These transition periods are often just this sort of whirlwind. One day the economy looks awful, the next impervious to any downside. Today, it has been the latter with the BLS providing the warm comfort of headline payrolls. For now, it won’t matter how hollow. Yesterday, completely different story. Apple got it started downhill and the ISM pushed it off the cliff. The tech giant’s CEO admitted the global economy is in a world of trouble, EM’s and China first. Tim Cook said his company did not “foresee” how bad it was getting and how quickly, if only because his company was taking its cues from Jay Powell rather than the shadows. Despite Apple’s clear prestige and place in the hierarchy of bellwethers, the ISM may

Topics:

Jeffrey P. Snider considers the following as important: 5) Global Macro, Composite PMI, currencies, downturn, economy, EuroDollar, Featured, Federal Reserve/Monetary Policy, IHS Markit, ism manufacturing index, Markets, newsletter, payrolls, PMI, The United States, U.S. Manufacturing PMI, U.S. Markit Composite PMI

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

These transition periods are often just this sort of whirlwind. One day the economy looks awful, the next impervious to any downside. Today, it has been the latter with the BLS providing the warm comfort of headline payrolls. For now, it won’t matter how hollow.

Yesterday, completely different story. Apple got it started downhill and the ISM pushed it off the cliff. The tech giant’s CEO admitted the global economy is in a world of trouble, EM’s and China first. Tim Cook said his company did not “foresee” how bad it was getting and how quickly, if only because his company was taking its cues from Jay Powell rather than the shadows.

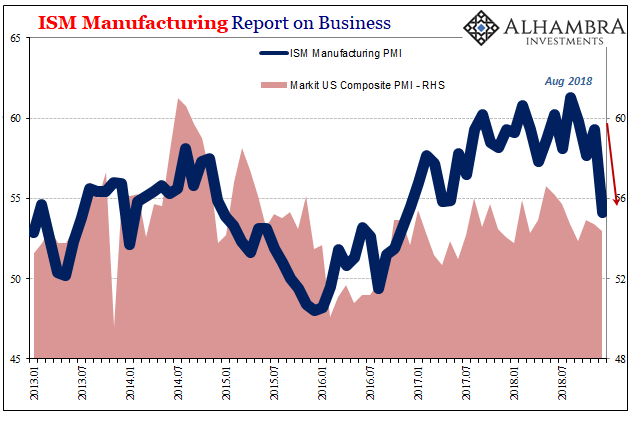

Despite Apple’s clear prestige and place in the hierarchy of bellwethers, the ISM may have been the more damaging announcement. For several years it has been the real highflyer. The trade group’s manufacturing PMI has been pretty much the only figure consistent with the US unemployment rate.

According to it, domestic manufacturing and therefore the US economy has rarely ever been better. Or, it was.

| For December 2018, the ISM’s index plunged from 59.3 to 54.1. The latest monthly estimate isn’t by itself much concern, it’s the change that is. The one thing looking great suddenly adds to the mountain of doubt about where things are really heading, especially when some of the forward-looking subcomponents like New Orders just collapsed last month (from 62.1 in November to 51.1 in December). |

US ISM Manufacturing PMI and Markit Composite PMI, Jan 2013 - 2019(see more posts on U.S. Manufacturing PMI, U.S. Markit Composite PMI, ) |

Yesterday, markets could ill-afford to confront the possible loss of one of the very few suggesting boom. When it was above 60 as last summer, it was much easier to cling to the “strong” economy. Fifty-four doesn’t erase that completely, but it does make everyone take a step back. Is this just a one-month temporary aberration, or is the downturn really happening?

According to several other PMI’s and like indications it is the latter. Since they were released today, they aren’t grabbing near the attention.

In addition to the dozens constructed by IHS Markit for so many individual countries, the information firm in conjunction with JP Morgan produces both a services and composite (manufacturing plus services) PMI for the entire global economy (or, what could cover most of it).

No good news from the composite here:

The global economy ended 2018 on a subdued note, with the rate of output expansion slowing to a 27-month low. This mainly reflected the ongoing weakness in new order intakes, especially a second fall in international trade of goods and services during the past four months. The trend in new export business will need to show meaningful signs of revival early in 2019 if global economic growth is to make meaningful strides forward in the coming months.

It always begins with global trade, not just this time but each time, because that’s what’s most exposed to problems with global reserve currency (eurodollar). The previous several instances didn’t require trade wars because it’s not about trade wars. Trade requires financing which requires the money to do it. If it becomes difficult and uneconomical to obtain required dollar grease, the wheel will stop turning.

But on a day like today when markets were oversold (or overbought, as bonds) after the outbreak of fear gripping Wall Street (more so Lombard Street) the past several weeks, the BLS takes center stage. I doubt it lasts. The downward lurch is just showing up in too many places, economy as well as markets.

Even the ISM Manufacturing is no longer so assured.

Tags: Composite PMI,currencies,downturn,economy,EuroDollar,Featured,Federal Reserve/Monetary Policy,IHS Markit,ism manufacturing index,Markets,newsletter,payrolls,PMI,U.S. Manufacturing PMI,U.S. Markit Composite PMI