Right now there are two conventional propositions behind the “reflation” trade, and in many ways both are highly related if not fully intertwined. The first is that interest rates have nowhere to go but up. The Fed is raising rates again and seems more confident in doing more this year than it wanted to last year. With nominal rates already rising in the last half of 2016, and with more (surveyed) optimism than even...

Read More »U.S. CPI after the energy push

The Consumer Price Index for January 2017 rose 2.5%, pulled upward by its energy component which thanks to oil prices now being comparing to the absolutely lows last year saw that part of the index rise 11.1% year-over-year. Given that oil prices bottomed out on February 11, 2016, this is the last month where oil prices and thus energy inflation will be at its most extreme (except, of course, should WTI actually rise...

Read More »Bi-Weekly Economic Review

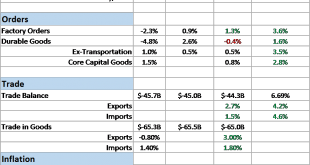

Economic Reports Scorecard The economic data since my last update has improved somewhat. It isn’t across the board and it isn’t huge but it must be acknowledged. As usual though there are positives and negatives, just with a slight emphasis on positive right now. Interestingly, the bond market has not responded to these slightly more positive readings with nominal and real yields almost exactly where they were in the...

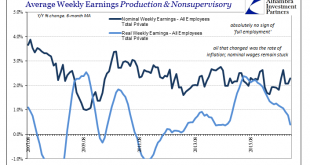

Read More »Real Wages Really Inconsistent

Real average weekly earnings for the private sector fell 0.6% year-over-year in January. It was the first contraction since December 2013 and the sharpest since October 2012. The reason for it is very simple; nominal wages remain stubbornly stagnant but now a rising CPI subtracts even more from them. Consumers receive no significant boost to their incomes, but are starting to pay more (in comparative terms) for things...

Read More »A New Frame Of Reference Is Really All That Is Necessary To Start With

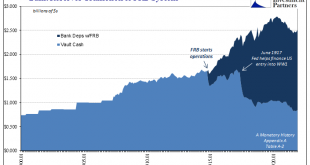

In the middle of 1919, the United States was beset by a great many imbalances. Having just conducted a wartime economy, almost everything before then had been absorbed by the World War I effort. With fiscal restraint subsumed by national emergency, inflation was the central condition. Given that the Federal Reserve was by then merely a few years old, no one was quite sure what to do about it. Chairman of the Federal...

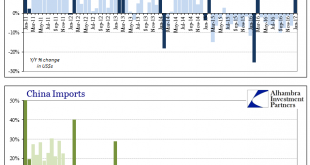

Read More »No China Trade Interpretations

The National Bureau of Statistics (NBS) of China does not publish any of the big three data series (Industrial Production, Retail Sales, Fixed Asset Investment) for the month of January. It combines January data with February data because of the large distortions caused by Lunar New Year holidays. Unlike Western holidays that are but a single day, the Golden Week is a week, and therefore when the calendar points do not...

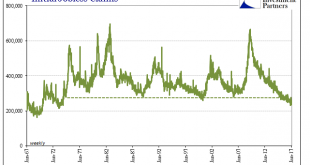

Read More »Jobless Claims Look Great, Until We Examine The Further Potential For What We Really, Really Don’t Want

Initial jobless claims fell to just 234k for the week of February 4, nearly matching the 233k multi-decade low in mid-November. That brought the 4-week moving average down to just 244k, which was a new low going all the way back to the early 1970’s. Jobless claims seemingly stand in sharp contrast to other labor market figures which have been suggesting an economic slowdown for nearly two years. Unemployment insurance...

Read More »2016 off to a turbulent start

Published: 12th February 2016 Download issue: A turbulent start to a volatile year Global markets had a very difficult start to 2016, with equity markets experiencing one of the largest January falls in history, currency markets also seeing major disruption, and a sharp widening of spreads on high yield corporate bonds. By the end of the month, though, there were signs that a rebound was underway. Although the magnitude of the sell-off was clearly a concern, these developments are not out...

Read More »The Millennials: Decoding the New Generation

[embedded content] Published: Wednesday November 25 2015 Millennials are increasingly driving spending growth in the US. Marianne Johnson, Financial Analyst at Pictet Wealth Management, explains the particular characteristics of this key demographic, and the implications of the generational handover for companies and investors.

Read More »About That Liquidity Crunch…

Just as a fierce storm can change the shape of a shoreline, liquidity has drained away from the post-crisis financial markets, creating new and unfamiliar sandbars where investors can wind up shipwrecked if they’re not careful. To navigate the newly parched market, Credit Suisse’s Private Banking and Wealth Management division says that investors must not only pay much closer attention to liquidity risks in their portfolios, but also learn to use illiquidity to their advantage. The...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org