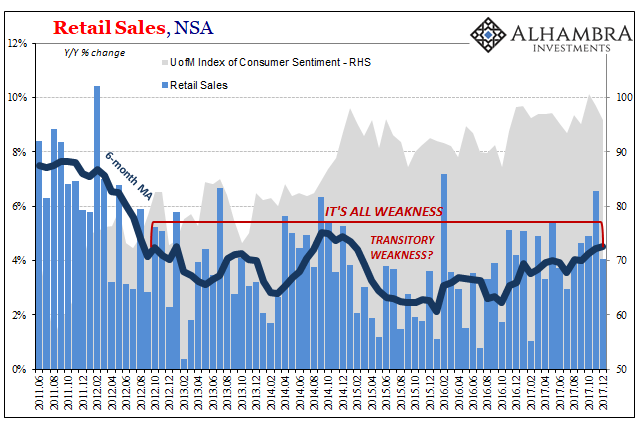

The surveys never ask consumers to really try to define “good.” Better than 2015, or 2009, isn’t really a meaningful comparison; better than 1999 would be, but that’s nowhere to be found. The hurricane boost, such that it was, appears to have run its course, though we can’t say for sure on one additional month of data. In December 2017, retail sales were disappointing across-the-board, surprising mostly “analysts” mistaking the prior three months for long-awaited end of “transitory” factors. Year-over-year, retail sales (unadjusted) were up just 4.0% in December – right back in the same level of malaise that has prevailed since 2012. |

US Retail Sales NSAm June 2011 - Dec 2017(see more posts on U.S. Retail Sales, ) |

| I don’t think it surprising that consumer confidence jumped in 2014 just as retail sales and the rest of the economy started to fall off in another downturn. That was the year QE ended, the unemployment rate fell sharply, and the financial media couldn’t write enough stories about the “best jobs market in decades.” If you paid little or no attention to data, which most people don’t, then you would have tended to believe things were looking up for somebody somewhere.

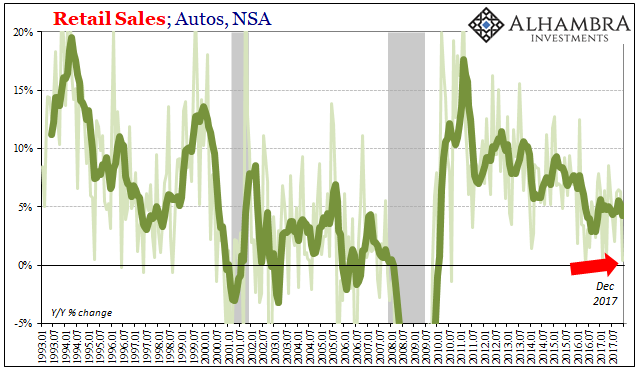

Transitory always applies to the good months, however, as they prove time and again to the aberrations. The economic baseline is nothing like we have seen in other well-established (and corroborated by more than sentiment) growth periods. Given December’s place in the retail calendar, the apex of Christmas shopping, to falter again on the biggest month of the year tells us a lot about marginal conditions. One of the major weak spots last month was auto sales; they were flat to last December, rising just 0.4%. It would seem to suggest (repeat caveat about one month of data) that the “benefit” of so many cars have been destroyed in and around Houston has been exhausted. |

US Retail Salese: Autos, NSA 1993 - Dec 2017(see more posts on U.S. Retail Sales, ) |

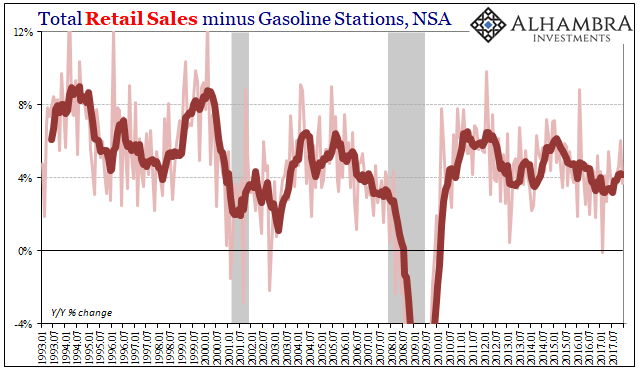

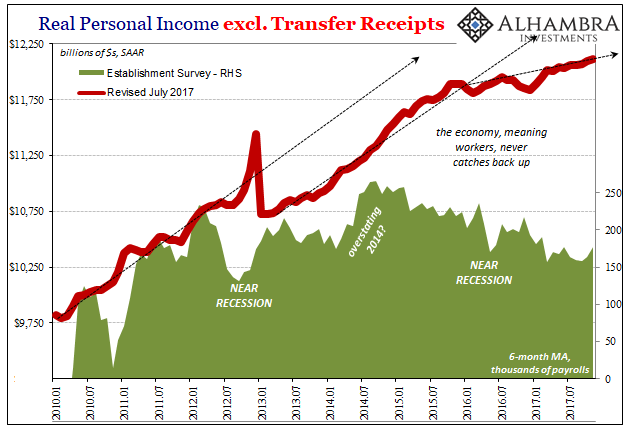

| These are not hopeful results given that beyond consumer sentiment there are similar indications of dissonance. As noted earlier, revolving consumer credit has surged over the past few months, all the while income and wage growth continues to be conspicuously less than indicated by a 4.1% unemployment rate, substantially less, even, than what we would expect for a much higher rate of unemployment. |

US Retail Sales ex Gas, Jan 1993 - Jan 2018(see more posts on U.S. Retail Sales, ) |

US Retail Sales, January and July 1993 - 2017(see more posts on U.S. Retail Sales, ) |

|

| Without sustained income growth, there is simply no way for spending in any form, including retail sales, to be in any other state than closer to recession than growth. The economy continues to be severely restrained, but consumers aren’t all that concerned anymore – at least in terms of published sentiment. The Great “Recession” is so far in the past that for most people there is simply no way to realistically asses the economy from their view. |

US Real Personal Income, Jan 2010 - 2018(see more posts on U.S. Personal Income, ) |

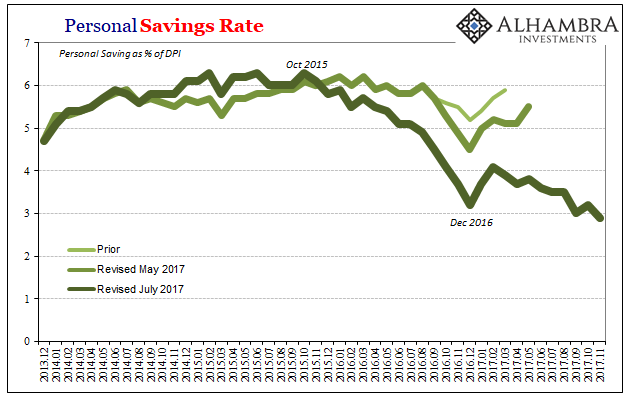

US Personal Savings, Dec 2013 - Dec 2017(see more posts on U.S. Savings Rate, ) |

Tags: Consumer Confidence,consumer spending,currencies,economy,Featured,Federal Reserve/Monetary Policy,hurricanes,Markets,newsletter,personal savings rate,real personal income excluding transfer receipts,Retail sales,U.S. Personal Income,U.S. Retail Sales,U.S. Savings Rate,university of michigan surveys of consumers,uofm