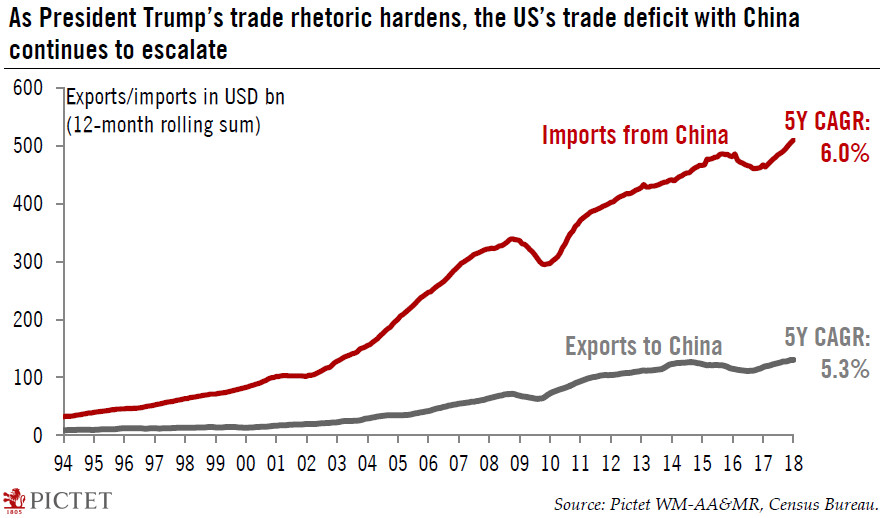

The escalating trade deficit with China comes at a politically sensitive time.The release of January trade data could not have been more topical, coming as it does shortly after the Trump Administration announced fresh tariffs on imports of steel and aluminum, in the context of dangerously hardening trade rhetoric.The monthly US trade defict rose to USD 56.6bn in January, the highest since October 2008. And the politically-sensitive deficit with China rose to USD 36.0bn (non-seasonally adjusted), the highest January figure ever. The bilateral deficit with China rose to USD 379.9bn in the 12 months to end January, a record high.The question now is whether Trump’s surprise announcement of tariffs on metal imports a few days ago is just political posturing to please his political base as

Topics:

Thomas Costerg considers the following as important: Macroview, US Chart of the week, Us imports, US trade deficit

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The escalating trade deficit with China comes at a politically sensitive time.

The release of January trade data could not have been more topical, coming as it does shortly after the Trump Administration announced fresh tariffs on imports of steel and aluminum, in the context of dangerously hardening trade rhetoric.

The monthly US trade defict rose to USD 56.6bn in January, the highest since October 2008. And the politically-sensitive deficit with China rose to USD 36.0bn (non-seasonally adjusted), the highest January figure ever. The bilateral deficit with China rose to USD 379.9bn in the 12 months to end January, a record high.

The question now is whether Trump’s surprise announcement of tariffs on metal imports a few days ago is just political posturing to please his political base as mid-term elections approach, or whether it represents a genuine regime shift in US trade policy, with more tariffs in the pipeline (and the risk of a full-blown trade war down the road). In a nutshell, we tend to view these tariffs as representing pre-election posturing, although the risk of a more substantial shift in policy has clearly risen in recent days (see also our latest ‘Flash Note – Steel-ing the show’)—especially so in light of Gary Cohn’s resignation as advisor to President Trump.

President Trump believes the trade balance matters. He is adamant that more protection on US imports is necessary to plug the gap, since countries like China do not play by the rules of global trade. However debatable are Trump’s views, the latest increase in imports from China risks providing him with additional ammunition.