We believe the announcement of new US import tariffs will have little macroeconomic effect, but there are real risks of an escalation in trade tensions.US President Trump wants to impose trade tariffs of 25% on imports of steel and 10% on aluminium, although the formal announcement and the exact details are yet to be released. The basis for this move is officially ‘national security’, although it is clear that there are also internal political considerations at play. Still, our base case is that US trade tariffs will remain industry-specific, (echoing what happened with Ronald Reagan’s 1980s trade policy) and that they have more of a micro than a macro impact.The fear of a market correction – especially since Trump has tied his political fortunes so much to the stock market – likely

Topics:

Thomas Costerg considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

We believe the announcement of new US import tariffs will have little macroeconomic effect, but there are real risks of an escalation in trade tensions.

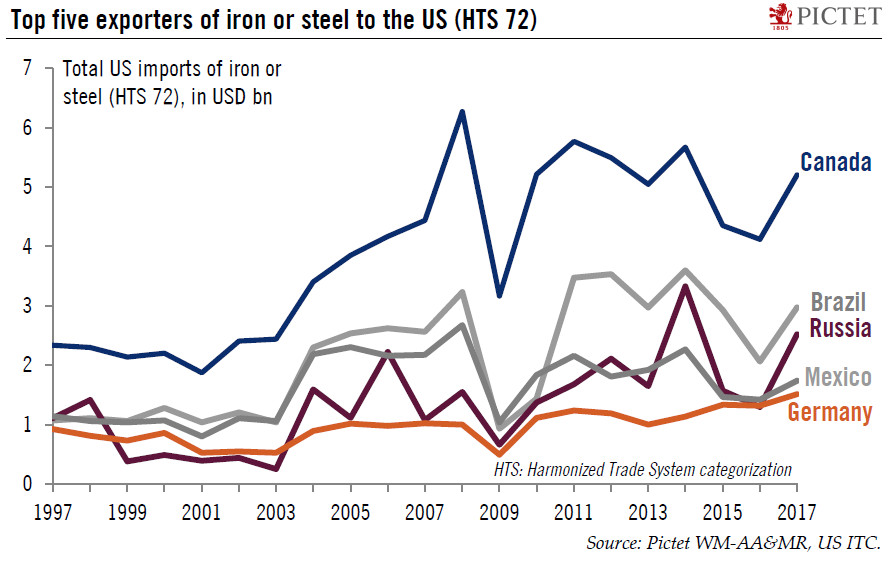

US President Trump wants to impose trade tariffs of 25% on imports of steel and 10% on aluminium, although the formal announcement and the exact details are yet to be released. The basis for this move is officially ‘national security’, although it is clear that there are also internal political considerations at play. Still, our base case is that US trade tariffs will remain industry-specific, (echoing what happened with Ronald Reagan’s 1980s trade policy) and that they have more of a micro than a macro impact.

The fear of a market correction – especially since Trump has tied his political fortunes so much to the stock market – likely mitigates the possibility of any sharp escalation in Trump’s trade rhetoric, in our view. Corporate lobbies, including importers and those involved in complex global supply chains, as well as the Republican Party leadership, are also likely to spring into action and limit the reach of the tariffs or any further trade protection measures. We do not believe that there will be blanket tariffs on all imports from a given country such as China.

But US import tariffs could raise medium-term risks to growth if they were followed by further trade restrictions and a worsening business environment. Trump’s tariff move could also revive fears that Trump’s populism goes beyond rhetoric. It is possible that Trump’s decision may be followed by trade tariffs to protect other ‘sensitive’ industries, like car manufacturing. There is also the risk of retaliation from trade partners, and even the tail risk of a trade war. If the US’s trade partners were to retaliate forcefully, there could be downside risks to the growth outlook – not only because of the impact on supply chains but also due to the potential hit to business confidence and decreased visibility.

While we prefer to remain relatively sanguine, the details of the new tariffs on steel and aluminium will provide a first impression on the direction of travel in terms of Trump trade policy—whether we stay at the micro level or whether we start to migrate, more worryingly, to a kind of protectionism that has a ‘macro’ impact.

For now, we are keeping our core 2018 US GDP growth forecast of 3.0% (up from 2.3% in 2017) and our forecast of four Fed rate hikes this year as we expect trade rhetoric to stay contained and underlying economic momentum remains solid.