United States The first quarter winds down. The dollar moved lower against all the major currencies. The best performer in the first three months of the year has been the Australian dollar’s whose 5.8% rally includes last week’s 1% drop. The worst performing major currency has been the Canadian dollar. It often underperforms in a weak US dollar environment. It’s almost 0.5.% gain is less than half the appreciation...

Read More »FX Daily, March 24: Dollar Trying to Stabilize Ahead of the Weekend

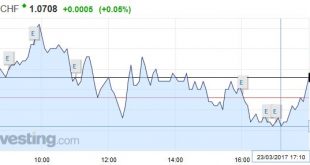

Swiss Franc EUR/CHF - Euro Swiss Franc, March 24(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF With just a few days to go before Article 50 is triggered the currency markets are waiting with baited breath for what may happen to the value of the Pound against all major currencies including against the Swiss Franc. Yesterday we saw a brief respite for the Pound vs the Swiss Franc with the release of...

Read More »FX Daily, March 23: Some Thoughts about the Recent Price Action

Swiss Franc EUR/CHF - Euro Swiss Franc, March 23(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The gains the US dollar scored last month have been largely unwound against the major currencies. The dollar’s losses against the yen are a bit greater, and it returned to levels not seen late last November. The down draft in the dollar appears part of a larger development in the capital markets that has...

Read More »Pressure, Sure, But From Where?

It may just be that in life you have to get used to disappointment. Though not for lack of trying, I have spent a great deal of time over the years intending to piece together exactly what happened on days like October 15, 2014. The official explanation is an obvious whitewash, one so haphazard that I doubt it will ever be referred to again outside of ridicule. So much changed after that one day, a buying panic in the...

Read More »FX Daily, March 21: Euro Recovery Continues, Posts New Six Week High Other Currencies Mixed

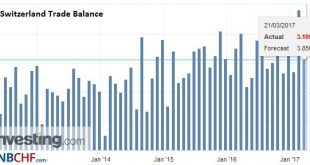

Swiss Franc Switzerland Trade Balance, February 2017(see more posts on Switzerland Trade Balance, ) Source: Investing.com - Click to enlarge GBP/CHF The Swiss Franc continues to remain incredibly strong as it maintains its status as a safe haven currency in these uncertain economic times globally. The Swiss National Bank quarterly bulletin is released tomorrow afternoon at 14pm which is produced by the...

Read More »FX Weekly Preview: Divergence Theme Questioned

Recent developments have given rise to doubts over the divergence theme, which we suggested have shaped the investment climate. There are some at the ECB who suggest rates can rise before the asset purchases end. The Bank of England left rates on hold, but it was a hawkish hold, as there was a dissent in favor of an immediate rate hike, and the rest of the Monetary Policy Committee showed that their patience with both...

Read More »FX Daily, March 14: Brexit Takes Fresh Toll on Sterling, While Dollar Firms more Broadly

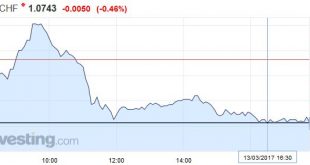

Swiss Franc EUR/CHF - Euro Swiss Franc, March 14(see more posts on EUR/CHF, ) - Click to enlarge FX Rates UK Prime Minister May got the parliamentary approval the courts ruled was necessary to formally trigger Article 50. It is not clear what UK she will lead out the EU. Scotland is beginning the legal proceedings to hold another referendum on independence. There is some talk that Northern Ireland, which...

Read More »FX Daily, March 13: Bonds and Equities Rally, Dollar Heavy

Swiss Franc EUR/CHF - Euro Swiss Franc, March 13(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The UK is edging closer to triggering Article 50 to start the formal negotiations of its exit from the EU. The House of Commons is expected to reject the amendments submitted by the House of Lords. If the House of Lords passes the stripped version, Prime Minister May could announce her intention to trigger...

Read More »FX Weekly Preview: Succinct Views of Ten Events and Market Drivers: Week Ahead

The week ahead is the busiest week of the first quarter. It sees four major central meetings, including the Federal Reserve which is likely to raise rates for the second time in four months. The Dutch hold the first European election of the year, and the populist-nationalist party remains in contention for the top slot. The week concludes with the G20 meeting, the first that the Trump Administration’s presence will be...

Read More »Time, The Biggest Risk

If there is still no current or present indication of rising economic fortunes, and there isn’t, then the “reflation” idea turns instead to what might be different this time as compared to the others. In 2013 and 2014, it was QE3 and particularly the intended effects (open ended and faster paced, a bigger commitment by the Fed to purportedly do whatever it took) upon expectations that supposedly set it apart from the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org