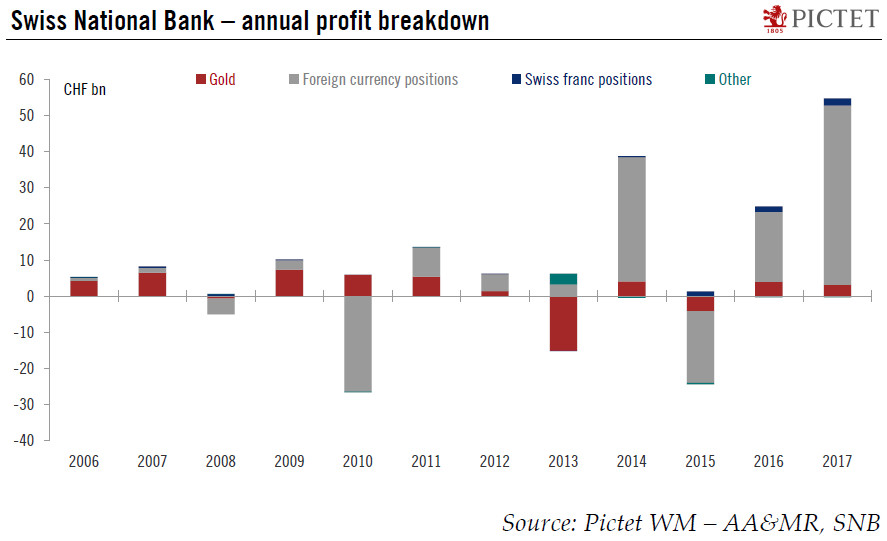

The SNB made a record high profit in 2017, mainly due to its foreign currency positions.The Swiss National Bank (SNB) published its 2017 annual result today. The SNB confirmed a profit of CHF54.4bn in 2017. This was more than double the 2016 figure (CHF24.5bn) and its biggest profit ever. Earnings from the SNB’s foreign currency positions amounted to CHF49.7bn, its gold holdings increased in value by CHF3.1bn and its Swiss positions by CHF2bn.The CHF2bn profit the SNB made on its Swiss franc positions essentially arose from the SNB’s negative interest charge* on sight deposit account balances (CHF2.0bn). This was more than in 2016 (CHF1.5bn) and in 2015 (CHF1.1bn).Regarding foreign-currency positions, interest income amounted to CHF9.3bn and dividend income to CHF3.2bn. Price losses of

Topics:

Nadia Gharbi considers the following as important: Macroview, SNB

This could be interesting, too:

investrends.ch writes SNB schreibt 2024 definitiven Gewinn von über 80 Milliarden Franken

investrends.ch writes Wechsel an der VR-Spitze von Julius Bär

investrends.ch writes WEF 2025: SNB schliesst Negativzinsen nicht aus

investrends.ch writes SNB mit Rekordgewinn – Bund und Kantone freuen sich

The SNB made a record high profit in 2017, mainly due to its foreign currency positions.

The Swiss National Bank (SNB) published its 2017 annual result today. The SNB confirmed a profit of CHF54.4bn in 2017. This was more than double the 2016 figure (CHF24.5bn) and its biggest profit ever. Earnings from the SNB’s foreign currency positions amounted to CHF49.7bn, its gold holdings increased in value by CHF3.1bn and its Swiss positions by CHF2bn.

The CHF2bn profit the SNB made on its Swiss franc positions essentially arose from the SNB’s negative interest charge* on sight deposit account balances (CHF2.0bn). This was more than in 2016 (CHF1.5bn) and in 2015 (CHF1.1bn).

Regarding foreign-currency positions, interest income amounted to CHF9.3bn and dividend income to CHF3.2bn. Price losses of CHF5.5bn were posted on interest-bearing paper and instruments. The SNB’s equity holdings benefited from the favourable stock market environment and contributed CHF21.5bn to the net result. Overall, exchange rate-related gains amounted to CHF21.0bn.

As we mentioned previously, there are several reasons to believe that the SNB may soon start to normalise its monetary policy. First, the macroeconomic outlook has improved: Swiss growth is picking up and becoming broader based across a range of sectors, while inflation is also gradually rising. Second, upward pressure on the Swiss franc has slackened considerably; indeed, the currency has weakened. Third, other central banks (in particular the Fed and the ECB) are gradually removing some of their own stimulus.

A change of communication about future monetary policy is likely to come during H2 2018. Before it moves, the SNB will want to wait for sure signs that the ECB is ending its quantitative easing (QE) programme and that an ECB deposit rate hike is on the cards for Q3 2019, as we expect.

Regarding rates, our best guess is that there will be a first rate hike of 25bp in December 2018 (assuming that the ECB has signalled the end of its QE programme by then). This would still leave the SNB’s policy rate below the ECB’s current deposit rate of -0.40%. We forecast a second SNB hike for Q3 2019, when we also expect the ECB to raise policy rates for the first time.