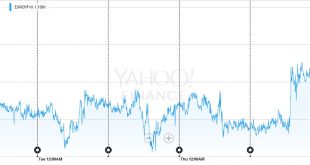

EUR/CHF The massive surprise in the US job report was reflected in currency rates. The EUR/CHF surprisingly increased, despite weak US data. This reflects the fact that the ECB is currently considered the most dovish central bank.Consequently the biggest short speculative position is in the euro, while traders are long CHF against USD. Click to expand USD/CHF After a relatively steady week, the dollar lost 130 bips on Friday. Click to expand Continued by Marc Chandler:...

Read More »FX Daily, June 2: Greenback Mostly Softer Ahead of ECB and ADP

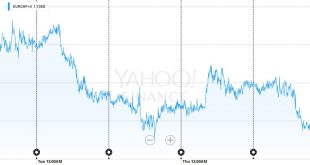

The US dollar remains under pressure. It is off for the third day against the yen and slipped below JPY109 for the first time in a little more than two weeks. The Nikkei struggled to cope with the foreign exchange developments, lost 2.3%, the most in a month, after gapping lower. At JPY108.50, the dollar would have given back 50% of its rally off the May 3 low near JPY105.50. Below there, the JPY107.80 is the 61.8% retracement. The euro is north of $1.12 after having briefly...

Read More »FX Daily, June 1: Swiss SVME PMI strongest PMI

The US dollar is trading with a heavier bias to start the month of June. Weaker stocks and firmer bonds has seen the yen rise the most, while sterling’s losses have been extended after an ICM telephone survey showed a small lead for those favoring Brexit. The Swiss Franc was one of the strongest performers. Click to enlarge. The Nikkei fell 1.6%, the largest loss since May 2 and snaps a five-day advance. The delay in the sales tax was confirmed. This second delay now puts...

Read More »FX Daily, May 31: Sterling Slips and Aussie Pops as Investors Await Fresh Insight into Fed Trajectory

The US dollar is broadly mixed. The main narrative of increased prospects for a Fed hike in June or July has been pushed off center stage as the market reacts to local developments as investors await from US economic data. Ostensibly the data will determine whether the Fed raises rates in June or July. The Swiss Franc lost both against the dollar and versus the euro. Click to enlarge. On the other hand, despite the Fed’s data dependency, we argue that the determining factor is...

Read More »FX Weekly: Dollar Set to Snap Three-Month Decline

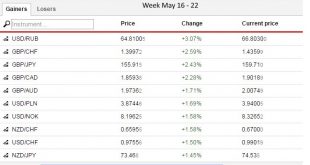

EUR/CHF The EUR/CHF moves lower, following the descent of EUR/USD. This happens often, when European and global growth is sluggish. USD/CHF But the Swiss franc weakened against the dollar. Continued by Marc Chandler: The US dollar was mostly firmer over the past week. There were two exceptions among the major currencies: Sterling and the Canadian dollar. GBP/USD Many linked sterling’s outperformance (+0.8%) to a growing sense that the UK will vote to remain in the EU,...

Read More »Great Graphic: Gold and the Dollar

Many investors still think about gold as if it were money. Economists identify three functions of money: store of value, means of exchange, and a unit of account. It can be a store of value, but the price fluctuates compared with other forms of money, or other commodities, like oil or silver. Some argue that it is a store of value because of the limited supply, but that argument applies to many other goods, including commodities and real estate (which Mark Twain said you have to...

Read More »Great Graphic: Dollar Pushes Back Below JPY110

The yen is the strongest of the major currencies. It has gained about 0.65% against the dollar. It has been grinding lower throughout the Asian and European session and has remained in narrow ranges near its highs in the US morning. Japan still seems isolated in terms of it desire to intervene. Ahead of the G7 heads of state summit this coming, the risk of intervention remains slight. Asian and European shares were lower, which favors the yen. US yields are flat, while the US...

Read More »FX Daily May 23

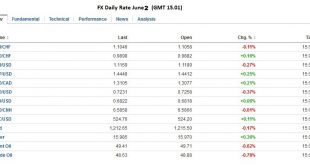

The capital markets are off to a mixed start to start the last week of the month. Asian shares were mostly higher, though the Nikkei shed 0.5%. European shares are also higher, extending the three-week high seen last week. FX Rates The US dollar is mixed. The yen is the strongest of the majors. The media continues to play up tension between the US and Japan at the weekend G7 meeting over the appropriateness of intervention, but Europe is not very sympathetic either. Today’s...

Read More »Daily FX, May 20: Divergence Reasserted, Extends Greenback’s Recovery

The combination of stronger US economic data and signals from the Federal Reserve that it is looking to continue the normalization process helped the dollar extended its recovery. The dollar posted a significant technical reversal against many of the major currencies on May 3. The Dollar Index rose for its third week, as the greenback climbed against all the major currencies but sterling (+0.9%). Sterling was aided by some polls indicating a shift toward the Remain camp. The...

Read More »FX Daily, May 19: FOMC Minutes Extend Dollar Gains

We felt strongly that the FOMC minutes would be more hawkish than the statement that followed the meeting, and we were not disappointed. However, our caveat remains: the minutes dilute the signal that emanates from the Fed’s leadership, Yellen, Fischer, and Dudley. The latter two speak in the NY morning. Fischer and Dudley’s comment will be scrutinized for confirmation of the hawkish read of the FOMC minutes. Yellen speaks at Harvard at the end of next week. Her comments at the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org