CEPR Discussion Paper 13778, June 2019, with Markus Brunnermeier. PDF. (Local copy of NBER wp.) We develop a generic model of money and liquidity that identifies sources of liquidity bubbles and seignorage rents. We provide sufficient conditions under which a swap of monies leaves the equilibrium allocation and price system unchanged. We apply the equivalence result to the “Chicago Plan,” cryptocurrencies, the Indian de-monetization experiment, and Central Bank Digital Currency (CBDC). In...

Read More »“On the Equivalence of Private and Public Money,” NBER, 2019

NBER Working Paper 25877, May 2019, with Markus Brunnermeier. PDF. (Local copy.) We develop a generic model of money and liquidity that identifies sources of liquidity bubbles and seignorage rents. We provide sufficient conditions under which a swap of monies leaves the equilibrium allocation and price system unchanged. We apply the equivalence result to the “Chicago Plan,” cryptocurrencies, the Indian de-monetization experiment, and Central Bank Digital Currency (CBDC). In particular, we...

Read More »The Spreads Blow Out, Update 1 May

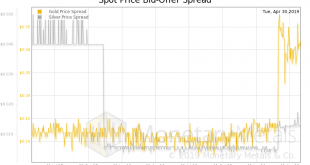

The bid-ask spread of both (spot) gold and silver has blown out. Both, on March 1. In gold, the spread had been humming along around 13 cents—gold is the most marketable commodity, and this is the proof, a bid-ask spread around 1bps—until… *BAM!* It explodes to around 35 cents, or two and half times as wide. On the same day, silver went from half a cent to 1.5 cents, or about triple. We zoomed out far enough—it does...

Read More »COT Blue: Distinct Lack of Green But A Lot That’s Gold

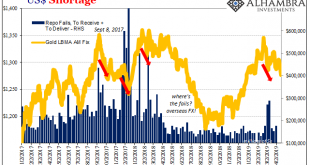

Gold, in my worldview, can be a “heads I win, tails you lose” proposition. If it goes up, that’s fear. Nothing good. If it goes down, that’s collateral. In many ways, worse. Either way, it is only bad, right? Not always. There are times when rising gold signals inflation, more properly reflation perceptions. Determining which is which is the real challenge. Corroboration and consistency are paramount. Gold had been...

Read More »Fed Balance Sheet Policy and Collateral

On his blog, Stephen Williamson discusses the Fed’s plan to maintain a much larger balance sheet in the future than before the crisis. He is not convinced that this plan is a good one. But what’s the harm in a large Fed balance sheet? The larger the balance sheet, the lower is the quantity of Treasury securities in financial markets, and the higher is reserves. Treasuries are highly liquid, widely-traded securities that play a key role in overnight repo markets. Reserves are highly liquid...

Read More »Fed Balance Sheet Policy and Collateral

On his blog, Stephen Williamson discusses the Fed’s plan to maintain a much larger balance sheet in the future than before the crisis. He is not convinced that this plan is a good one. But what’s the harm in a large Fed balance sheet? The larger the balance sheet, the lower is the quantity of Treasury securities in financial markets, and the higher is reserves. Treasuries are highly liquid, widely-traded securities that play a key role in overnight repo markets. Reserves are highly liquid...

Read More »Nothing To See Here, It’s Just Everything

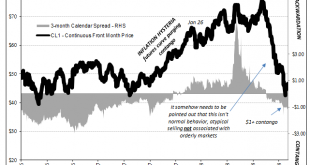

The politics of oil are complicated, to say the least. There’s any number of important players, from OPEC to North American shale to sanctions. Relating to that last one, the US government has sought to impose serious restrictions upon the Iranian regime. Choking off a major piece of that country’s revenue, and source for dollars, has been a stated US goal. In May, the Trump administration formally withdrew from the...

Read More »Price Effects of Purchases of Greek Sovereign Debt by the ECB

In a CEPR discussion paper, Christoph Trebesch and Jeromin Zettelmeyer argue that ECB bond buying had a large impact on the price of short and medium maturity bonds … However, the effects were limited to those sovereign bonds actually bought. We find little evidence for positive effects on market quality, or spillovers to close substitute bonds, CDS markets, or corporate bonds. A multiple equilibria view of the crisis would probably suggest otherwise.

Read More »Little Behind CNY

The framing is a bit clumsy, but the latest data in favor of the artificial CNY surge comes to us from Bloomberg. The mainstream views currency flows as, well, flows of currency. That’s what makes their description so maladroit, and it can often lead to serious confusion. A little translation into the wholesale eurodollar reality, however, clears it up nicely. Demand for foreign exchange outstripped that for yuan for...

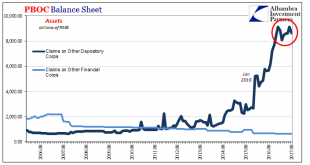

Read More »PBOC RMB Restraint Derives From Experience Plus ‘Dollar’ Constraint

Given that today started with a review of the “dollar” globally as represented by TIC figures and how that is playing into China’s circumstances, it would only be fitting to end it with a more complete examination of those. We know that the eurodollar system is constraining Chinese monetary conditions, but all through this year the PBOC has approached that constraint very differently than last year.The updated balance...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org