After GDP growth of 1.7% in 2017, we expect the Japanese economy to continue its cyclical recovery in 2018 but momentum is slowing.The second preliminary GDP reading showed that Japanese GDP rose 0.4% over the previous quarter (1.6% annualised) in real terms and 2.0% year-over-year (y-o-y). This latest data release points to Japanese GDP growth of 1.7% in full-year 2017, slightly below our forecast of 1.8%. This still marks the highest annual growth rate for Japan since 2013, and extends the number of consecutive quarters of expansion to eight, the longest streak since 2001.The latest GDP data, which are still subject to further revisions, point to a moderation in growth momentum in Japan in the final quarter of 2017. While the slowdown itself is not a surprise to us, the speed of the

Topics:

Dong Chen considers the following as important: Japan GDP forecast, Japan Q4 GDP, Japanese growth, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

After GDP growth of 1.7% in 2017, we expect the Japanese economy to continue its cyclical recovery in 2018 but momentum is slowing.

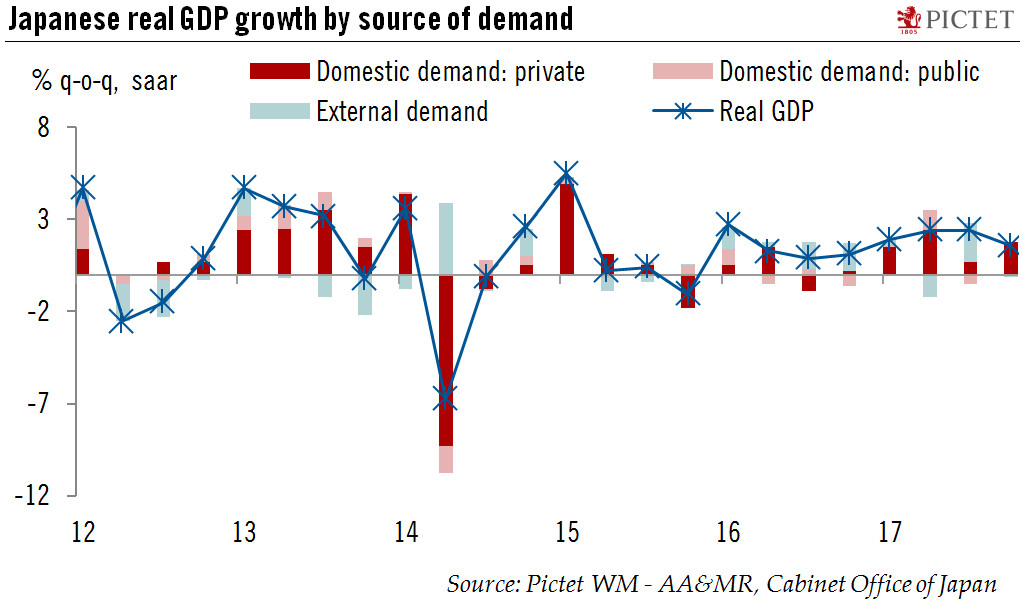

The second preliminary GDP reading showed that Japanese GDP rose 0.4% over the previous quarter (1.6% annualised) in real terms and 2.0% year-over-year (y-o-y). This latest data release points to Japanese GDP growth of 1.7% in full-year 2017, slightly below our forecast of 1.8%. This still marks the highest annual growth rate for Japan since 2013, and extends the number of consecutive quarters of expansion to eight, the longest streak since 2001.

The latest GDP data, which are still subject to further revisions, point to a moderation in growth momentum in Japan in the final quarter of 2017. While the slowdown itself is not a surprise to us, the speed of the deceleration is slightly above our expectations. Both domestic and external demand contributed to growth in Q4 2017, although net exports’ contribution turned slightly negative because of a strong rise in imports. Household consumption rebounded after a soft Q3, while corporate capex seems to be picking up gradually.

As we move further into 2018, various indicators are pointing to further moderation in Japan’s growth momentum in Q1, both on the household consumption and industrial fronts.

Looking ahead, we expect the Japanese economy to continue its cyclical recovery in 2018 but with less momentum than last year. Solid external demand will likely continue to support the export sector, although the recent strengthening of the yen and the rising protectionism of the Trump administration may dampen the outlook for export growth to some extent. On the other hand, corporate capex will likely continue to rise in response to the increasingly tight capacity constraints. The consumer sector is gradually recovering, but could be constrained by wage growth, which remains modest at the moment.

With all these in mind, we have decided to revise our GDP forecast for Japan in 2018 slightly down, to 1.2% from the previous 1.3%. This small numerical adjustment does not change our core scenario for Japan in any significant way.