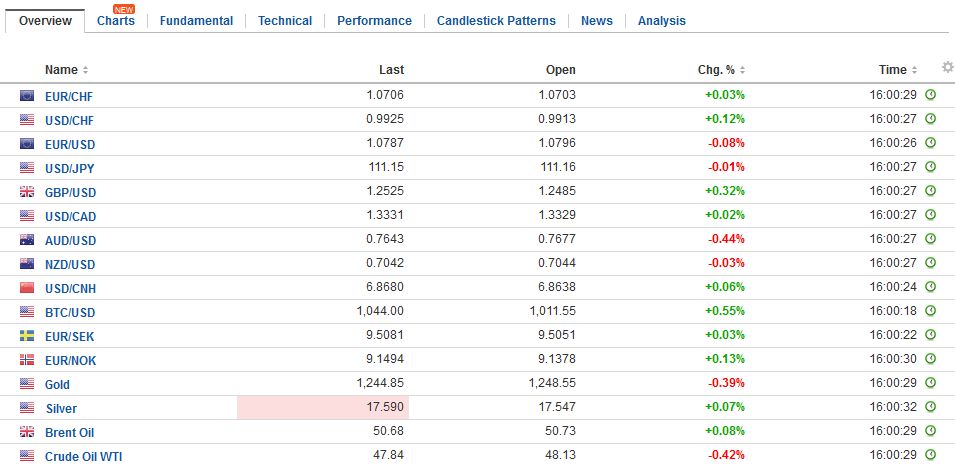

Swiss Franc EUR/CHF - Euro Swiss Franc, March 23(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The gains the US dollar scored last month have been largely unwound against the major currencies. The dollar’s losses against the yen are a bit greater, and it returned to levels not seen late last November. The down draft in the dollar appears part of a larger development in the capital markets that has also seen the US 10-year yield slide 25 bp in less than two weeks. The two-year yield is off 17 bp. The yield of 1.25% is 25 bp on top of the upper end of the Fed funds target range. There is much focus on the scheduled Thursday vote in the House of Representatives on the replacement for the Affordable Care Act. We suspect that if it does not appear to have the votes, the vote will be delayed. In some ways, there is much riding on it. A defeat would be seen as jeopardizing President Trump’s agenda. It would be a defeat for Speaker Ryan by the same forces that brought down his predecessor (the Freedom Caucus). In other ways, there is less riding on the particulars of the bill at this juncture. The Senate has opposed views, and it will likely pass its own version. Then the two differences are hammered out in the reconciliation process. It is there that the bill ultimately is shaped into law.

Topics:

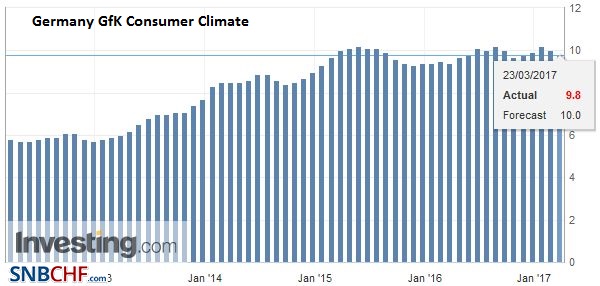

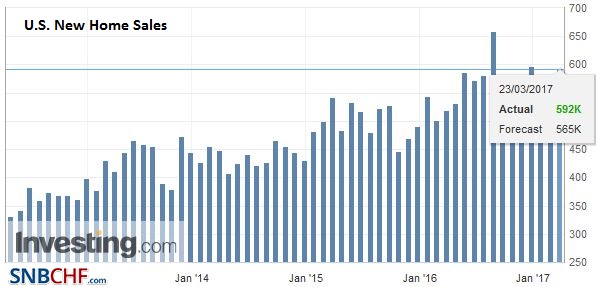

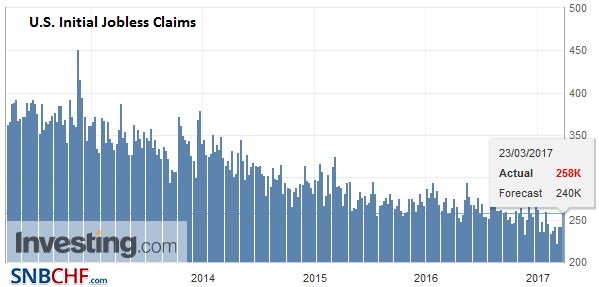

Marc Chandler considers the following as important: AUD, CAD, EUR, Eurozone Consumer Confidence, Featured, FX Trends, GBP, Germany GfK Consumer Climate, JPY, newslettersent, U.K. Retail Sales, U.S. New Home Sales, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss Franc |

EUR/CHF - Euro Swiss Franc, March 23(see more posts on EUR/CHF, ) |

FX RatesThe gains the US dollar scored last month have been largely unwound against the major currencies. The dollar’s losses against the yen are a bit greater, and it returned to levels not seen late last November. The down draft in the dollar appears part of a larger development in the capital markets that has also seen the US 10-year yield slide 25 bp in less than two weeks. The two-year yield is off 17 bp. The yield of 1.25% is 25 bp on top of the upper end of the Fed funds target range. There is much focus on the scheduled Thursday vote in the House of Representatives on the replacement for the Affordable Care Act. We suspect that if it does not appear to have the votes, the vote will be delayed. In some ways, there is much riding on it. A defeat would be seen as jeopardizing President Trump’s agenda. It would be a defeat for Speaker Ryan by the same forces that brought down his predecessor (the Freedom Caucus). In other ways, there is less riding on the particulars of the bill at this juncture. The Senate has opposed views, and it will likely pass its own version. Then the two differences are hammered out in the reconciliation process. It is there that the bill ultimately is shaped into law. Trump and Ryan can compromise on much to get any bill passed, which can be heralded as a success. We suspect this will be the case before the weekend, and this could help support the dollar and stocks, while interest rates may also rise in response. |

FX Daily Rates, March 23 |

| In addition, Yellen, and the Fed’s leadership may not be satisfied with the market’s response to its statement and forecasts. If she or NY Fed President Dudley want to correct a misunderstanding or misperception, speeches on Thursday and Friday could offer such an opportunity.

Lastly, we had anticipated a pullback in oil prices after failing at $50 last week. However, we suggested that losses would not be sustained. This still seems like a reasonable assessment. Confirmation of a large build in US oil inventories by the Department of Energy saw the low recorded, but then prices recovered. A hammer candlestick appears to have been formed. There looks to be a bullish divergence in the RSI and the Slow Stochastics are turning higher. Higher oil prices may remove one source of pressure on US yields. The technical indicators have yet to turn for the dollar. We suspect that a break of $1.0740-$1.0750 would be an early sign that a top may be being formed. The euro spent the better part of the last two sessions between $1.0780 and $1.0820, so this allows for some range extension. |

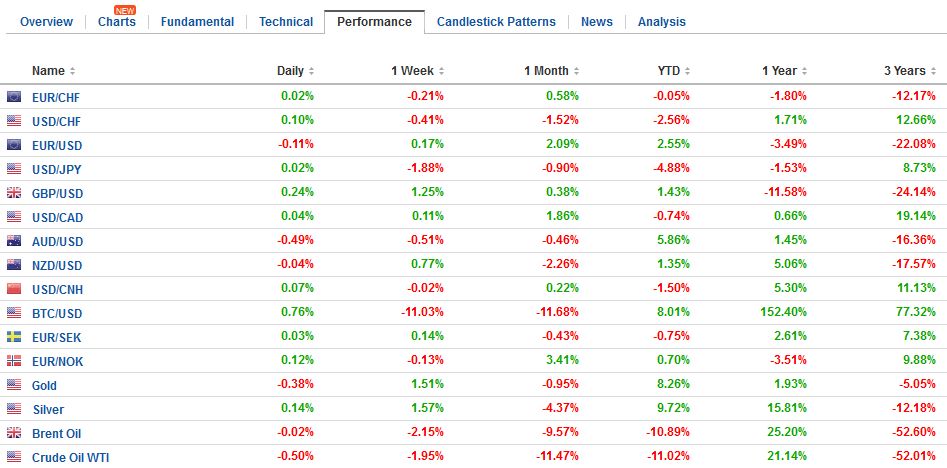

FX Performance, March 23 |

United KingdomSterling’s upside momentum that has seen it rally four cents since the day before the FOMC statement is stalling in the $1.2480-$1.2500 resistance area. A move above here could see a quick move toward $1.2565-$1.2585. On the downside, it probably requires a push through $1.2420 to be of note. Retail sales on March 23 are expected to increase after a three-month slide. After the upside surprise on inflation and the downward surprise on average weekly earnings, and the recent rally in sterling, the market may be more vulnerable to disappointing report than a better one. |

U.K. Retail Sales YoY, February 2017(see more posts on U.K. Retail Sales, ) Source: Investing.com - Click to enlarge |

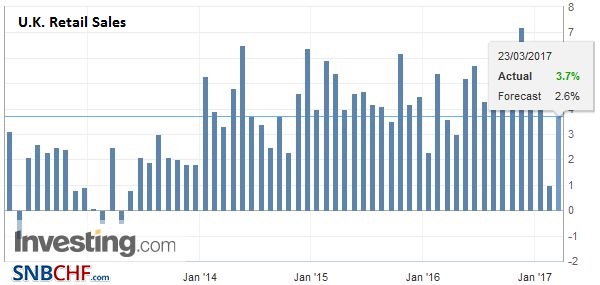

EurozoneA few forces are at work. First, is the reaction to the less aggressive stance at recent FOMC meeting. Second, the Dutch election outcome and poll still pointing to a defeat of Le Pen in the second round of the French presidential election has seen some unwind of safe haven demand. Third, oil prices have fallen. Consider that as recently as March 7, light sweet crude was near $54 a barrel. On March 22, it reached almost $47, the lowest level since the end of November. Fourth, President’s Trump draft budget for the remainder of the fiscal year and the drawn out process over his temporary travel ban and the replacement of the Affordable Care Act (Obamacare) warn that tax reform and infrastructure efforts will also be delayed. |

Eurozone Consumer Confidence, February 2017(see more posts on Eurozone Consumer Confidence, ) Source: Investing.com - Click to enlarge |

Germany |

Germany GfK Consumer Climate, February 2017(see more posts on Germany GfK Consumer Climate, ) Source: Investing.com - Click to enlarge |

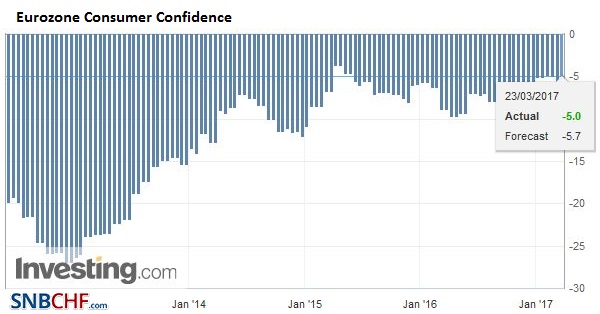

United StatesThe dollar’s performance against the yen seems to be driven more by US yields and equities than the news stream from Japan, which has been light. If US Treasuring can stabilize as we expect, then the dollar can begin recovering against the yen. On the upside, the greenback needs to resurface above the JPY111.75-JPY112.00 area to begin repairing the technical damage. The technical indicators have not turned higher for the dollar, and if US yields cannot stabilize, the technical potential extends toward JPY110.00. |

U.S. New Home Sales, February 2017(see more posts on U.S. New Home Sales, ) Source: Investing.com - Click to enlarge |

| We note that the Australian and Canadian dollars have underperformed in the first half of the week. Large speculators in the futures market had already shifted to a net long position while remaining net short euro, yen, and sterling. The Aussie continues to wrestle with an offer in the $0.7700 area. It is choppy in the upper end of its trading range. The US dollar reversed lower against the Canadian dollar after testing CAD1.34. We anticipate consolidation after the large price swings ahead of Friday’s February CPI. |

U.S. Initial Jobless Claims, February 2017(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,Eurozone Consumer Confidence,Featured,Germany GfK Consumer Climate,newslettersent,U.K. Retail Sales,U.S. New Home Sales