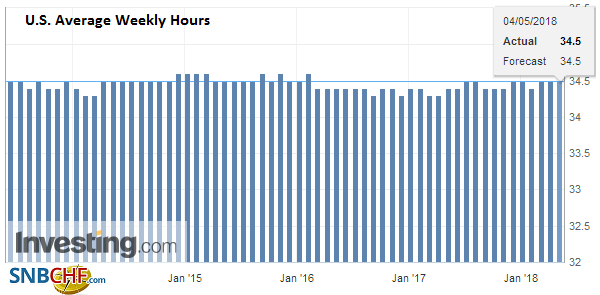

The US jobs report was broadly disappointing. However, the Federal Reserve will look through it and investors should too. A June hike is still by far the most likely scenario. The US created 164k net new jobs in April, and when coupled with the 32k upward revision in March, it was near expectations. The source of disappointment hourly earnings. March’s 2.7% year-over-year pace was revised to 2.6%, and there it remained in April with a less than expected 0.1% increase on the month. U.S. Average Weekly Hours, April 2018(see more posts on U.S. Average Weekly Hours, ) Source: Investing.com - Click to enlarge The unemployment rate was expected to have slipped to 4.0% from 4.1% where it has been stuck. It fell to

Topics:

Marc Chandler considers the following as important: 4) FX Trends, EUR, Featured, FOMC, GBP, jobs, JPY, newsletter, TLT, U.S. Average Weekly Hours, U.S. unemployment rate, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The US jobs report was broadly disappointing. However, the Federal Reserve will look through it and investors should too. A June hike is still by far the most likely scenario.

| The US created 164k net new jobs in April, and when coupled with the 32k upward revision in March, it was near expectations. The source of disappointment hourly earnings. March’s 2.7% year-over-year pace was revised to 2.6%, and there it remained in April with a less than expected 0.1% increase on the month. |

U.S. Average Weekly Hours, April 2018(see more posts on U.S. Average Weekly Hours, ) Source: Investing.com - Click to enlarge |

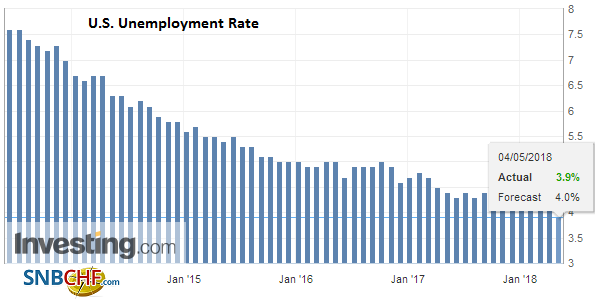

| The unemployment rate was expected to have slipped to 4.0% from 4.1% where it has been stuck. It fell to 3.9%, but it helped by an undesirable decline in workforce participation to 62.8% from 62.9%. |

U.S. Unemployment Rate, April 2018(see more posts on U.S. Unemployment Rate, ) Source: Investing.com - Click to enlarge |

There were two bright spots of the report to note. First, the underemployment rate fell to 7.8% from 8.0%. Like the unemployment rate, this too is at new cyclical lows. Second, manufacturing added another 24k jobs in April. This is a bit better than last year’s average of 17k and matches the Q1 average.

The ISM and jobs data warn that economic momentum may not have picked up at the start of Q2. However, that is not what is required at this stage to keep the Fed on its gradual tightening course. The economic dynamics of being reasonably close to full employment and its inflation target to ensure that unless the economy was hit with a negative shock, removing accommodation (negative real Fed funds rate). Today’s data will not undermine the Fed’s confidence that the economy continues to grow above trend. And with a large dollop of fiscal stimulus in the pipeline, the Fed, more than other major central banks, can look through what might seem to be disappointing high- frequency data for investors.

With the US 10-year yield now nearly 10 bp from its peak when it poked through 3.0%, the dollar has lost some luster against the yen and is making new lows for the week near JPY118.65. It had tried a few times to push through the offers at JPY110, which was the objective of the head and shoulders bottom pattern we had tracked. The euro and sterling continue to trade like there are trapped longs who are selling into modest upticks.

Tags: #GBP,#USD,$EUR,$JPY,$TLT,Featured,FOMC,jobs,newsletter,U.S. Average Weekly Hours,U.S. Unemployment Rate