Swiss Franc EUR/CHF - Euro Swiss Franc, March 24(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF With just a few days to go before Article 50 is triggered the currency markets are waiting with baited breath for what may happen to the value of the Pound against all major currencies including against the Swiss Franc. Yesterday we saw a brief respite for the Pound vs the Swiss Franc with the release of much better than expected Retail Sales. The figures for month on month showed a difference from 0.4% to 1.4% and this saw an impressive rise in Sterling. However, already this morning the gains seen yesterday have already disappeared as the focus will return to the political landscape in the UK. With Article 50 set to take place on Wednesday the time of the announcement has not yet been confirmed but you can be assured that the markets will react very quickly once Prime Minister Theresa May confirms that the UK will be formally leaving the European Union. With the ongoing uncertainty as to what may happen when the French elections take place on 23rd April as the Swiss Franc is considered a safe haven currency this is one of the key factors in the recent strength of the Swiss Franc vs the Pound.

Topics:

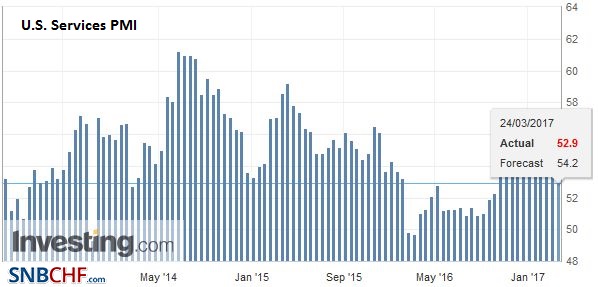

Marc Chandler considers the following as important: Canada consumer price index, EUR, Eurozone Manufacturing PMI, Eurozone Markit Composite PMI, Eurozone Services PMI, Featured, France Gross Domestic Product, France Manufacturing PMI, France Services PMI, FX Trends, GBP, Germany Composite PMI, Germany Manufacturing PMI, Germany Services PMI, Japan Manufacturing PMI, JPY, newsletter, U.S. Manufacturing PMI, U.S. Services PMI, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss Franc |

EUR/CHF - Euro Swiss Franc, March 24(see more posts on EUR/CHF, ) |

GBP/CHFWith just a few days to go before Article 50 is triggered the currency markets are waiting with baited breath for what may happen to the value of the Pound against all major currencies including against the Swiss Franc. Yesterday we saw a brief respite for the Pound vs the Swiss Franc with the release of much better than expected Retail Sales. The figures for month on month showed a difference from 0.4% to 1.4% and this saw an impressive rise in Sterling. However, already this morning the gains seen yesterday have already disappeared as the focus will return to the political landscape in the UK. With Article 50 set to take place on Wednesday the time of the announcement has not yet been confirmed but you can be assured that the markets will react very quickly once Prime Minister Theresa May confirms that the UK will be formally leaving the European Union. With the ongoing uncertainty as to what may happen when the French elections take place on 23rd April as the Swiss Franc is considered a safe haven currency this is one of the key factors in the recent strength of the Swiss Franc vs the Pound. If you need to make a currency transfer in the next few weeks and are concerned as to what may happen to GBPCHF exchange rates during this time period it may be worth looking at buying a forward contract which allows you to fix an exchange rate for a future date for a small deposit. |

GBP/CHF - British Pound Swiss Franc, March 24(see more posts on GBP/CHF, ) |

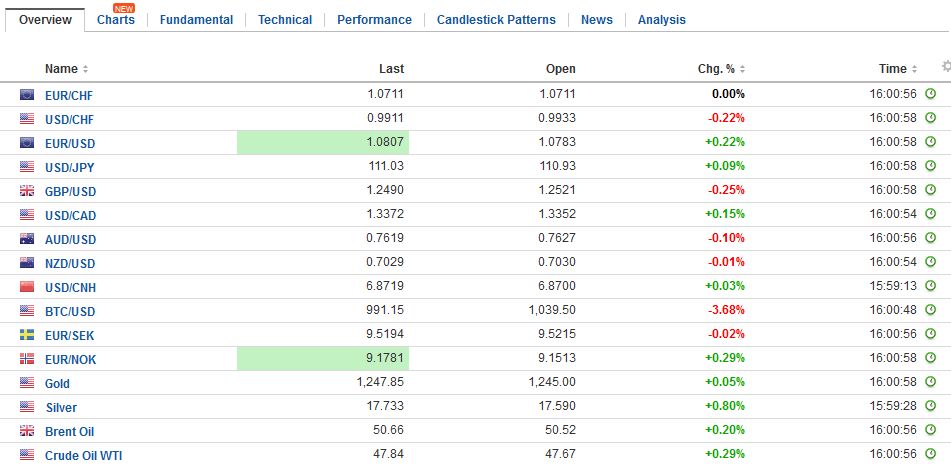

FX RatesThe US dollar has been stabilizing over the past couple of sessions. This broad stability of the dollar is impressive because of the questions of the prospects of US President Trump’s economic agenda. Expectations for tax reform and infrastructure spending have bolstered investor confidence and helped boost equity prices despite what appears to be stretched valuation. The wrangling over US healthcare is not simply a domestic concern. In addition to US households, healthcare is an essential element of the broader tax reform. The funds freed up by the projected cuts in some people being covered and the extent of the insurance will provide half the funds that will use to finance tax reform and tax cuts. Roughly the other half comes from the border adjustment, which is proving to be as controversial as replacing the Affordable Care Act (Obamacare). This is important because without being able to fund the tax reform, it may require the cooperation of Democrats to pass the legislation, which will be exceedingly difficult. Also, without the tax reform, the economic agenda unravels. The US President and the Speaker of the House Ryan allowed some changes in the original proposal to appeal to more of the Freedom Caucus, but in so doing risk losing some moderate. A defeat of the bill before the weekend will deal a potentially significant blow to the magnitude of the tax reform that will be possible. The White House tried to play down the implications and said it would simply turn to its next priority, tax reform. File it under bluster. |

FX Daily Rates, March 24 |

| On the other hand, if we are right, the Trump Administration recognizes the significance too and will do whatever it takes to win its first legislative battle. Its (temporary) ban on immigrants is meeting judicial constraints. This will ease of creeping doubts. At the same time, other developments may push in the same direction. Here we are thinking about a likely tick lower in the preliminary eurozone CPI due next week. The core rate, which bottomed at 0.6%, may ease from 0.9% back to 0.8%. It would add support to ideas that it is still premature to think about an ECB exit. Also, the participation in the ECB’s last long-term long (TLTOII) was larger at 233.5 bln euro, which is ore than twice median guesstimates.

The dollar has fallen in eight consecutive sessions against the yen coming into today. It is trading with a firmer bias in Tokyo. The dollar had not closed above its five-day moving average against the yen since the day before the Fed hiked. It is found today near JPY111.55. Still, it takes a move back above JPY112.00 to begin healing the technical damage. Strong UK retail sales helped extend sterling’s recovery. It is up in six of the past seven sessions coming into today. It a bit heavier in Asia and has been pushed back below $1.25. It too had not closed below its five-day average since the day before the Fed raised rates. It is found just bel02 $1.2320 today. |

FX Performance, March 24 |

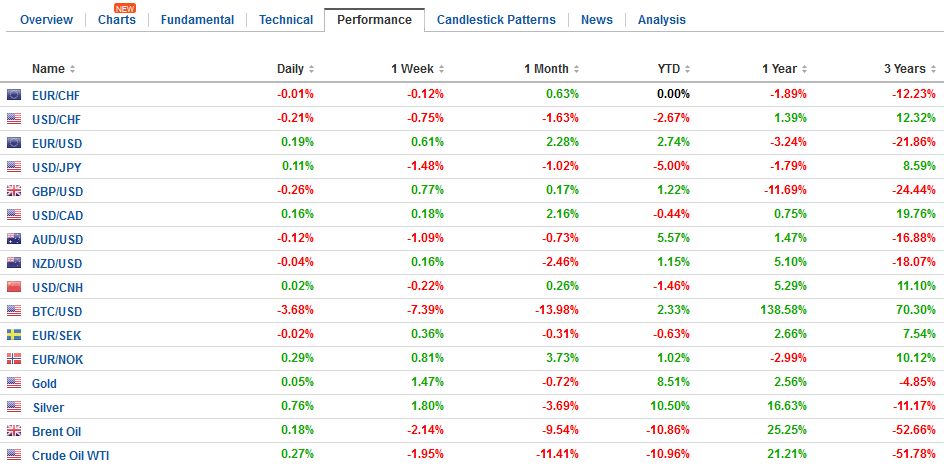

United StatesThe US reports personal consumption expenditure. There is scope for an upside surprise. Although retail sales were soft, the January figure was revised higher, which means that PCE can pick it up February or in the revision. In either case, it should help lift Q1 GDP estimates toward 1.25%-1.50%. |

U.S. Manufacturing PMI, February 2017(see more posts on U.S. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

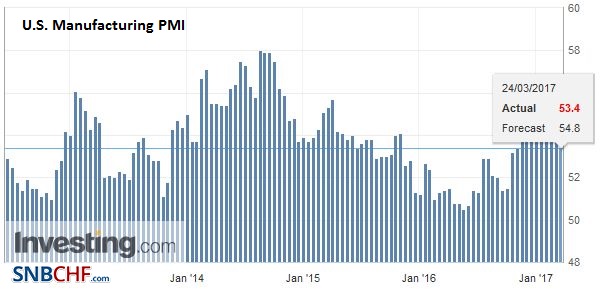

| OPEC’s five-nation monitoring committee meets over the weekend. OPEC compliance with the output agreement has been regarded as fairly high. Non-OPEC countries’ compliance is about half of OPEC’s. This meeting will not determine if the current agreement is extended. With global stocks still above the five-year average, OPEC will most likely feel compelled to extend the cut for another six months. However, many suspect that the new agreement will be a little softer or more flexible than the current one. |

U.S. Services PMI, February 2017(see more posts on U.S. Services PMI, ) Source: Investing.com - Click to enlarge |

JapanIn Japan, the BOJ appears quite content with its current stance. The yen trade continues to appear to be more a function of external factors, like the US 10-year yield and equities than domestic developments in Japan. That could change. Japanese institutions were buyers of foreign bonds last week, snapping a three-week sell-off. In fact, since the middle of January, it was only the second week of next purchases. The market’s reaction function may also change it the scandal over a contribution to and seemingly favorable government treatment of a, particularly nationalistic school. There are accusations against the Prime Minister and his wife. The support for the Abe Cabinet has fallen as a result, but few here seem to think it will have the last impact. There is not an obvious successor to Abe, who recently was given the authority to remain head of the LDP (which also means Prime Minister) for a third term. After posting an outside up day on Tuesday, the euro has drifted lower Wednesday and Thursday. It is trading softer Asia. The downtrend line on the hourly charts comes in around $1.0775 in early Europe. We still think a close below $1.0740 lend credence to ideas that a near-term high is in place. |

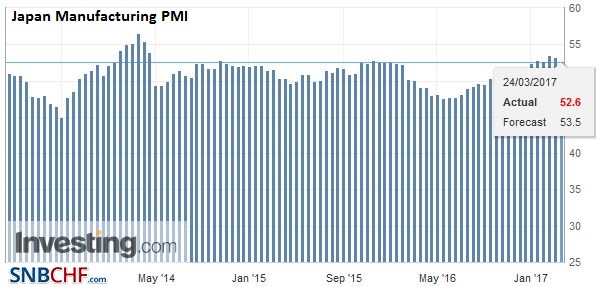

Japan Manufacturing PMI, February 2017(see more posts on Japan Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Eurozone |

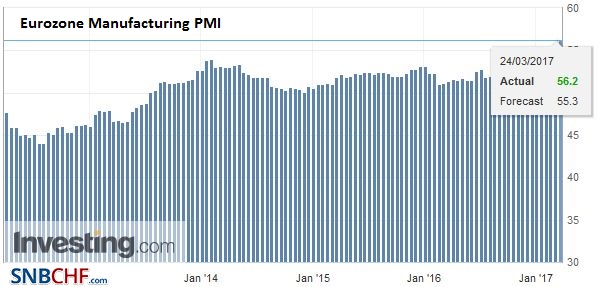

Eurozone Manufacturing PMI, February 2017(see more posts on Eurozone Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

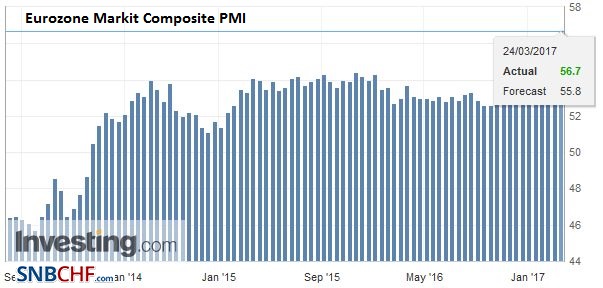

Eurozone Markit Composite PMI, February 2017(see more posts on Eurozone Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

|

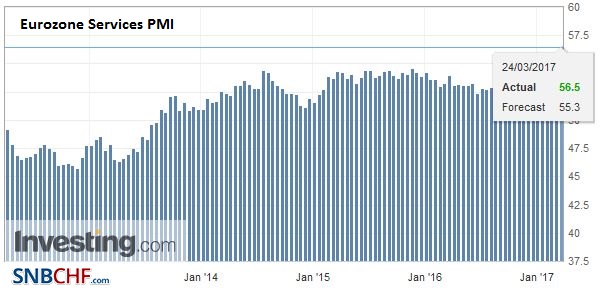

Eurozone Services PMI, February 2017(see more posts on Eurozone Services PMI, ) Source: Investing.com - Click to enlarge |

|

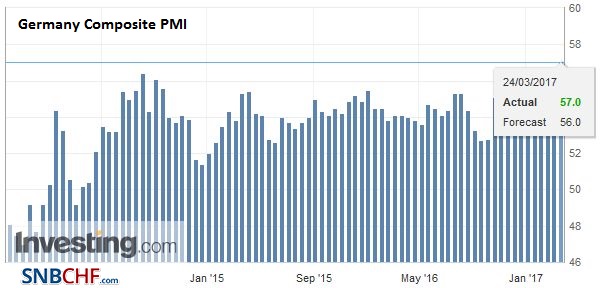

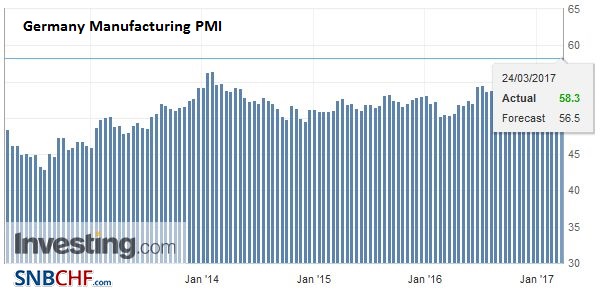

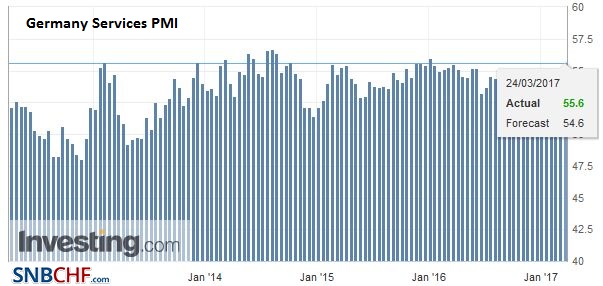

Germany |

Germany Composite PMI, February 2017(see more posts on Germany Composite PMI, ) Source: Investing.com - Click to enlarge |

Germany Manufacturing PMI, February 2017(see more posts on Germany Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

|

Germany Services PMI, February 2017(see more posts on Germany Services PMI, ) Source: Investing.com - Click to enlarge |

|

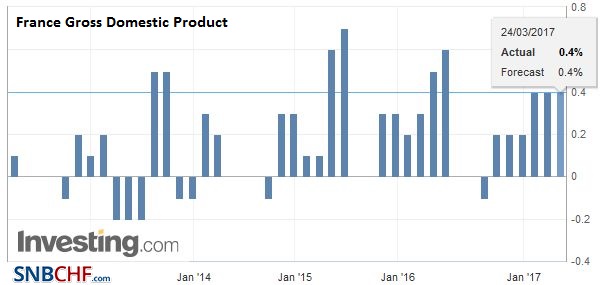

France |

France Gross Domestic Product (GDP), February 2017(see more posts on France Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

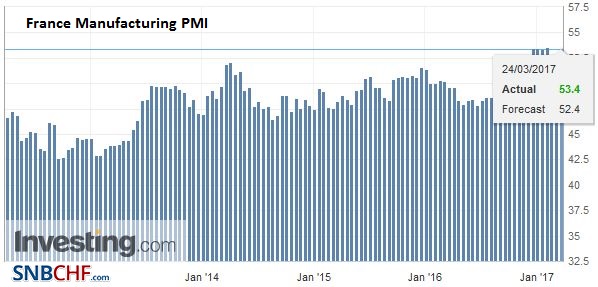

France Manufacturing PMI, February 2017(see more posts on France Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

|

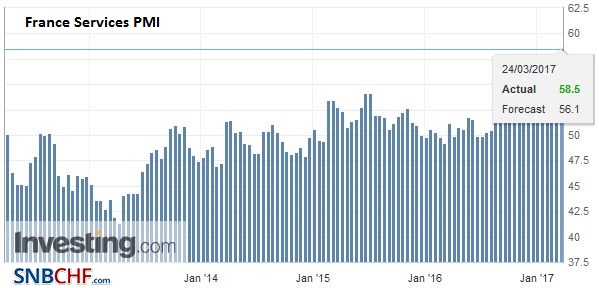

France Services PMI, February 2017(see more posts on France Services PMI, ) Source: Investing.com - Click to enlarge |

|

Canada |

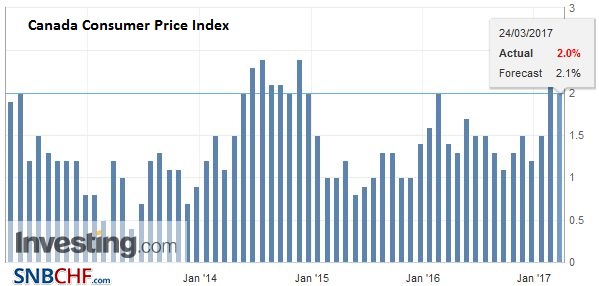

Canada Consumer Price Index (CPI) YoY, February 2017(see more posts on Canada Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$EUR,$JPY,Canada Consumer Price Index,Eurozone Manufacturing PMI,Eurozone Markit Composite PMI,Eurozone Services PMI,Featured,France Gross Domestic Product,France Manufacturing PMI,France Services PMI,Germany Composite PMI,Germany Manufacturing PMI,Germany Services PMI,Japan Manufacturing PMI,newsletter,U.S. Manufacturing PMI,U.S. Services PMI