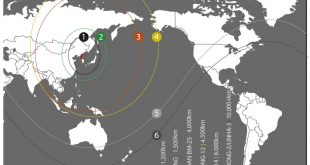

Tensions over North Korea’s nuclear programme look set to continue, but we believe the chances of a military conflict are low in the near term.The tensions between North Korea and the US that rose a notch in early August are rooted in the deep sense of insecurity of the regime of Kim Jong Un. A significant new stage in North Korea’s nuclear programme has now been reached, and the regime appears to believe that developing a credible nuclear deterrent is necessary to guarantee its...

Read More »The fourth industrial revolution is transforming corporates’ prospects

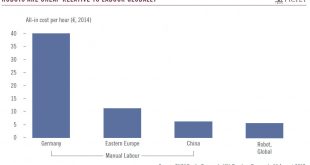

Digitalisation offers huge new opportunities and improved growth, margins and valuations for some industrial firms, but will also create losers as traditional machinery sales decline.Amid a growing challenge from the emerging world, US and European industrial companies must be at the forefront of technological innovation to stay competitive. With the fourth industrial revolution, a new industrial era is opening up: digitisation. The fields of application of digitisation are vast, covering...

Read More »The ECB and the euro, from Amsterdam to Sintra

The threat to the ECB’s inflation targets posed by the appreciation of the euro is being offset by strengthening growth in the euro area. The ECB should pursue its cautious exit strategy.The trade-weighted EUR has appreciated by 4.8% since the ECB’s June meeting. ECB models and Mario Draghi’s rule of thumb suggest that a stronger currency could lower euro area inflation by about 30-40bp in 2018-2019, all else being equal.But all else is not equal, and the euro area economy is in a very...

Read More »Monthly Investment Strategy Highlights, August 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationWe retain a slight overweight in DM equities owing to good fundamentals, but it is especially important at present to be well protected against downside risk.Markets appear unduly complacent, and volatility could rise in the coming months. This will create opportunities for tactical trading and especially hedge funds.Low correlations and a pick-up in disruptive M&A are already creating an improved...

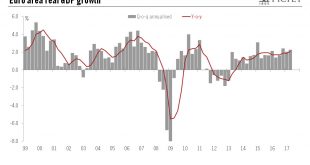

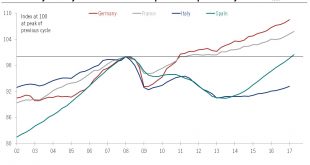

Read More »In spite of broadening growth, ECB will remain prudent

A growth spurt may push us to raise our euro area GDP forecast for this year and next, although we expect some slowdown in the pace of expansion and the ECB to continue to act cautiously.While the latest euro area GDP numbers were broadly in line with expectations, at 0.6% quarter-on-quarter in Q2, net revisions to past data pushed the GDP profile higher again.Once detailed estimates are published by Eurostat—and assuming there are no significant revisions to past data—we might revise our...

Read More »France & Spain : Strong Q2 GDP growth performance

The latest Q2 GDP figures published by France and Spain point to solid growth for the euro area. We maintain our euro area GDP growth forecast at 1.9% for 2017 as a whole.France and Spain today were the first big countries in the euro area to publish GDP growth figures for Q2 2017. French real GDP rose by 0.5% q-o-q in Q2 2017, the same pace as the two previous quarters. The details showed that domestic demand remained solid, while the sharp improvement in net exports offset the fall in...

Read More »Euro area : Momentum slows at the start of Q3

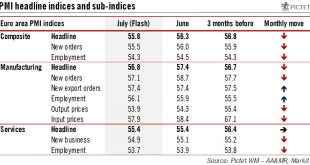

PMI surveys for the euro area eased somewhat in July, suggesting that momentum slowed at the start of Q3. We maintain our GDP growth forecast of 1.9% for 2017.The composite flash PMI fell to 55.8 in July from 56.4 in May, below consensus expectations (56.2). The headline dip was entirely driven by the manufacturing index, which fell to 56.8 in July from 57.4 in June. By contrast, the services index remained stable at 55.4. The PMI’s forward-looking components remained pretty strong, despite...

Read More »Sluggish inflation will keep BoJ on easing for a long time

The BoJ is keeping its policies unchanged, and there is no change in our scenario regarding its future policy moves.In July’s monetary policy meeting, the Bank of Japan (BoJ) decided to keep its monetary easing programme unchanged, maintaining its qualitative and quantitative easing (QQE) with yield-curve control (YCC). In addition, the BoJ cut its inflation estimates for the current and next fiscal years, and revised its expectation for hitting its 2% target to one year later than the...

Read More »ECB: see you in autumn

The ECB made no change in its forward guidance at its July meeting. Our baseline scenario remains unchanged.At its July meeting, the ECB made no change in its monetary policy statement, as we expected. Importantly, the bias for QE extension “in terms of size and/or duration” was kept in the statement. ECB president Mario Draghi mentioned that the Governing Council (GC) was unanimous in communicating no change to forward guidance.Draghi reiterated that a very substantial degree of...

Read More »Is there an end to the US dollar’s weakness?

Extreme negative sentiment on the greenback and improving US data should pave the way for a significant US dollar rebound.Following disappointing US economic data and another failure to form a Republican majority on key legislation, the US dollar has slipped to a 10-month low, at 94.68 on 18 July.This extreme USD weakness has led to strong negative market sentiment, as highlighted by speculative positions on the futures market.Although we acknowledge that the foundations (rising inflation...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org