I don’t think Milton Friedman would have made much of chess player. For all I know he might have been a grand master or something close to that rank, but as much as his work is admirable it invites too the whole range of opposite emotion. He was the champion libertarian of the free market who rescued economics from the ravages of New Deal socialism, but in doing so he simply created the avenue for where Economics of...

Read More »Macroeconomic Effects of Bank Solvency vs. Liquidity

In a CEPR discussion paper, Òscar Jordà, Björn Richter, Moritz Schularick, and Alan M. Taylor suggest that higher bank capital ratios help stabilize the financial system ex post but not ex ante, and that illiquidity breeds fragility. Abstract of their paper: Higher capital ratios are unlikely to prevent a financial crisis. This is empirically true both for the entire history of advanced economies between 1870 and 2013 and for the post-WW2 period, and holds both within and between...

Read More »Money, Banking, and Dreams

In another excellent post on Moneyness, J P Koning likens the monetary system to the plot in the movie Inception, featuring a dream piled on a dream piled on a dream piled on a dream. Koning explains that [l]ike Inception, our monetary system is a layer upon a layer upon a layer. Anyone who withdraws cash at an ATM is ‘kicking’ back into the underlying central bank layer from the banking layer; depositing cash is like sedating oneself back into the overlying banking layer. Monetary...

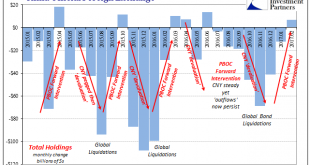

Read More »China And Reserves, A Straightforward Process Unnecessarily Made Into A Riddle

The fact that China reported a small increase in official “reserves” for February 2017 is one of the least surprising results in all of finance. The gamma of those reserves is as predictable as the ticking clock of CNY, in no small part because what is behind the changes in those balances are the gears that lie behind face of the forex timepiece. Yet, each and every time the delta pushes positive there is the same...

Read More »Not Recession, Systemic Rupture – Again

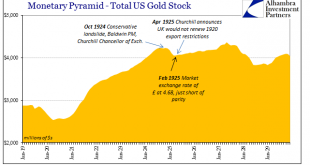

For the very few in the mainstream of economics who venture further back in history than October 1929, they typically still don’t go much last April 1925. And when they do, it is only to further bash the gold standard for its presumed role in creating the conditions for 1929. The Brits under guidance of Winston Churchill made a grave mistake, one from which gold advocates could never recover given what followed. There...

Read More »Not Recession, Systemic Rupture – Again

For the very few in the mainstream of economics who venture further back in history than October 1929, they typically still don’t go much last April 1925. And when they do, it is only to further bash the gold standard for its presumed role in creating the conditions for 1929. The Brits under guidance of Winston Churchill made a grave mistake, one from which gold advocates could never recover given what followed. There...

Read More »Collateral Values in ECB Operations

In the NZZ, Kjell Nyborg questions whether the collateral values of the securities the ECB accepts in monetary policy operations reflect market values. He argues that the valuation is discretionary and politicized. Meine Analyse macht deutlich, dass der Besicherungsrahmen in der Euro-Zone in unterschiedlicher Ausprägung unter all diesen Problemen leidet. Das öffentliche Verzeichnis der zulässigen notenbankfähigen Sicherheiten enthält 30 000 bis 40 000 verschiedene Wertpapiere, von...

Read More »Seignorage and Cantillon Effects in India

On Alt-M, Larry White discusses three aspects of the Indian “demonetization” experiment. The transition from old notes blocks “honest” currency transactions, reduces income, and harms the poor who don’t have access to alternative means of payment. Because not all old notes will be redeemed, the transition into new notes will generate seignorage revenue for the government on the order of USD 40 billion, according to White’s estimates. Not all groups or industries get access to the new...

Read More »Pawn Shops, Information Insensitivity, and Debt-on-Debt

In a BIS working paper (January 2015), Bengt Holmstrom summarizes some of the implications of the research on information insensitive debt. He cautions against moves to increase transparency in debt markets and defends the shadow banking system. He explains why opacity and information insensitivity are valuable and argues that debt-on-debt arrangements are (privately) optimal. It all started with pawn shops: The beauty lies in the fact that collateralised lending obviates the need to...

Read More »Should the Fed Reduce the Size of its Balance Sheet?

On his blog, Ben Bernanke discusses the merits of the Fed’s strategy to slowly reduce the size of its balance sheet to pre crisis levels. Bernanke suggests that this strategy should be reconsidered: First, the large balance sheet provides lots of safe and liquid assets for financial markets. This might strengthen financial stability. (DN: In my view, there are also reasons to expect the opposite.) Second, a larger balance sheet can help improve the workings of the monetary transmission...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org