Hurricane Ida swept up the Gulf of Mexico and slammed into the Louisiana coastline on August 29. The storm would continue to wreak havoc even as it weakened the further inland it traversed. By September 1 and 2, the system was still causing damage and disruption into the Northeast of the United States. While absolutely tragic for those who suffered its blow, in economic terms this means that any weakness exhibited by whichever economic account during both August and September will be blamed on Ida’s loitering. Since it did so at the end of the one and the beginning of the other, the tropics can take the heat off cooling delta COVID case counting. . According to the Federal Reserve, US Industrial Production declined by a large 1.3% in September 2021 from August –

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, commodities, COVID, Crude Oil, currencies, Deflation, economy, Featured, Federal Reserve/Monetary Policy, industrial production, inflation, manufacturing, Markets, Motor Vehicle Assemblies, natural gas, newsletter, Oil

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Hurricane Ida swept up the Gulf of Mexico and slammed into the Louisiana coastline on August 29. The storm would continue to wreak havoc even as it weakened the further inland it traversed. By September 1 and 2, the system was still causing damage and disruption into the Northeast of the United States.

While absolutely tragic for those who suffered its blow, in economic terms this means that any weakness exhibited by whichever economic account during both August and September will be blamed on Ida’s loitering. Since it did so at the end of the one and the beginning of the other, the tropics can take the heat off cooling delta COVID case counting. |

|

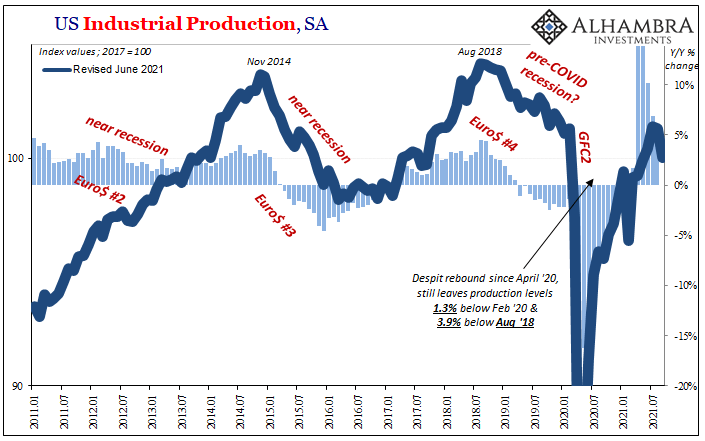

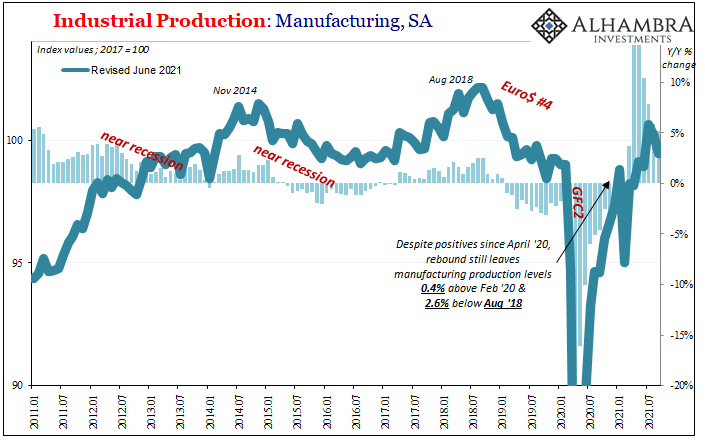

| According to the Federal Reserve, US Industrial Production declined by a large 1.3% in September 2021 from August – with August’s estimate being revised downward to -0.1% month-over-month. Two months straight of decline, those particularly two months, what else could it be if not Ida’s perfect timing? | |

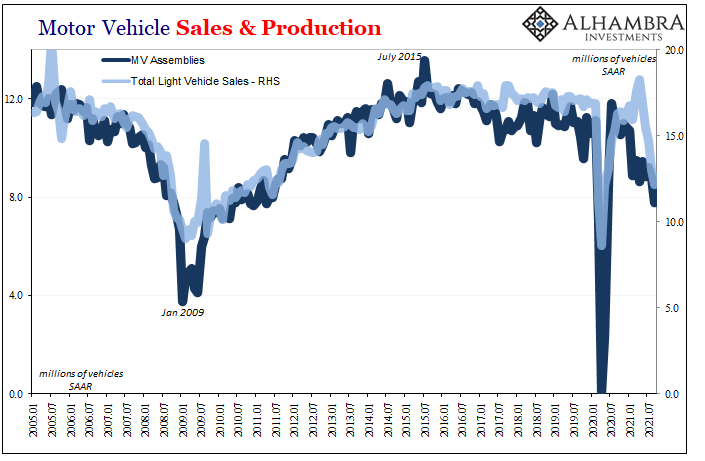

| Well, if not weather then certainly supply problems particularly semiconductors without which no one can finish much for vehicles. Domestic automobile production (Motor Vehicle Assemblies) fell below 8 million (SAAR) in September from a significantly downward revised 8.8 million the month before, dragging down the manufacturing sector. These are recessionary low levels.

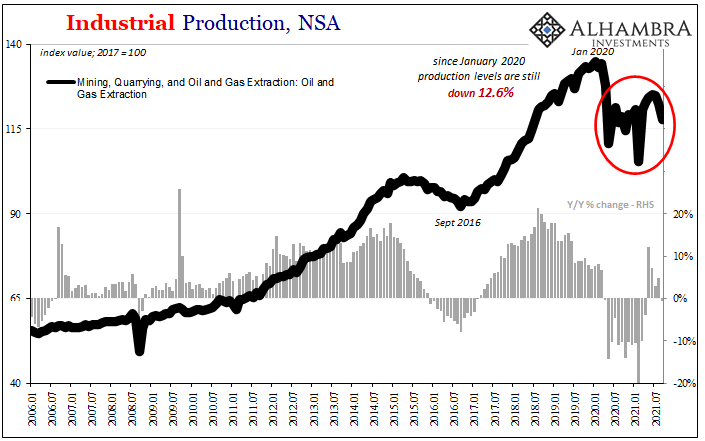

Yet, oil and natty gas. Yes, Ida caused some disruption to both in both August and September, but why hadn’t production for the combined energy industry more than fully recovered beforehand especially given the prices being shelled out in each? We’re led to focus on the narrow and immediate concerns with individual monthly circumstances, such as Ida or semis over the last few months, when the entire global industrial base has been off for more than a year. |

|

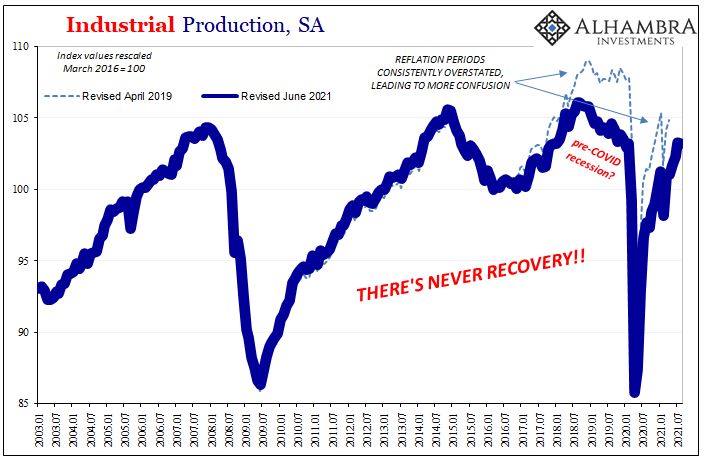

| Several years, as a matter of fact. The US industrial segment, too, and it has to be something else only starting with energy.

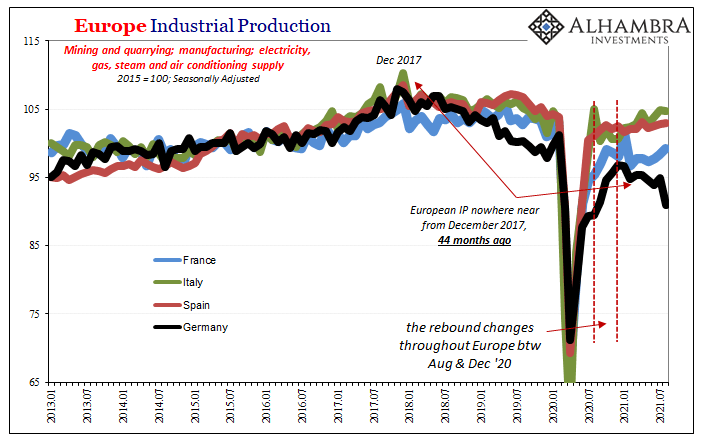

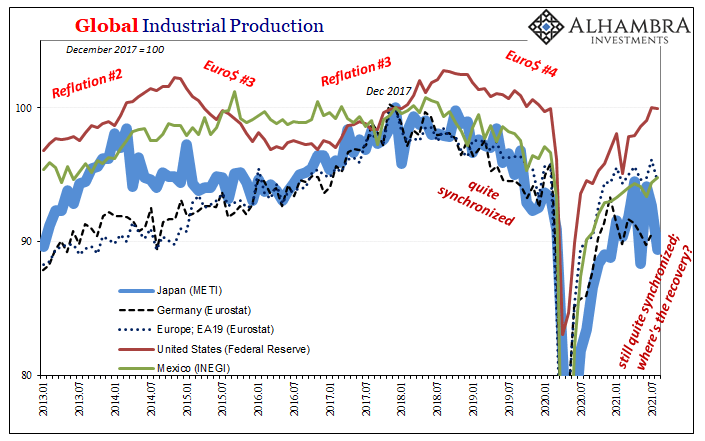

Maybe Ida can account for recent drops in it over the past two particular months, and maybe semis constrict domestic motor vehicles to these extremes, but what about how each recent drop comes from an always and already-low starting point? There isn’t common weather to explain why European IP has behaved practically the same as in America. Sure, there are parts shortages over there, too, but there wasn’t a Hurricane named Ida nor was the chip problem so disruptive before around May; definitely not last summer. In fact, if you go through the various national statistics on industry across Europe what you’ll find is that the rebound from last year’s recession changed, downshifted around late summer to start, by the end of 2020 at the latest (Germany). Long before recent American storms and well in advance of delta COVID. Italy had been the best of the European industry, but has struggled since last August. France going back to September 2020. Likewise Spain. Germany’s been in an industrial recession for all of 2021. How about Japan? There was a clear inflection beginning around the same timeframe as Germany, January 2021, a setback that was fully set aside until April and then downhill from there. |

|

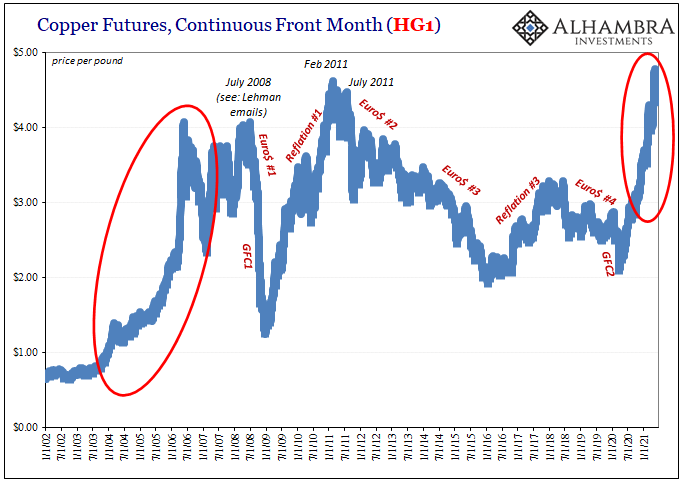

| In other words, the entire global industrial sector hasn’t just had a few bad months easily explained by recent weather and pandemic developments. This weakness is synchronized and it goes back only beginning with the Summer Slowdown of 2020. Further back several more years, none of these places has even sniffed previous highs from around the end of 2017 (middle of 2018 for the US).

It is a problem-within-a-problem that goes far deeper than just post-COVID or from the latest whichever excuse. The entire global economy fell off-track almost four years ago, and then the 2020 recession hit. We’re struggling to get out of that later hole which began with the global economy already in a serious deficit. But that’s not how the public is being led to think about the current economic state. On the contrary, everything’s reportedly hugely inflationary – or it would be, if only Ida, the chip shortage, or whatever comes next hadn’t gotten in the way. Industry would be exploding if… Rather than wishing, maybe the global economy really is in bad shape and it isn’t actually getting all that much better. |

|

| Perhaps a pandemic recession coming along as the pre-existing one was just getting going really would leave the world in a world of economic hurt.

This would be quite a bit more significant than the “growth scare” or even slowdown chatter of late which is only beginning to creep its way past those other attempts at excusing. As such, it presents an enormous investment challenge, as noted earlier today. While we might see the data and from it easily see past all the blaming, those are plausible even convincing to the vast majority of the public, including the investing public conditioned to judge economic risks and circumstances by stock prices and central banker bird flipping (hawks).

Having been consistently biased toward inflation and growth/acceleration – if only because “everyone” says so – it takes quite a lot of contrary reality for reality to become acceptable.

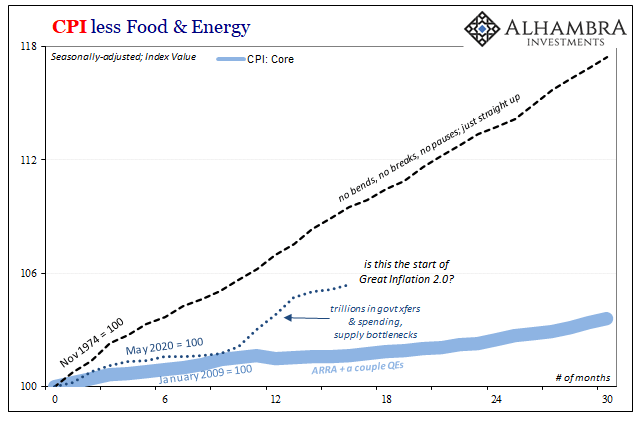

The consistent picture I see is one of deflation and disinflation globally, and that view already misunderstood only further clouded by non-economic interference along the way (helicopters and such). For a few months, the idea of recovery and its inflation might have seemed reasonable maybe even probable given a cursory, surface analysis of this year’s CPI’s. |

|

| With history as a guide, we can recognize both how that was never likely at any point while also how it took quite a long time each time for reality to sink in (not stocks) amongst the hugely disappointed investing public told to bet the sure-thing inflation. The inflation narrative is like some horror movie villain; it takes repeated, increasing effort until the evidence is unambiguously overwhelming before it finally expires.

There’s a reason why this L-shaped pattern repeats regardless of immediate circumstances. It isn’t supply bottlenecks or even COVID; those just robbed an already deflationary environment of that much more potential which has been continuously impaired going back to 2007 and 2008. Hole-within-a-hole-within-a-hole. |

|

Tags: Bonds,commodities,COVID,Crude Oil,currencies,Deflation,economy,Featured,Federal Reserve/Monetary Policy,industrial production,inflation,manufacturing,Markets,Motor Vehicle Assemblies,Natural Gas,newsletter,OIL