We continue to expect the ECB to announce a gradual tapering of QE in the middle of the year.The ECB made one small change to its communication in March consistent with a normalisation process that is likely to remain very gradual. In line with our expectations, today the Governing Council (unanimously) decided to drop its commitment to increase asset purchases “in terms of size and/or duration” if needed, which had steadily become more difficult to justify and less credible anyway. In effect, the ECB has started the process of “de-linking” QE from the inflation outlook and “rotating” its forward guidance, towards a policy stance that will be driven by the whole set of instruments, including reinvestment and “especially” policy rates.This rotation is not hawkish in itself – the ECB can

Topics:

Frederik Ducrozet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

We continue to expect the ECB to announce a gradual tapering of QE in the middle of the year.

The ECB made one small change to its communication in March consistent with a normalisation process that is likely to remain very gradual. In line with our expectations, today the Governing Council (unanimously) decided to drop its commitment to increase asset purchases “in terms of size and/or duration” if needed, which had steadily become more difficult to justify and less credible anyway. In effect, the ECB has started the process of “de-linking” QE from the inflation outlook and “rotating” its forward guidance, towards a policy stance that will be driven by the whole set of instruments, including reinvestment and “especially” policy rates.

This rotation is not hawkish in itself – the ECB can push back against rate hike expectations, and it will do just that if inflation disappoints. A sustained adjustment in core inflation is still required to provide the burden of proof, hence the ‘patient, persistent, prudent’ motto before proper policy normalisation can start in H2 2018.

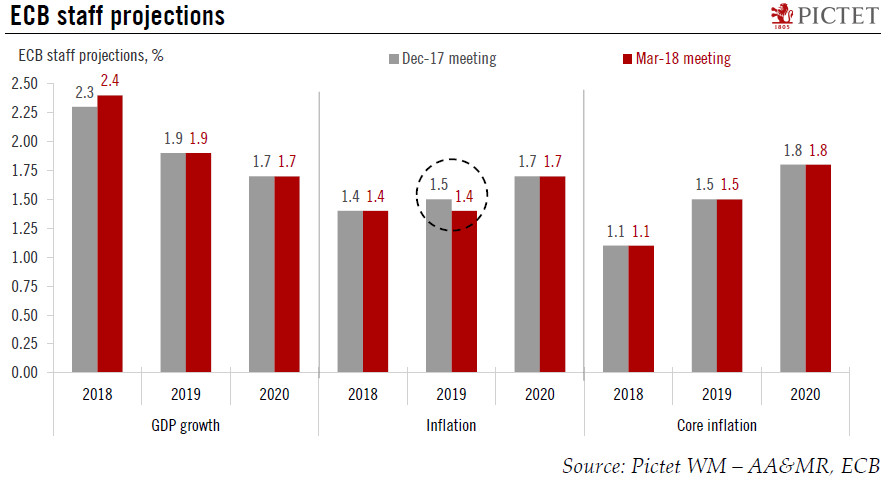

The general tone of today’s press conference was broadly neutral, with upbeat comments on domestic developments offset by downside risks to global growth linked to the threat of protectionist measures by the US. The revisions to ECB staff projections were small but dovish, on balance, including a slightly lower end-point for quarterly inflation forecasts in spite of lower unemployment, in our view reflecting the lagged impact of a stronger currency. Still, the ECB remains confident that the rapid decline in economic slack will lead to inflationary pressure over the medium term.

The revisions to ECB staff projections were small, but dovish overall. The ECB remains confident over the medium-term outlook, but is still waiting for core inflation to provide the burden of proof.

We continue to expect the ECB to announce a gradual tapering of QE in June or July, with asset purchases likely to be wound down to zero over the course of a few months. Ultimately, we expect the market’s focus to shift from the timing of the first rate hike to the broader pace of monetary tightening.