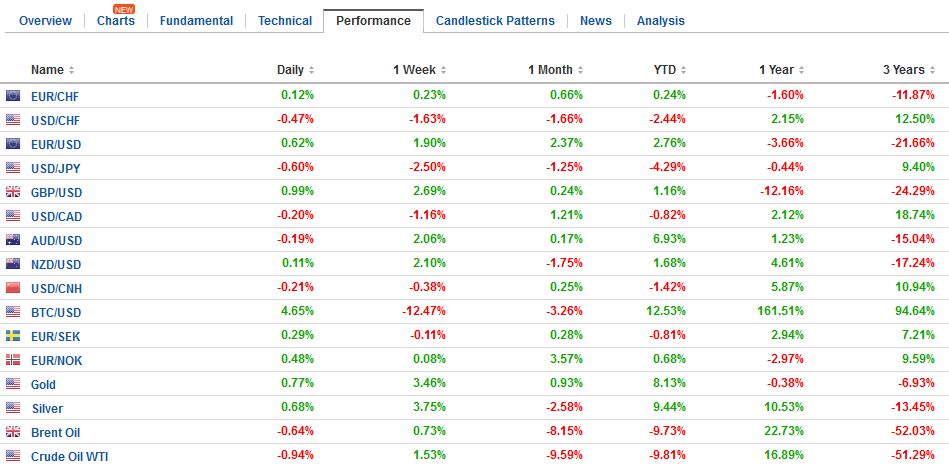

Swiss Franc Switzerland Trade Balance, February 2017(see more posts on Switzerland Trade Balance, ) Source: Investing.com - Click to enlarge GBP/CHF The Swiss Franc continues to remain incredibly strong as it maintains its status as a safe haven currency in these uncertain economic times globally. The Swiss National Bank quarterly bulletin is released tomorrow afternoon at 14pm which is produced by the central bank and acts as a good barometer of how the Swiss economy is performing and can create considerable volatility. The report also focuses on exchange rates under the “Exchange rate survey” largely as a result of the strength of the Swiss Franc which the bank likes to keep an eye on. The Swiss National Bank have surprised the markets in the past and any concerns could result in a policy change which could impact on Swiss Franc exchange rates. When a cap was introduced for CHF EUR the market moved around 40% between high and low as the statement was made. Article 50 will be invoked in the UK next Wednesday 29th March and considerable volatility is to be expected for GBP CHF. This is a permanent move for Great Britain and the act that day will be made on a global stage for the world to see. It would be unwise to think that there wouldn’t be volatility at this time.

Topics:

Marc Chandler considers the following as important: AUD, EUR, Featured, FX Trends, GBP, JPY, newslettersent, SPY, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss Franc |

Switzerland Trade Balance, February 2017(see more posts on Switzerland Trade Balance, ) Source: Investing.com - Click to enlarge |

GBP/CHFThe Swiss Franc continues to remain incredibly strong as it maintains its status as a safe haven currency in these uncertain economic times globally. The Swiss National Bank quarterly bulletin is released tomorrow afternoon at 14pm which is produced by the central bank and acts as a good barometer of how the Swiss economy is performing and can create considerable volatility. The report also focuses on exchange rates under the “Exchange rate survey” largely as a result of the strength of the Swiss Franc which the bank likes to keep an eye on. The Swiss National Bank have surprised the markets in the past and any concerns could result in a policy change which could impact on Swiss Franc exchange rates. When a cap was introduced for CHF EUR the market moved around 40% between high and low as the statement was made. Article 50 will be invoked in the UK next Wednesday 29th March and considerable volatility is to be expected for GBP CHF. This is a permanent move for Great Britain and the act that day will be made on a global stage for the world to see. It would be unwise to think that there wouldn’t be volatility at this time. Those clients either buying or selling Swiss Francs may wish to get in touch to look at the options available to take the risk out of the markets. Developments from the Scottish parliament which meets today and will vote on Wednesday on whether they will request a second vote on Scottish independence from Westminster. Any further pushing for an extra referendum could create additional volatility for GBP CHF. |

GBP/CHF - British Pound Swiss Franc, March 21(see more posts on GBP/CHF, ) |

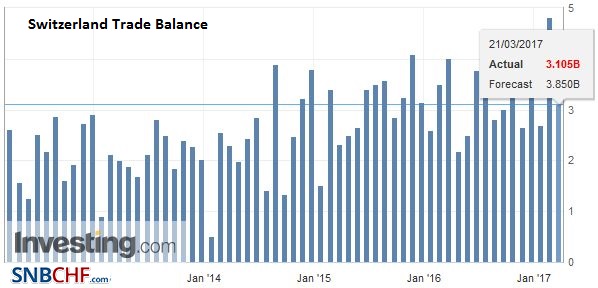

FX RatesGrowing confidence that Le Pen will not be the next president of France following the televised debate for which two polls showed Macron doing best has lifted the euro and reduced the French interest rate premium over Germany. The euro pushed through $1.0800 after initially dipping below yesterday’s lows. The outside day (engulfing pattern) would be strengthened with a close above yesterday’s high, a little above $1.0775. The next target is the February 2 high near $1.0830. It reached almost $1.0875 following the ECB’s decision in December to extend QE longer than had been anticipated but at a reduced pace of 60 bln a month (down from 80 bln). The US two-year premium over Germany peaked nearly two weeks ago near 223 basis points. Today it is near 205 basis points, the lower end of where it has been over the past month. The US 10-year premium peak shortly after last Christmas near 235 basis points. Today it is just around 202 basis points. Over the past four months, it has only closed below 200 basis points once. |

FX Daily Rates, March 21 |

| While the euro is outpacing the other major currencies, it is dragging up other currencies against the dollar, including sterling, the Swiss franc, and the Scandi currencies. Core bond yields are 2-3 basis points firm, but peripheral yields are a bit softer. European stocks are heavy, and the Dow Jones Stoxx 600 is threatening to snap a three-day advance.

The MSCI Asia Pacific Index and the MSCI Emerging Market Index continued to rally. Each is posting their eighth consecutive advance. The former is up 10.2% year-to-date, while the latter has risen 13.2%. In contrast, the S&P 500 has fallen for three consecutive sessions coming into today and four of the last five. For the fifth day, the dollar taken out the previous day’s low against the yen. It is also the fifth day of lower highs as well. The dollar recovered to approach yesterday’s highs but stalled. Intraday technical indicators warn that more work may be necessary at lower levels before a base can be from which to launch an assault on JPY113.00 |

FX Performance, March 21 |

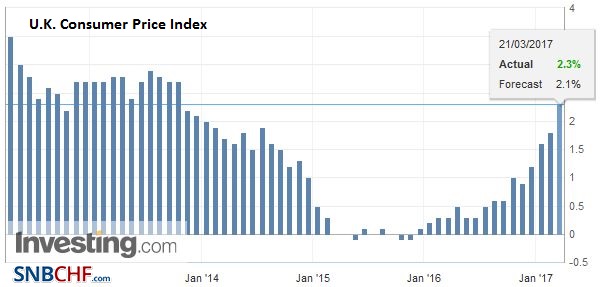

United KingdomSterling has recovered over the past week or so. Assuming it holds on to some gains today, it will be the sixth advancing session in the past eight. The somewhat stronger than expected consumer inflation helped propel sterling through a down trendline drawn off the Feb 2 and 24 highs and catching yesterday’s high. It is found near $1.2435 today. The break could point to another cent or two on the upside. Headline consumer prices rose 0.7% in January for 2.3% year-over-year increase. The median estimate in the Bloomberg survey was for a 0.5% and 2.1% increase respectively. The core rate jumped to 2.0% from 1.6% in January. The market expected a smaller increase. Of note too, the CPIH, which is the measure that includes a component for owner-occupied costs, rose to 2.3% from 1.9%. |

U.K. Consumer Price Index (CPI) YoY, February 2017(see more posts on U.K. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

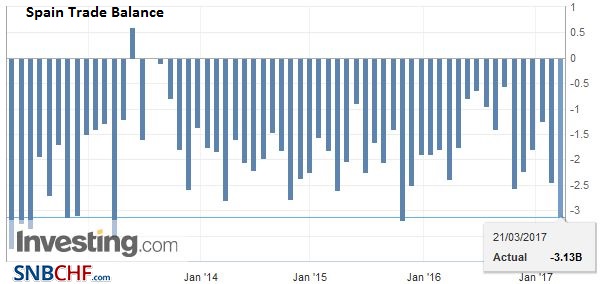

Spain |

Spain Trade Balance, February 2017(see more posts on Spain Trade Balance, ) Source: Investing.com - Click to enlarge |

The Australian dollar is trading a with a slightly softer bias, but mostly consolidating after rallying back through the past ceiling around $0.7700. The minutes of the this month’s RBA meeting failed to shed fresh light, but news that house prices rose 4.1% in Q4 16, which is the fastest pace since mid-2015 is a timely reminder of why the RBA may be reluctant to ease despite soft inflation and softening labor market. The consolidative range seems to be around $0.7660 to $0.7745. The intraday technicals suggest upside potential in the North American session.

The Canadian dollar is trading with a slightly firmer bias. The recent string of Canadian data has been stronger than expected, and if today’s report of January retail sales follows suit, then the Canadian dollar may strengthen further. Initial support for the US dollar is seen in the CAD1.3280-CAD1.3300 area.

The US session features the Q4 16 current account balance. It is too historical to have much market impact. Option expiries may draw attention. There is a 320 mln euro option struck at $1.0825 that is cut today. There is $460 mln and $442 mln at JPY112.25 and JPY113 respectively that expire today. Two sterling strikes stand out. There are GBP516 mln struck at $1.23, and almost GBP400 mln struck at $1.2427.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$EUR,$JPY,Featured,newslettersent,SPY