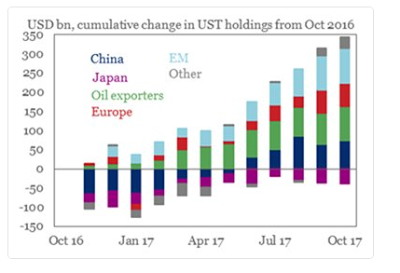

The combination of a falling dollar and rising US interest rates has sparked a concern never far from the surface about the foreign demand for US Treasuries. Moreover, as the Fed’s balance sheet shrinks, investors will have to step up their purchases. This Great Graphic was created by the Institute of International Finance (IIF). It is drawn from the US TIC data that tracks foreign holdings of US Treasuries. The most recent data is through October, but November data will be available tomorrow. The chart shows the cumulative changes in US Treasury holdings over the past year. In Q4 2016 and into the start of 2017 demand was soft. Look at last January’s bar. Most main foreign investors were sellers, including China,

Topics:

Marc Chandler considers the following as important: capital flows, China, Featured, FX Trends, Great Graphic, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| The combination of a falling dollar and rising US interest rates has sparked a concern never far from the surface about the foreign demand for US Treasuries. Moreover, as the Fed’s balance sheet shrinks, investors will have to step up their purchases.

This Great Graphic was created by the Institute of International Finance (IIF). It is drawn from the US TIC data that tracks foreign holdings of US Treasuries. The most recent data is through October, but November data will be available tomorrow. The chart shows the cumulative changes in US Treasury holdings over the past year. In Q4 2016 and into the start of 2017 demand was soft. Look at last January’s bar. Most main foreign investors were sellers, including China, Japan, and Europe. Only oil exporters and emerging markets were consistent buyers of US Treasuries over this period. However, as the year evolved, foreign demand for US Treasuries broadened and grew. In October 2017, only Japan was reducing its Treasury holdings. |

Treasury Holdings |

To a large extent the demand for Treasuries is a function of the demand for reserves. Given continued rise in oil prices and the rise of reserves already reported for several large countries in Asia, including China, it would not be surprising to learn that foreign demand for US Treasuries remained robust.

That said, the Federal Reserve acts as a custodian for foreign central banks. The value of the Treasuries it holds fell in January and February 2017 and rose through September. It fell by nearly $8 bln in October and made it up plus some in November (+9.25 bln), but fell sharply in December (-$26.40 bln) in December.

A weaker dollar often spurs developing countries to intervene to slow their currencies’ appreciation. In effect, in one part of the cycle, the private sector buys dollars and other foreign assets, which in effect recycle current account surpluses. When the private sector is not willing or capable, central banks often step in to fill the vacuum.

Many are concerned that an increase in trade tensions with China could reduce its appetite for Treasuries, which may have been hinted last week. Earlier today, a Chinese credit rating agency downgraded the US to BBB+. Of course, this cannot be ruled out, but as the chart illustrates, the Treasury market has been able to absorb Chinese sales in for half the period without disruption. If China wants to continue rebuilding its reserves, it must by definition buy foreign assets. The US Treasury market remains the larges and most transparent in the world, and offers yields that are a multiple of Japan and European yields.

Tags: #USD,capital flows,China,Featured,Great Graphic,newsletter