Swiss Franc The Euro has risen by 0.09% to 1.152 CHF. EUR/CHF and USD/CHF, February 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is narrowly mixed in uneventful turnover. Of note, the dollar selling seen in Asia last week slacken today and the greenback moved above the pre-weekend highs seen in the US. It is the first time in eight sessions, the dollar...

Read More »FX Weekly Preview: Four Key Numbers in the Week Ahead

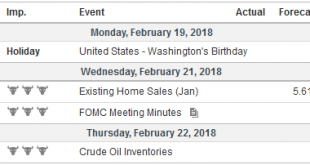

The US markets are closed on Monday, and many parts of Asia will continue to celebrate the Lunar New Year. The economic schedule is fairly light, and market psychology appears fragile after the dramatic activity in equities and what appears to be shifting macro-relationships. To help navigate the challenging investment climate, we identify four “numbers” that can illuminate the path ahead. The equity market is center...

Read More »FX Daily, February 16: Worst Week for the Dollar since 2015-2016, While Stocks Continue to Recover

Swiss Franc The Euro has fallen by 0.13% to 1.1513 CHF. EUR/CHF and USD/CHF, February 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Nearly all the major currencies have risen at least two percent against the US dollar this week. The Canadian dollar is an exception. It has risen one percent this week ahead of today’s local session. Sterling is becoming another...

Read More »FX Daily, February 15: Stocks Jump, Bonds Dump, and the Dollar Slumps

Swiss Franc The Euro has fallen by 0.24% to 1.1535 CHF. EUR/CHF and USD/CHF, February 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The significant development this week has been the recovery of equities after last week’s neck-breaking drop, while yields have continued to rise. The dollar has taken is cues from the risk-on impulse from the equity market and the...

Read More »FX Daily, February 14: Investors Remain Uneasy even as Equities Stabilize

Swiss Franc The Euro has fallen by 0.08% to 1.1533 CHF. EUR/CHF and USD/CHF, February 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There is an unease that continues to hang over the market. It is as if a shoe fell last week, and most investors seem to be waiting for the other shoe to drop. It is hard to imagine the kind of body blow that the equities took last week...

Read More »FX Daily, February 13: Tuesday’s Two Developments

Swiss Franc The Euro has fallen by 0.09% to 1.1531 CHF. EUR/CHF and USD/CHF, February 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There are two important developments today. First, the recovery in the global equity markets is being challenged. Second, the yen has strengthened across the board, and is now at its best levels against the dollar since last September’s...

Read More »FX Daily, February 12: Equity Markets Find Firmer Footing, Dollar Softens

Swiss Franc The Euro has fallen by 0.11% to 1.1505 CHF. EUR/CHf and USD/CHF, February 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The most important development today has been the stability in the equity markets after last week’s meltdown. The recovery from new lows in the US before the weekend set the tone for today’s moves. Tokyo markets were on holiday, and the...

Read More »FX Daily, February 09: Equity Sell-Off Extends to Asia, but More Muted in Europe

Swiss Franc The Euro has risen by 0.38% to 1.1502 CHF. EUR/CHF and USD/CHF, February 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The 100-point slide in the S&P 500 and the 1000-point drop in the Dow Jones Industrials yesterday spurred more bloodletting in Asia. The 1.8% drop in the MSCI Asia Pacific Index (for a 6.7% loss for the week) may conceal the magnitude...

Read More »Great Graphic: FX Vol Elevated, but Still Modest

Summary: FX implied vol bottomed before the VIX took off. FX vol is at the highs for the year, but euro and yen vol is lower than last September. Sterling vol has risen the most. With the substantial swings in the volatility of equities that have captured the imagination of journalists and punished investors who bought financial derivatives that profited from the low vol environment, we thought it would be...

Read More »Great Graphic: Major Currencies Year-to-Date

Summary: The major currencies but the Canadian dollar peaked Jan 25-26. The Australian dollar has fallen the most since peaking. Many are still viewing the dollar’s recovery as technical in nature and not a turn in the trend. This Great Graphic was created on Bloomberg. It shows five major currencies against the US dollar this year. To avoid giving a misleading impression, the currencies are index to start...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org