When Alan Greenspan went back to Stanford University in September 1997, his reputation was by then well-established. Even as he had shocked the world only nine months earlier with “irrational exuberance”, the theme of his earlier speech hadn’t actually been about stocks; it was all about money. The “maestro” would revisit that subject repeatedly especially in the late nineties, and it was again his topic in California early Autumn ’97. As Emil Kalinowski and I had just talked about in our latest podcast episode of Eurodollar University, Greenspan wasn’t so much letting the audience in on the Federal Reserve’s dirty little secret out of kindness. Money supply numbers were rendered unhelpful a long time before. They stopped using M1 around 1982, or so they later

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, Alan Greenspan, bonds, currencies, economy, establishment survey, Featured, Federal Reserve/Monetary Policy, household survey, jay powell, labor force, labor force participation rate, Labor market, M1, M2, Markets, Money, newsletter, payrolls, rate hikes, taper, unemployment rate

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

When Alan Greenspan went back to Stanford University in September 1997, his reputation was by then well-established. Even as he had shocked the world only nine months earlier with “irrational exuberance”, the theme of his earlier speech hadn’t actually been about stocks; it was all about money.

The “maestro” would revisit that subject repeatedly especially in the late nineties, and it was again his topic in California early Autumn ’97. As Emil Kalinowski and I had just talked about in our latest podcast episode of Eurodollar University, Greenspan wasn’t so much letting the audience in on the Federal Reserve’s dirty little secret out of kindness.

Money supply numbers were rendered unhelpful a long time before. They stopped using M1 around 1982, or so they later declared, when the FOMC had at several times advised of the same’s obsolescence a decade before then. M2 had become an equally obvious problem by the late eighties.

Thus, the irrational exuberance speech centered around how “money supply trends had veered off path several years ago” with Emil slamming the former Fed Chair for just how much weasel work the qualifier “several years ago” was left to accomplish.

So, the guy wasn’t trying to be helpful as much as he was just complaining how hard his job had become. Pity the man:

Nonetheless, we recognize that inflation is fundamentally a monetary phenomenon, and ultimately determined by the growth of the stock of money, not by nominal or real interest rates. In current circumstances, however, determining which financial data should be aggregated to provide an appropriate empirical proxy for the money stock that tracks income and spending represents a severe challenge for monetary analysts.

| If you are nominally a “central bank”, and you no longer have any useful monetary aggregate, data, or even understanding to anchor nominally monetary policy, all you’re left with are “discretionary” policies.

Subjective, in other words. You would have to pick and choose from an array of economic and financial data – not money numbers – from which to divine either success or unsatisfactory results by basically winging it. As Greenspan says in the quote below, you can’t even make a single model from these aggregates because the real world, like the money in it, is constantly changing all the time. One year you might settle upon, oh, the unemployment rate, just throwing it out there, but find out the next it may not be a suitable guide after all. Or the Establishment Survey? If you might recall, the Federal Reserve had for years been keen to point to both the headline payroll figure as well as the unemployment rate as evidence for QE’s post-2008 success. Going back to 2014, when the former accelerated and the latter began to drop precipitously, the two together made a seemingly formidable judgement. Didn’t exactly work out. |

|

Discretionary monetary policy, however, can mean exactly what was troubling Greenspan in 1997; in the absence of any anchor, policymakers might simply choose the wrong data leaving them exposed to fooling themselves while just making it up on the fly:

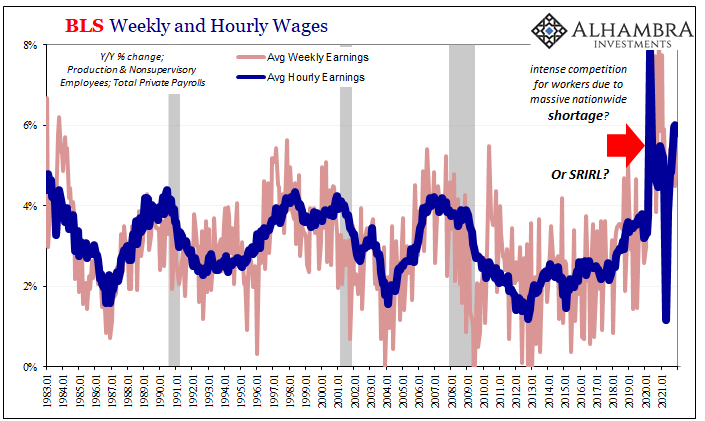

Interesting, isn’t it, that in today’s payroll report, the Establishment Survey’s deceleration revealed by it and these ongoing “misses” factor nothing in mainstream assessments of continuing double taper along with further expectations for triple rate hikes or better. In other words, even though it just may be the labor market has really slowed down, this doesn’t seem like it will matter to those at the Fed who have given themselves the discretion to pick and choose data as they like. What they like is, apparently, the unemployment rate and now wage data. But as I said to Emil, I don’t actually believe they actually believe in the wage data, either. I seriously question the official commitment to the unemployment rate, too. |

|

| In private, I mean; in public, it’s entirely another matter. Yes, Jay Powell and his committee members will extol the sudden virtues of wages that look way too much like SRIRL with which many of them (not the empty suits) are undoubtedly familiar. And we just did this with the unemployment rate not even two and a half years ago!

However, these officials have to justify tapering and rate hiking if for no other reason than to quell public anxiety (political pressure?) and they’ll craft a façade of high wages and tight labor in order to do it! Whether those things are true in any real sense doesn’t necessarily matter to those whose operating theory is, by expectations, you make your own reality (by making the public believe you). That’s discretionary policy in the 21st century; with no money to be seen nor heard, just pick whichever data, labor and otherwise, you need to fit in the expectations policy regime you are trying to sell. |

|

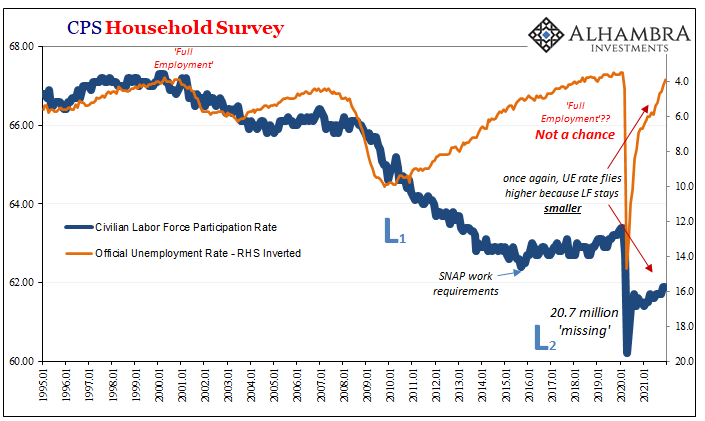

| The December 2021 payroll report delivered on all these accounts, good and bad. The good (for taper): the unemployment rate tumbled to just 3.9% as if it really is 2019 all over again. The reason for the drop, a large monthly gain in the Household Survey unaccompanied – as usual – by any significant increase in the labor force (the latter up just 168,000 last month, having added back a meek 1.6 million for all of 2021; note: all CPS data was revised back to 2017 to update seasonal adjustment factors).

The result is the unemployment rate tumbling two whole points in just the last six months! Tight labor market? Sure, if you subjectively choose not to count the participation problem which has only gotten worse. |

|

| Discretionary policy allows the Fed to merely ignore or rationalize this as it has been doing for more than a decade thus far.

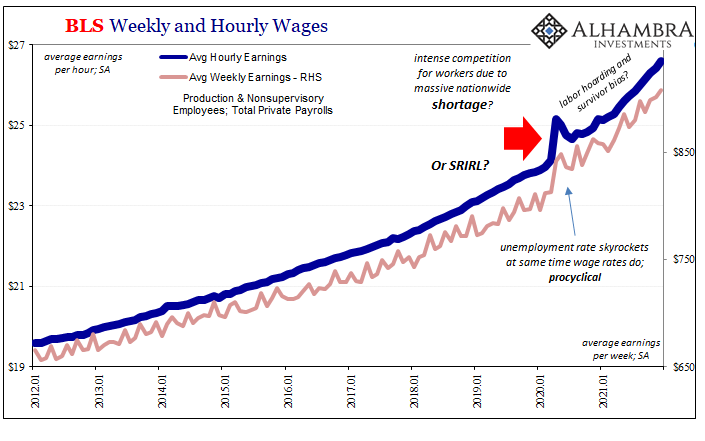

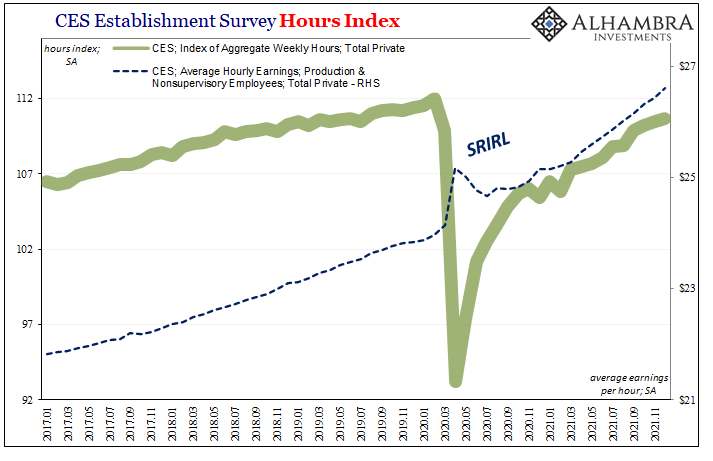

Next to the unemployment rate, wages. I wrote about this data earlier this week with just this set of circumstances in mind. What I would add here is more and strongly compelling evidence of SRIRL in that data: hours as much as the stubborn labor force. |

|

| In my view, what you see above is due to clear labor hoarding including timing aspects (why published wage rates are way up but hours worked on the whole continue, like the labor force, to be frustratingly less than February 2020). Again, however, while I believe the FOMC is aware of these correlations and what they seem to indicate (not inflation), Powell’s group won’t necessarily care so long as the published data is helpful to further the taper narrative in the public mind.

Getting to that now requires completely dismissing the Big Shot of the labor data, the Star of the Show, the headline laypersons have been conditioned to almost exclusively rely upon for their quick take on what must be the economic condition. |

|

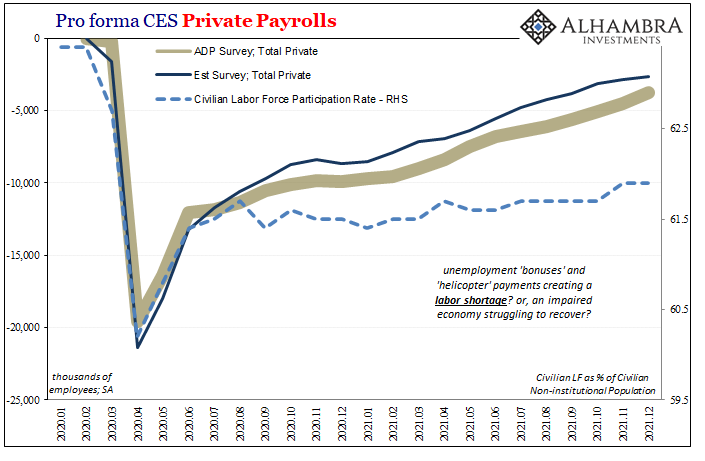

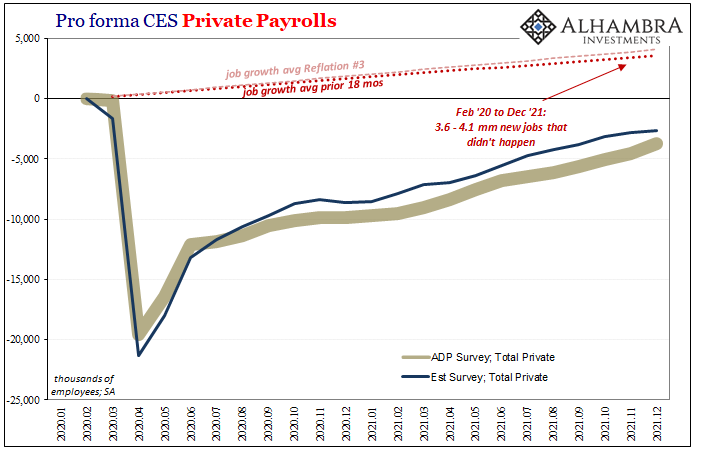

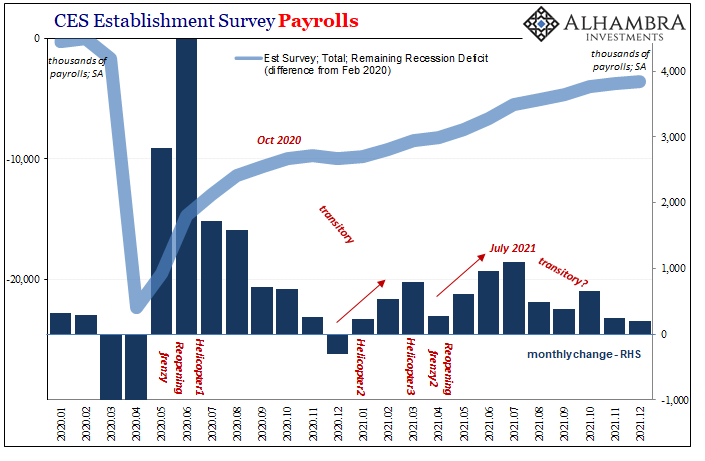

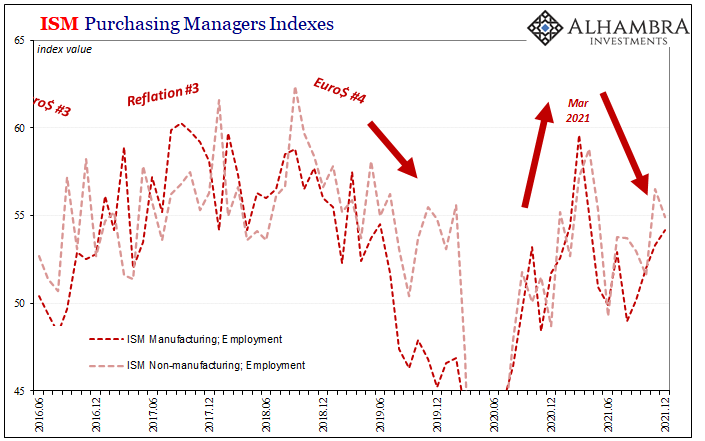

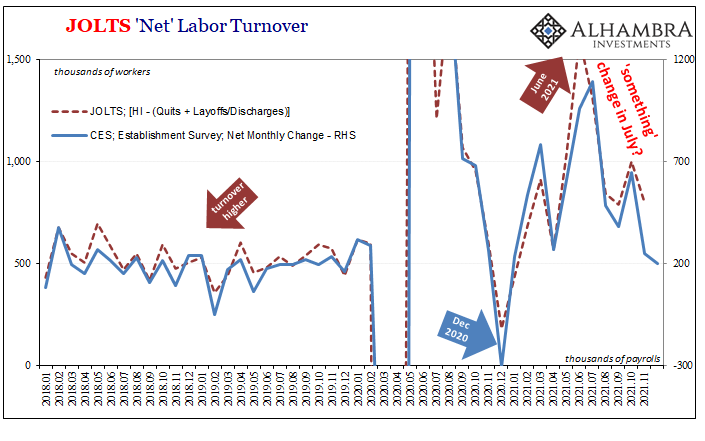

| Yes, the Establishment Survey missed badly for the second straight month – something we previewed just yesterday with ISM numbers as well as the day before looking into some recent discrepancies by way of JOLTS – but more than that has clearly decelerated since July. | |

| You could assign a number of reasons for the second half of 2021 missing the pattern of past reopening rebounds (and not just in payrolls; these figures merely consistent with a rash of “growth scare” estimates here as well as overseas), whether COVID variants, politics of one kind or another, possibly, as I favor, macro pressures which do abound.

Either way, whatever your preferred explanation, two things seem pretty clear at this juncture: the labor market just might have cooled way down; and that won’t matter one bit to the FOMC which many months ago had cornered itself about taper.

|

If they don’t accelerate their QE taper now, they risk sending the wrong signals to the economy which everyone says verges on the edge of 1973.

That’s the last thing about discretionary policy and the non-money of it; the whole ball of wax is little more than psychology, a puppet show. It was never a very good one, either, even when it included the Star of the Show, the Establishment Survey. Now it doesn’t even have that much, at least not since July.

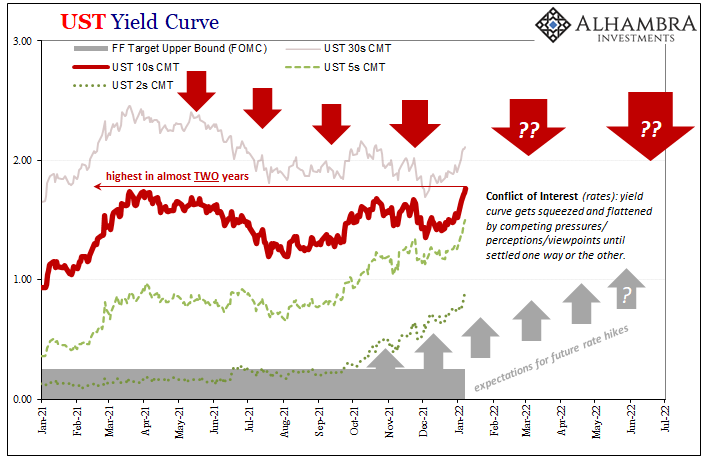

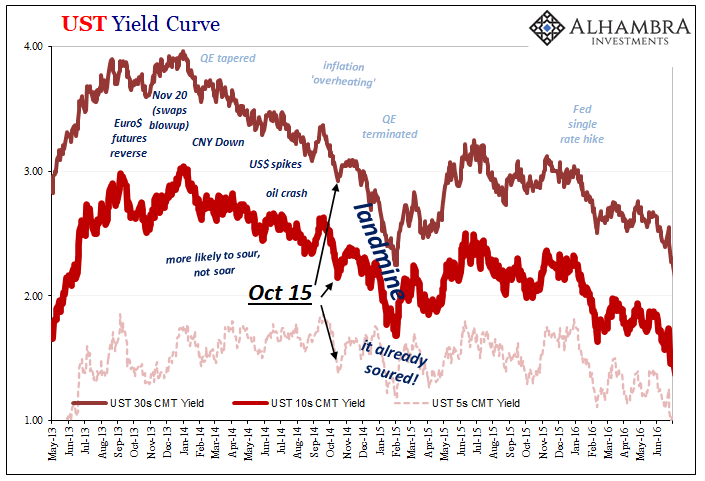

Taper away anyway, even if the economy really is on its growth scare path. No wonder Greenspan was such a complainer, and the bond market would “conundrum” seven years after Stanford. We might see that continue, too, for another round in ’22.

Taper rationalized into the short curve pressures, opposed by a growth scare factored in the opposite at the long end – even if nominal rates rise modestly in the meantime.

Tags: Alan Greenspan,Bonds,currencies,economy,establishment survey,Featured,Federal Reserve/Monetary Policy,household survey,jay powell,labor force,labor force participation rate,Labor Market,M1,M2,Markets,money,newsletter,payrolls,rate hikes,taper,unemployment rate