Although close to the end of a long-term up-cycle, the dollar has the potential to recover ground lost recently given the outlook for Fed rate rises and balance sheet reduction.Our latest forecasts for major currencies over the coming months can be summarised as follows:US dollar. In terms of duration and valuation, the USD up-cycle is likely close to ending. However, the USD is likely to remain strong on the back of robust US growth and the outlook for inflation. It should also benefit from continued monetary policy divergence (the Fed should announce a reduction of its balance sheet in September and raise rates again in December ). At this stage, despite US political turmoil, a fiscal stimulus (likely around the end of the year) remains the most likely scenario.Euro. The debate over the

Topics:

Luc Luyet considers the following as important: currencies, currencies forecasts, Currency fluctuations, Currency outlook, Dollar strength, Macroview

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: Questions

Joseph Y. Calhoun writes Weekly Market Pulse: It’s An Uncertain World

Joseph Y. Calhoun writes Weekly Market Pulse: Are Higher Interest Rates Good For The Economy?

Joseph Y. Calhoun writes Weekly Market Pulse: Monetary Policy Is Hard

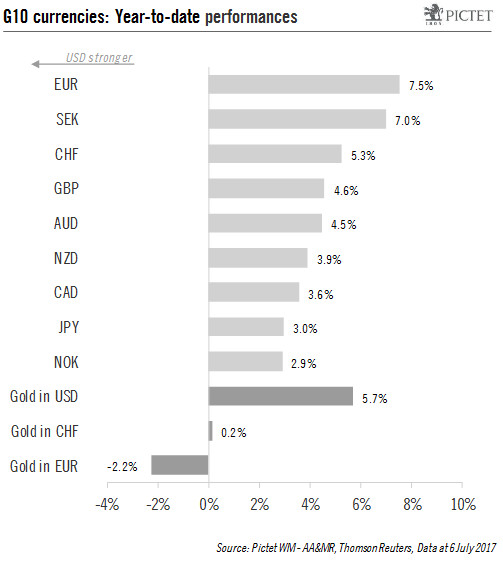

Although close to the end of a long-term up-cycle, the dollar has the potential to recover ground lost recently given the outlook for Fed rate rises and balance sheet reduction.

Our latest forecasts for major currencies over the coming months can be summarised as follows:

US dollar. In terms of duration and valuation, the USD up-cycle is likely close to ending. However, the USD is likely to remain strong on the back of robust US growth and the outlook for inflation. It should also benefit from continued monetary policy divergence (the Fed should announce a reduction of its balance sheet in September and raise rates again in December ). At this stage, despite US political turmoil, a fiscal stimulus (likely around the end of the year) remains the most likely scenario.

Euro. The debate over the ECB’s exit strategy is likely to be key for the euro in the coming months. Confidence that inflation will move closer to the ECB’s target is supportive of the euro. However, the euro’s upside potential should be limited: monetary policy may well remain accommodative as inflation dynamics are not well established, so prudence will be needed to avoid an unwarranted tightening of financial conditions. Overall, the euro seems vulnerable in the coming months given weak inflation pressure and the elevated optimism surrounding the currency.

Swiss franc. The Swiss National Bank is expected to continue to rely on FX intervention to curb unwanted CHF appreciation, but a rate cut remains unlikely. Although Switzerland’s large current account surplus supports a strong CHF, reduced European political uncertainty since the French elections and a gradually more hawkish ECB are expected to reduce the upward pressure on the Swiss franc.

British pound. The June snap election called by PM Theresa May has led to a hung parliament. A hung parliament increases the chance of a softer Brexit (only a minority of Tory politicians want a hard Brexit), which is GBP positive. However, as the prime minister is dependent on various small groups of MPs with different objectives, the risk of a disorderly Brexit has also increased, which is GBP negative. In the next few months, our forecast for a slowdown in the UK economy should reduce the odds of a Bank of England rate hike and weigh on sterling. Ultimately, our scenario still favours a hard Brexit (loss of single market access) as we do not expect EU concessions on the free movement of people.

Japanese yen. The Bank of Japan’s framework for monetary policy (yield curve control) is likely to remain unchanged throughout the year given that inflation is nowhere near its 2% target. Without deeper coordination between fiscal and monetary policies, the attractiveness of the JPY (in terms of real rates) relies mostly on external factors such as long-term yields in other countries, the Fed’s monetary policy and oil prices. Barring a lasting rise in political and geopolitical tensions, our scenario for higher US yields should make the JPY particularly unattractive.