Swiss Franc The Euro has risen by 0.08% at 1.1379 EUR/CHF and USD/CHF, October 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The Dollar index is trading within last Friday’s trading ranges. The year’s high, set on August 15, was just shy of 97.00. The euro continues to straddle the $1.14 level but is spending more time in Europe below there. There is a 1.5 bln euro...

Read More »What Can Kill a Useless Currency, Report 28 Oct 2018

There is a popular notion, at least among American libertarians and gold bugs. The idea is that people will one day “get woke”, and suddenly realize that the dollar is bad / unbacked / fiat / unsound / Ponzi / other countries don’t like it / <insert favorite bugaboo here>. When they do, they will repudiate it. That is, sell all their dollars to buy consumer goods (i.e. hyperinflation), gold, and/or whatever other...

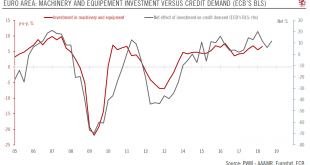

Read More »Credit Conditions in the Euro Area Remain Supportive of Investment Recovery

We are sticking to our forecast of 2.0% euro area GDP growth for 2018, but with risks tilted to the downside. Investment is an important driver of the business cycle and a key determinant of potential growth. In the euro area, total investment makes up about 20% of GDP. Construction, machinery and equipment (including weapons systems), intellectual property rights and agricultural products account, respectively, for...

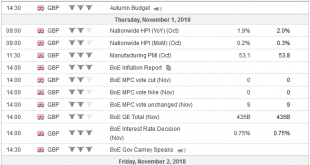

Read More »FX Weekly Preview: Thumbnail Sketch of Six Things to Monitor This Week

Equities Global equities have sold off hard. The magnitude of the recent loss is similar to what happened earlier this year. The MSCI World Index of developed countries fell 10.5% in January-February carnage and are now off about 11% this month. The MSCI Emerging Markets Index has matched the 11% loss back at the start of the year, but never truly recovering in between. The Dow Jones Stoxx 600 fell around 9% initially...

Read More »What’s the Real Meaning of the Stock Market Swoon?

Nobody dares discuss it openly for fear of triggering a panic, but there aren’t enough lifeboats for everyone. There’s no shortage of explanations on the whys and wherefores of the US stock market’s recent swoon / swan-dive / plummet. Here’s a few of the many credible explanations: the economy has reached peak earnings so there’s no fundamentals-driven upside left; bond yields are now high enough to dampen enthusiasm...

Read More »PostBus may lose some routes after scandal

A Post bus on a route on the Flüela Pass in Graubünden (© KEYSTONE / PETRA OROSZ) - Click to enlarge The state-owned PostBus company is threatened with losing bus routes in several regions, following a scandal over illegal subsidies. Jura is the first canton that will put its 38 routes out to tender next spring, SonntagsZeitungexternal link has reported. “We were not convinced of the costs and quality of the post...

Read More »Investigating suspected welfare cheats – where to draw the line

On 25 November 2018, Swiss will vote on whether to accept laws allowing detectives to uncover welfare fraud. ©-Dan-Grytsku-_-Dreamstime.com_ - Click to enlarge Currently, there is nothing specific in Swiss law covering the practice. In the past, investigators have been used to gather evidence on disability and accident beneficiaries. Between 2009 and 2016, detectives were used on around 220 investigations a year, of...

Read More »Switzerland expecting a 2.5 billion franc federal surplus for 2018

© Marekusz | Dreamstime.com The latest figures forecast Switzerland’s federal spending for 2018 will be CHF 0.9 billion less than expected. This and higher than expected receipts of CHF 1.3 billion add up to an extra CHF 2.2 billion on top of an original budget surplus of CHF 0.3 billion, bringing the total forecast federal surplus to CHF 2.5 billion. Switzerland’s federal government is now expecting to spend CHF 70.2...

Read More »Self-Employment declining in Switzerland

The percentage of Switzerland’s workers working for themselves has been slowly declining. In 2010, 13.7% of workers were self-employed. By 2017, the figure was 12.8% – self-employed includes those working as independents and those working for companies they own. Swiss (14.5%) are far more likely to be self-employed than foreigners (7.9%). This is partly explained by the low number of foreign farmers – farming is the...

Read More »Monthly Macro Monitor – October 2018 (VIDEO)

[embedded content] Economic thoughts and analysis from Alhambra Investments CEO Joe Calhoun. Related posts: Monthly Macro Monitor – October 2018 Special Edition: Markets Under Pressure (VIDEO) Monthly Macro Monitor – September 2018 Monthly Macro Monitor – September Monthly Macro Monitor – August Monthly Macro Monitor – August 2018 Global Asset...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org