Communication from European central banks over the last few weeks has been consistent with a more cautious stance and, in some cases, is likely to lead to delays in their monetary policy normalisation plans. Each situation is different, with a loss in economic momentum, subdued underlying inflation, and political risks playing a role to varying degrees in the euro area, the UK, Switzerland and Sweden. At the same time,...

Read More »Thousands of Swiss take to streets to mark May Day

A May Day rally in the centre of Basel in northwest Switzerland on May 1, 2018 (Keystone) - Click to enlarge Workers and activists have been celebrating May Day in Switzerland with rallies in numerous cities urging their government to address employment issues, such as equal pay. Around 50 rallies and events are planned across Switzerland. On Tuesday morning, 13,000 took part in a demonstration in Zurich...

Read More »Look Past Disappointing Jobs Data, Luke

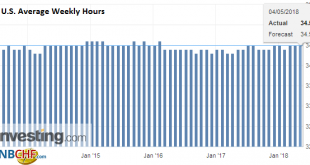

The US jobs report was broadly disappointing. However, the Federal Reserve will look through it and investors should too. A June hike is still by far the most likely scenario. The US created 164k net new jobs in April, and when coupled with the 32k upward revision in March, it was near expectations. The source of disappointment hourly earnings. March’s 2.7% year-over-year pace was revised to 2.6%, and there it remained...

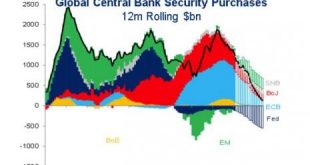

Read More »Taking the Pulse of a Weakening Economy

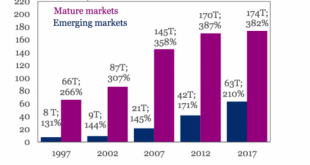

Corporate buybacks provide the key analogy for the economy as a whole. Central banks have been running a grand experiment for 9 years, and now we’re about to find out if it succeeds or fails. For 9 unprecedented years, central banks have pushed the pedal of monetary stimulus to the metal: near-zero interest rates, monumental purchases of bonds, mortgage-backed securities, stocks and corporate bonds, injecting trillions...

Read More »The Oil Curse Comes to Washington

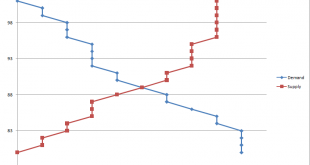

Meandering Prices Prices rise and prices fall. So, too, they fall and rise. This is how the supply and demand sweet spot is continually discovered – and rediscovered. When supply exceeds demand for a good or service, prices fall. Conversely, when demand exceeds supply, prices rise. Supply and DemandSupply and demand (the curves usually shown in such charts are unrealistic, as bids and offers in the market are...

Read More »Why sovereign money would hurt Switzerland?

Swiss National Bank (SNB) Chairman Thomas Jordan speaks to the media during a news conference in Bern June 14, 2012. REUTERS/Ruben Sprich - Click to enlarge Ladies and gentlemen Today, the Swiss Institute of Banking and Finance at the University of St. Gallen celebrates its 50th anniversary. Let me extend my sincere congratulations on reaching this milestone. Our financial system has evolved steadily over the past five...

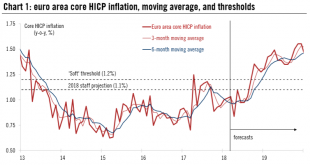

Read More »Euro area growth: somewhere between hard and soft data

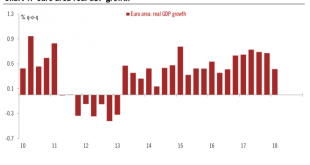

According to Eurostat’s preliminary flash estimate, euro area real GDP expanded by 0.4% q-o-q in Q1 2018 (1.7% q-o-q annualised, 2.5% y-o-y), in line with consensus expectations (0.4%) and down from an upwardly revised figure of 0.7% q-o-q for Q4 2017. The implications of the growth slowdown on ECB staff projections should remain limited, in our view. In March, they had pencilled in 0.7% q-o-q GDP growth for Q1, but...

Read More »Demand for organic food grows strongly in Switzerland

A worker checks the organic fresh food selection at a Coop supermarket in Wetzikon in 2007 (Keystone) - Click to enlarge One in ten fresh food items sold in Switzerland last year was organic, according to the Federal Office for Agriculture. The market share of organic products rose from 4.6% in 2007 to 9% in 2017, while the share of fresh organic food sold in Switzerland rose from just under 6% to 11.5% over...

Read More »FX Daily, May 04: US Jobs-Not the Driver it Once Was

The US dollar fell last month in response to the disappointing non-farm payroll report. However, in general, the jobs report is not the market mover that it was in the past. With unemployment is at cyclical lows of 4.1% and poised to fall further. Weekly jobless claims and continuing claims at or near lows in a generation, though over qualification is more difficult than previously. The monthly net job creation is a...

Read More »What Lies Beyond Capitalism and Socialism?

The status quo, in all its various forms, is dominated by incentives that strengthen the centralization of wealth and power. As longtime readers know, my work aims to 1) explain why the status quo — the socio-economic-political system we inhabit — is unsustainable, divisive, and doomed to collapse under its own weight and 2) sketch out an alternative Mode of Production/way of living that is sustainable, consumes far...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org