Is recession coming? Well, yeah, of course, it is but whether it is now, six months from now or 2 years from now or even longer is impossible to say right now. Our Jeff Snider has been dutifully documenting all the negativity reflected in the bond and money markets and he is certainly right that things are not moving in the right direction. But moving in the wrong direction, even deeply, as we discovered in 2015/16, doesn’t necessarily mean recession. This slowdown – and that’s what it is right now – like all slowdowns we go through in a business cycle, puts the economy in greater danger of recession. It is a lot easier for growth to turn negative when you are growing at 1% than it is when you are growing at 3%. So,

Topics:

Joseph Y. Calhoun considers the following as important: 5) Global Macro, Alhambra Research, cfnai, China, economic growth, economic sentiment, economy, employment, Featured, housing, inflation, Investment, job openings, Markets, Monthly Macro Monitor, newsletter, Population growth, Productivity, Real estate, Recession, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Is recession coming? Well, yeah, of course, it is but whether it is now, six months from now or 2 years from now or even longer is impossible to say right now. Our Jeff Snider has been dutifully documenting all the negativity reflected in the bond and money markets and he is certainly right that things are not moving in the right direction. But moving in the wrong direction, even deeply, as we discovered in 2015/16, doesn’t necessarily mean recession. This slowdown – and that’s what it is right now – like all slowdowns we go through in a business cycle, puts the economy in greater danger of recession. It is a lot easier for growth to turn negative when you are growing at 1% than it is when you are growing at 3%. So, yes, we are definitely vulnerable right now and seemingly more so with just about every economic data point. Which, by the way, has also been true for most of this cycle.

I am sympathetic though to the idea that negative sentiment, as expressed through markets, can change the economic outcome. Does the yield curve invert before recession because markets are anticipating a recession that is already inevitable? Or does the yield curve inversion actually create the recession? I do not pretend to know the answer to that but as with most things in life, it is probably a bit of both. Assuming I’m right about that (always a risky notion) I also have to question whether the yield curve will be as infallible as it has been in the past now that knowledge of its foresight is so well known. However, when a lot of markets all seem to be pointing in the same direction, as they are now, I think it wise to take notice. And so I will.

I’ve been saying for a year now that we should expect the economy to slow back to trend growth of 2 – 2.5% and that an overshoot to a 1% handle would not be a surprise. The fiscal changes were destined to fade and the only real surprise is the speed with which that has come true. There were some positive changes in the last tax bill but overall, it wasn’t large enough or permanent enough to really change the underlying growth dynamic. If we had seen a sustained surge in investment I might have changed my mind but that just hasn’t happened. As for the increased government spending and deficit, there may be a short term positive impact on GDP but we can’t spend our way to prosperity.

In the long run, economic growth is a function of population (workforce) and productivity growth. In the case of the US, population growth last year stood at an 80 year low of 0.62% and our current immigration policies make that unlikely to change. Productivity growth is a function of investment and as you’ll see below we’re still investing like it’s 1999 in an economy that is considerably larger. The dot com bubble was driven by over-investment but I find it hard to believe that we are still working off the excesses two decades later.

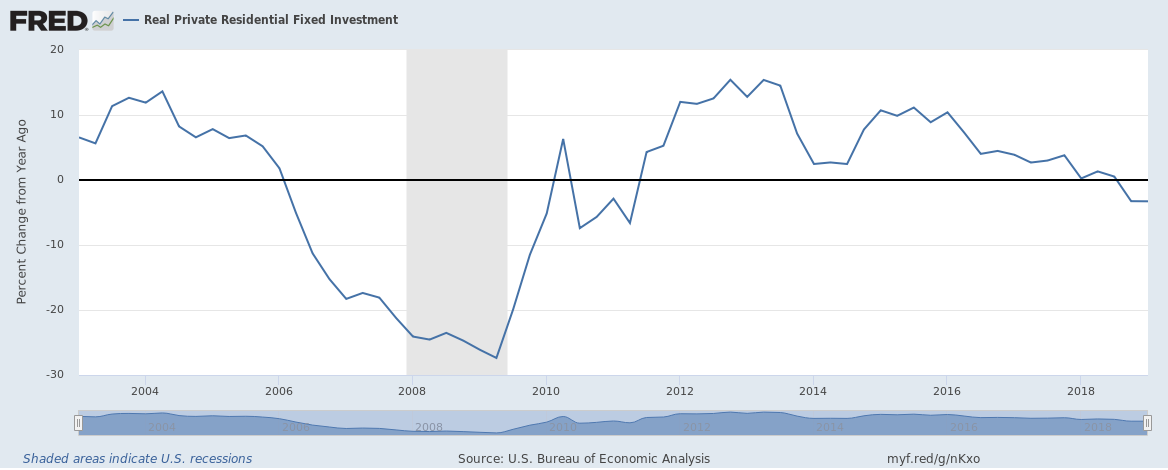

| The economic reports over the last month show an economy that is slowing. It isn’t recessionary – yet – but the momentum is definitely to the downside. I’m not sure what would turn things more positive but then we never do. A trade deal is the obvious choice but Trump seems more interested in expanding the list of countries on his naughty list. Economies ebb and flow despite the machinations of politicians and central bankers, not because of their efforts. Tariffs may make markets less efficient, the threat of them may create uncertainty, but in the end, business finds a way to get things done. Maybe less efficient than before but effective nonetheless.

Sentiment on the global economy is very negative right now – economic bears are not exactly an endangered species. You should understand that if you are watching the yield curves fretting about an impending recession, you are right smack dab in the middle of the consensus. It’s a warm inviting place but it isn’t generally crowded with successful investors. |

|

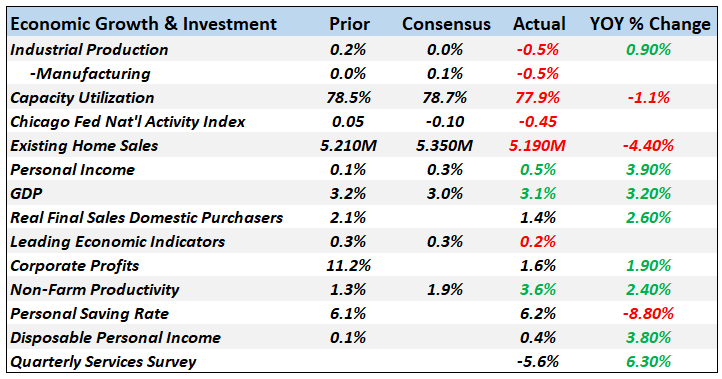

| CFNAI

The Chicago Fed National Activity Index, one of my favorite broad indicators, is still in negative territory and continuing to worsen at -0.45. The 3-month average though is -0.32, still quite a ways from the -0.75 that is the threshold we watch for imminent recession. For comparison purposes, the 2015/16 slowdown took the 3-month average down to -0.42 and the Euro crisis in 2012 took it to -0.51. Negatives, as you can see from the chart, are not that uncommon for this series. That’s just the normal ebb and flow we see in a business cycle. |

Chicago Fed National Activity Index, 1970-2015 |

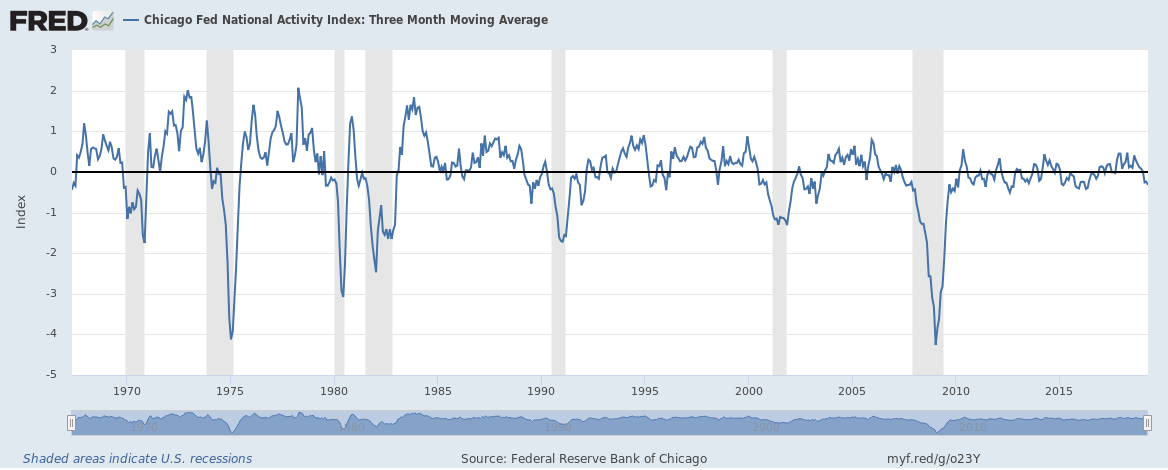

| Non-Residential Investment

The first revision of Q1 GDP showed a slight downtick to 3.1%, as both consumption and investment were downgraded slightly. Investment is the key to our future growth and the rate of change is pointing south right now – and was never very good this cycle in any case. |

Real Private Nonresidential Fixed Investment, 2004-2018 |

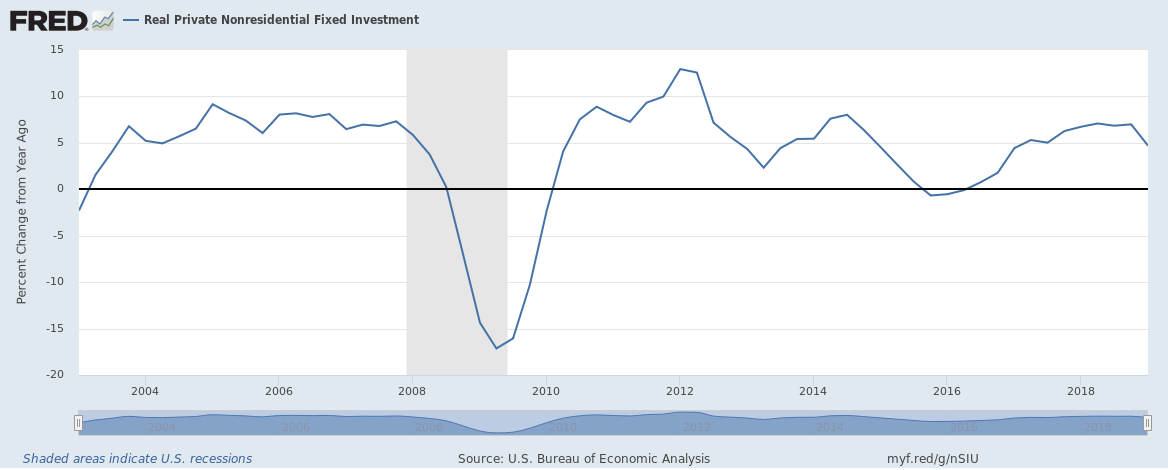

| Residential Investment

Not that it matters for future productivity but the year over year change in residential investment is already negative. Real estate isn’t as big a part of the economy as it was prior to 2008 so maybe it doesn’t matter as much today but it sure isn’t positive. It also means, as I’ve pointed out recently, that we are underinvesting in housing. Either we start building more housing or prices are going to go higher and getting that comparative lit major out of your basement is going to be that much harder. |

Real Private Residential Fixed Investment, 2004-2018 |

| Productivity

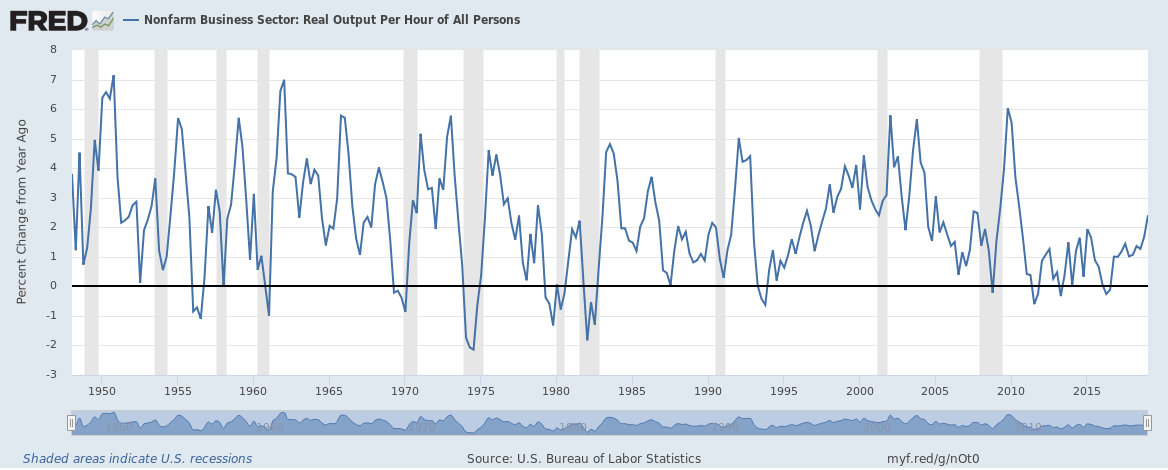

Despite the lack of investment, productivity growth has picked up recently. Whether it heralds a change in the downtrend that started around the turn of the century or just a head fake I don’t know. It may be that companies are hesitating somewhat on hiring until they know how the trade war turns out. Until we see a sustained pick up in investment I’ll be skeptical. |

Nonfarm Business Sector, 1950-2015 |

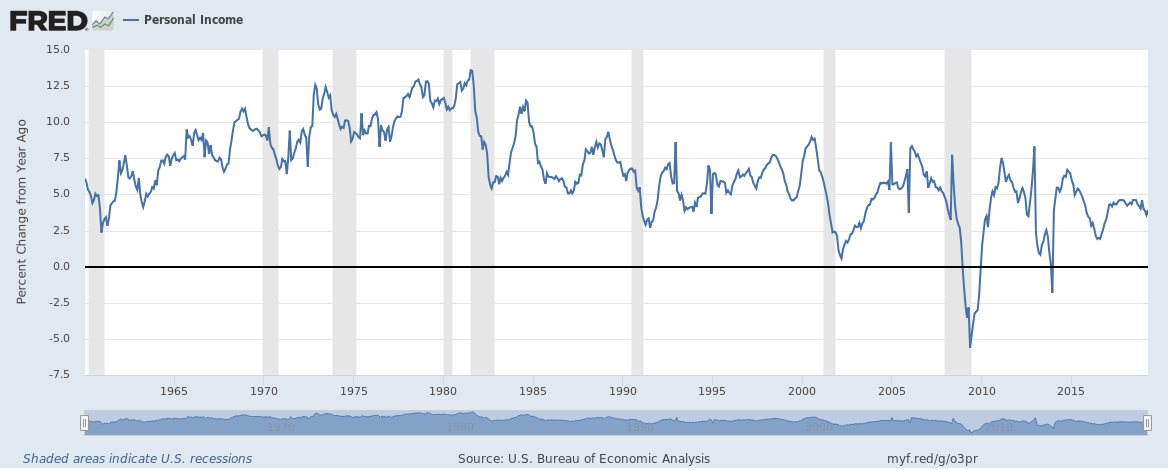

| Personal Income

Incomes are still rising and with low inflation real disposable personal income is doing pretty good. But the rate of change is still disappointing and it does not look like it is improving. Tight labor market? I don’t think so. |

Personal Income, 1965-2015 |

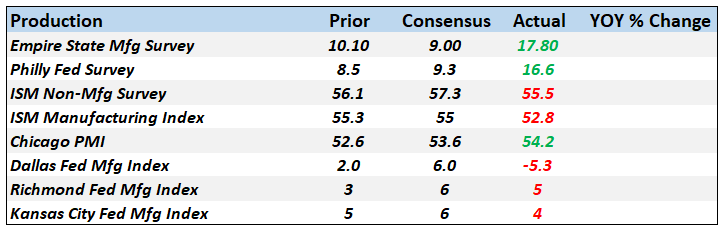

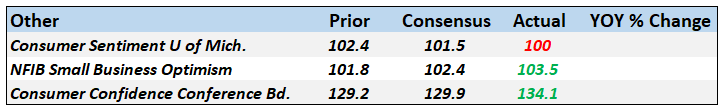

| Most of these sentiment type reports were less than expected over the last month but they are generally still showing expansion. These reports are not particularly helpful in identifying a downturn in any case. They are much more useful at the bottom of recession when sentiment plays a big role in the initial recovery. | |

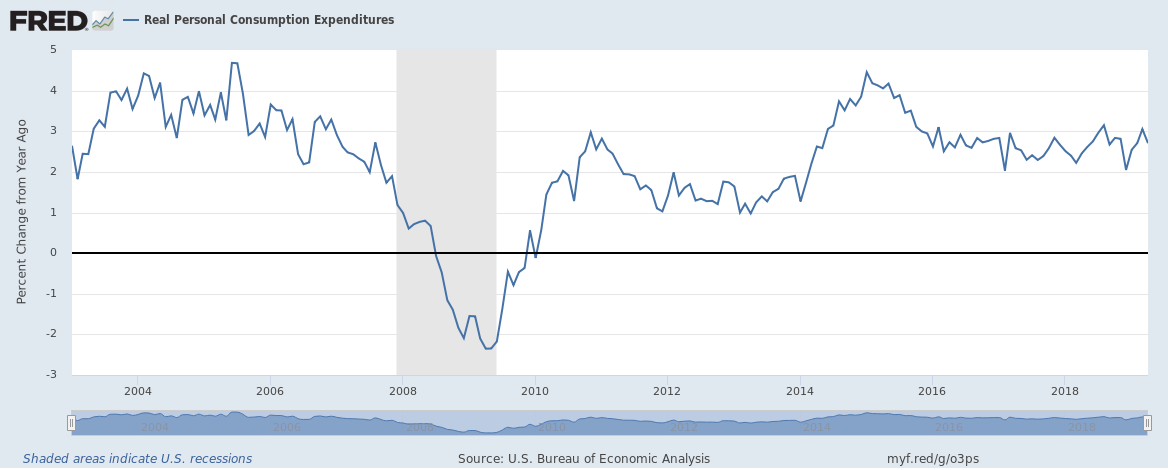

| Real Consumption

Consumption continues to expand but as with incomes the pace of the rise is disappointing. It is steady though and consumer sentiment is high. Again, this is not particularly helpful in identifying the onset of recession. Consumption is always a lagging indicator. |

Real Personal Consumption Expenditures, 2004-2018 |

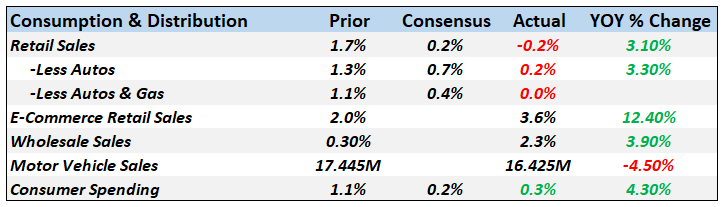

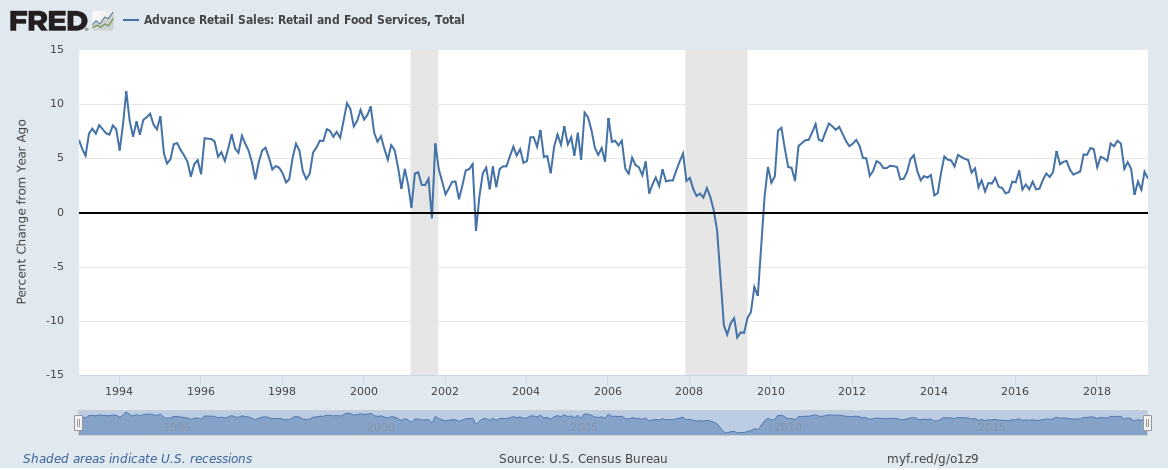

| Retail Sales

Retail sales are slipping again but still positive. But there are distortions from autos and gas stations. If we take those out, retail sales were actually flat last month. A little curious with consumer confidence at cycle highs but maybe people have finally bought all the junk they think they need. Nah….. |

Advance Retail Sales, 1994-2018 |

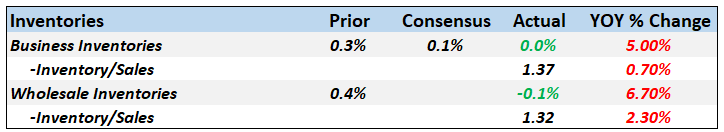

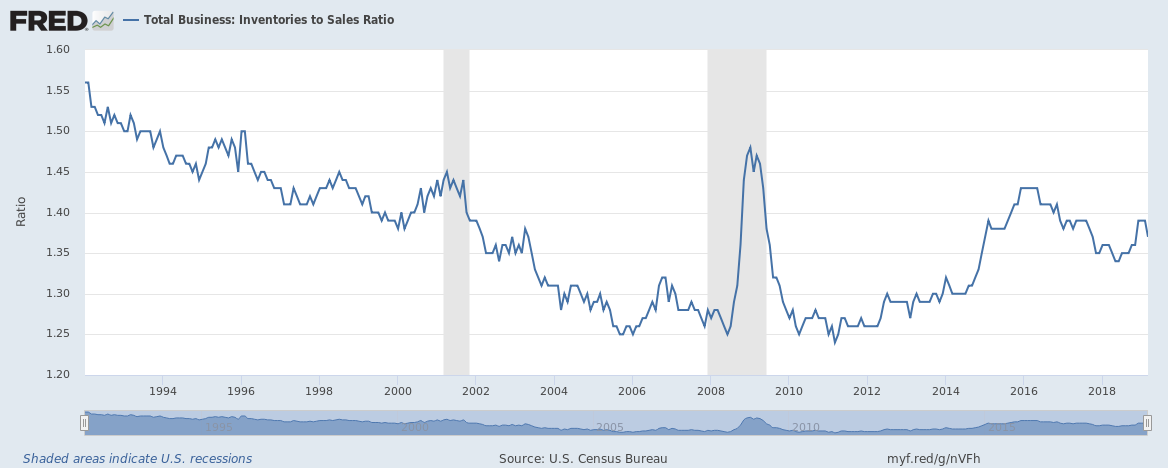

| Inventory to Sales Ratio

Inventories have, at least for the moment, stopped rising relative to sales. Inventories are still a bit elevated but in general, it appears companies are doing a pretty good job of management. |

Total Business: Inventories to Sales Ratio, 1994-2018 |

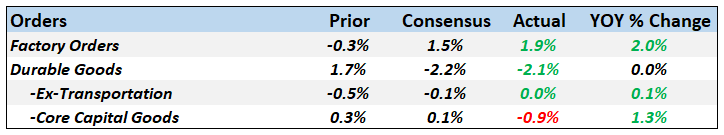

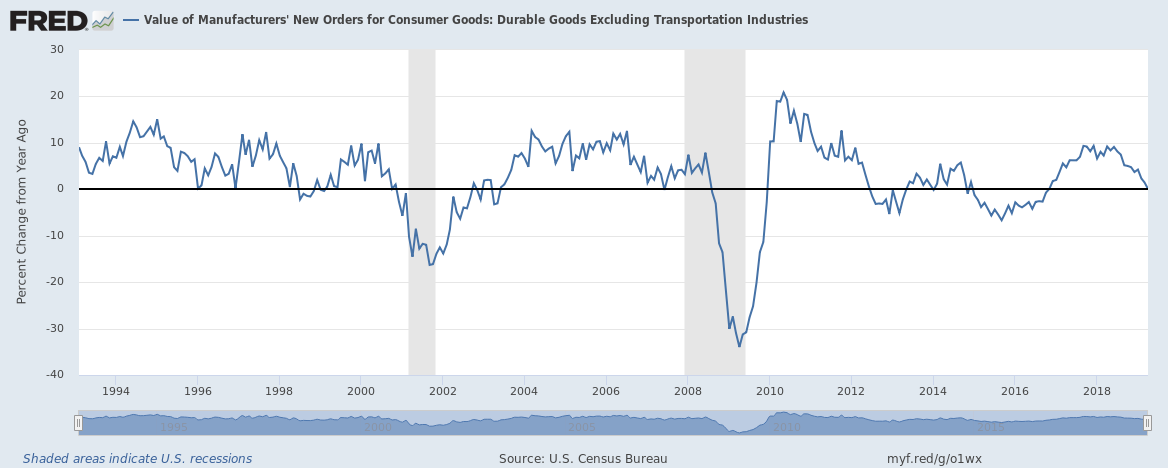

| Durable Goods Orders

Durable goods orders are now flat year over year. Again, not a definitive signal of recession but not a good trend. |

Value of Manufacturers New Orders for Consumer Goods, 1994-2018 |

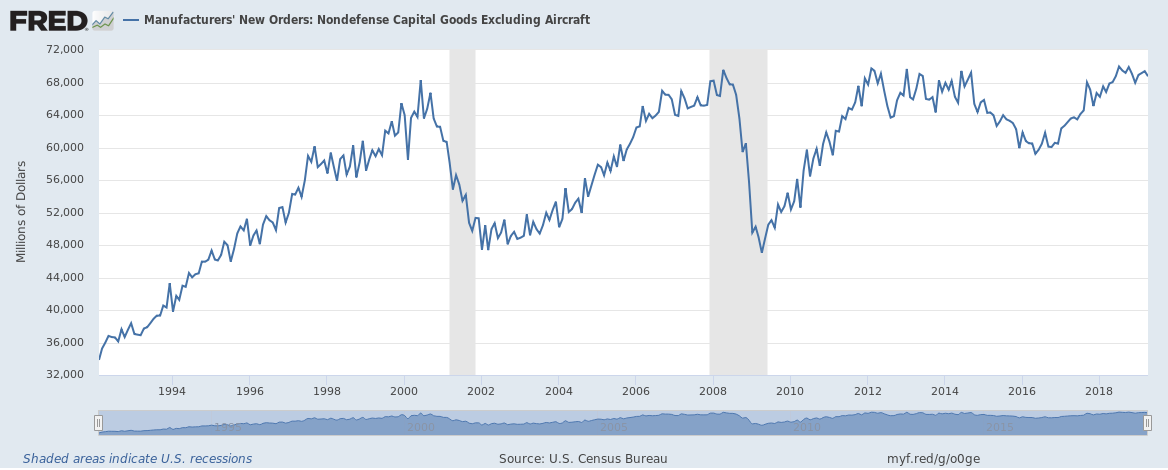

| More concerning is the trend of core capital goods. This is the investment story which is the productivity story which is the slow growth story, the secular stagnation story. As you can see, core capital goods orders are barely higher today than they were at the peak of the dot com boom. Capital goods aren’t all the investment story and in our modern economy, a lot of our investments are of the more intellectual variety. Still, it can’t be positive that core capital goods orders are at 1999 levels in an economy that is more than twice as large. |

Manufacturers' New Orders, 1994-2018 |

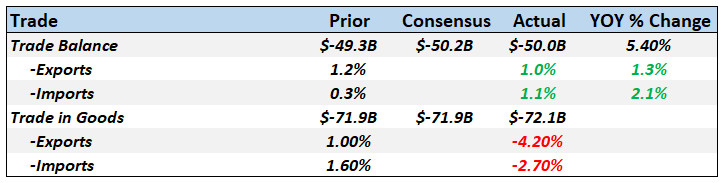

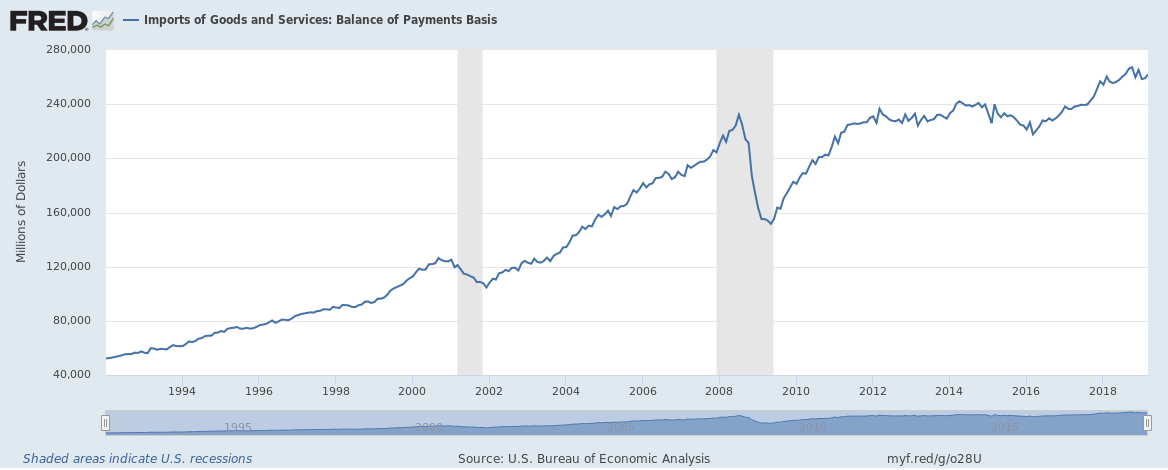

| The tariffs are starting to bite on the goods side of the trade economy and I would expect to see an impact on the overall numbers with the next release. Frankly, trade has not performed well this entire cycle. Imports and exports spent most of the time from 2011 to 2016 flatlining. Through March, things had looked a bit better under Trump – not that it had anything to do with his trade policies – but now trade is starting to shrink again. |

Imports of Goods and Services: Balance of Payments Basis, 1994-2018 |

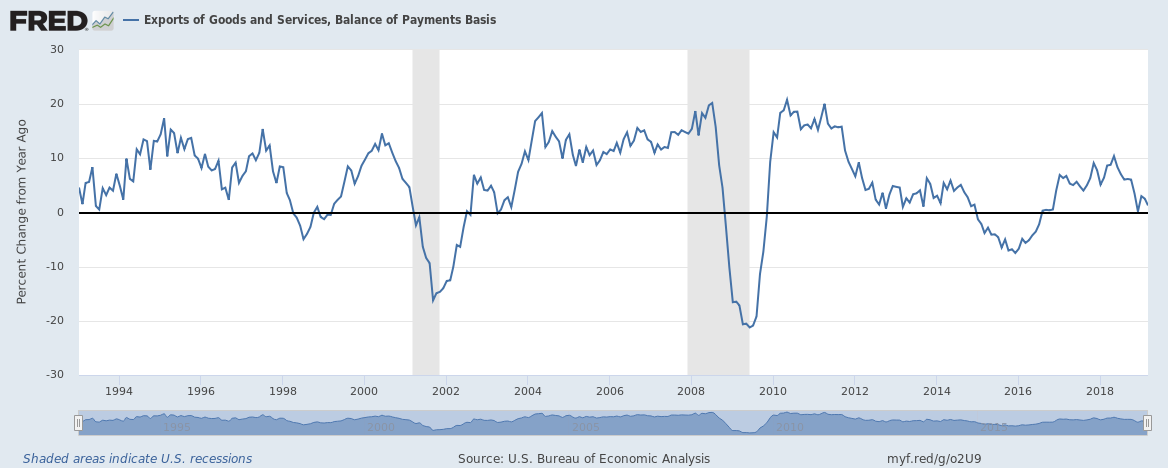

| Exports have recently gone flat year over year. We aren’t going to change that with a trade war. Here’s a question for the Trump administration trade team. If trade is the zero-sum game you guys seem to think it is and our tariffs weaken our trading partners’ economies, how will they buy the things we want to sell them? You can’t make us stronger by making everyone else weaker. |

Exports of Goods and Services, Balance of Payments Basis, 1994-2018 |

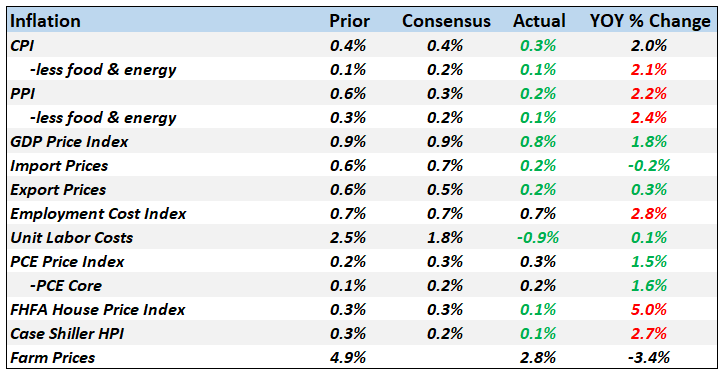

| Inflation remains a non-problem and even housing prices are moderating with the Case-Shiller index up less than 3% year over year. You’ll notice too the drop in farm prices in the table above. The accepted narrative is that farmers are taking the brunt of the trade war and prices do seem to reflect that. But soybeans are soybeans and if we sell less to China and Brazil sells more, we’ll sell more somewhere else (indeed we may sell more to Brazil who then sells them to China). And it isn’t that simple anyway. Brazil had a record crop of beans last year and prices would be low regardless of the trade war. Swine fever in China has also reduced the pig herd and demand for beans. Other agricultural commodities have their own unique supply/demand issues. If prices are down, it is easy to blame the bad foreigners for cutting demand but that might not be the right answer. | |

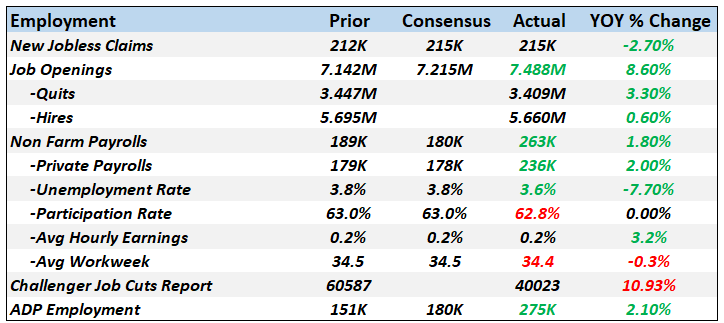

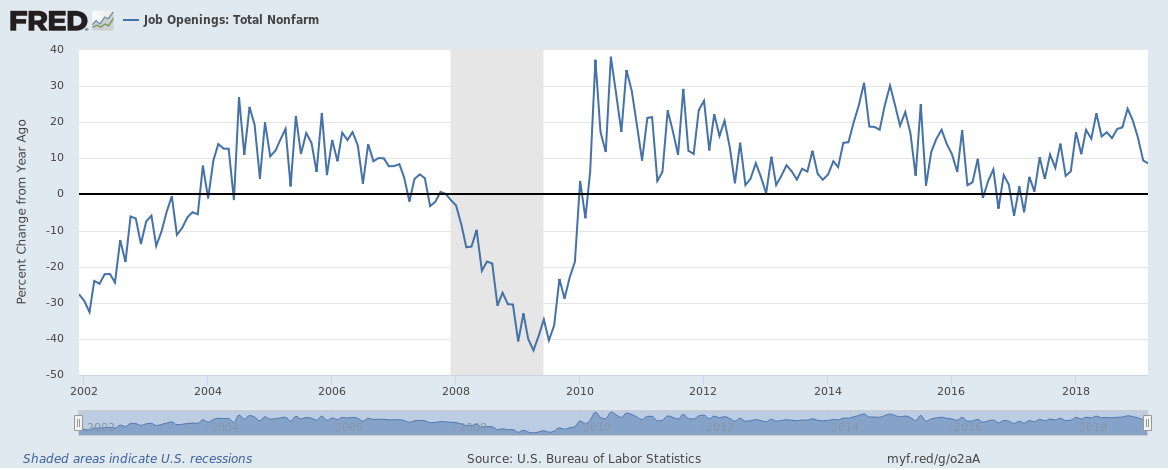

| Job openings are still rising but at a slower rate. This is similar to the two other cycle slowdowns we’ve seen since 2009. |

Job Openings: Total Nonfarm, 2002-2018 |

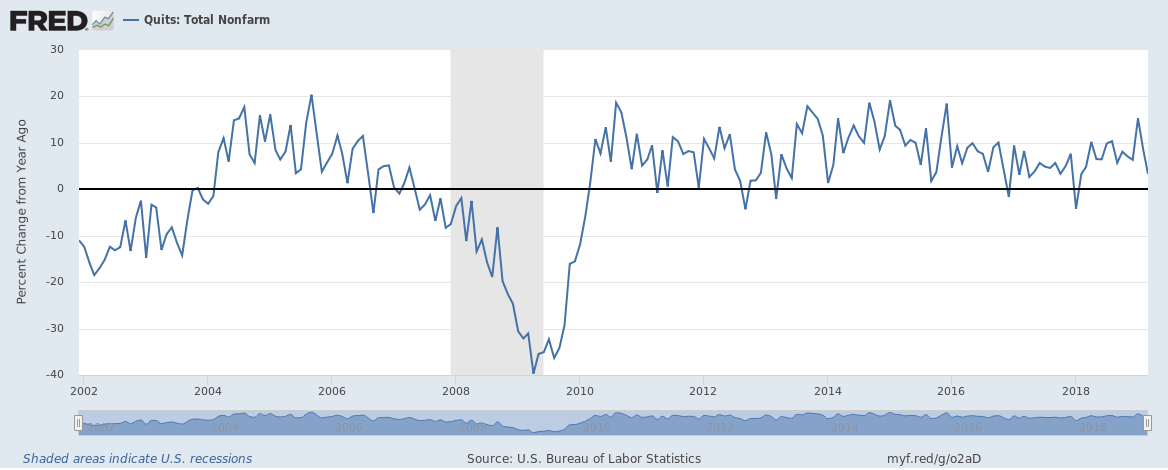

| Quits never accelerated like openings did but this still looks fairly healthy. |

Quits: Total Nonfarm, 2002-2018 |

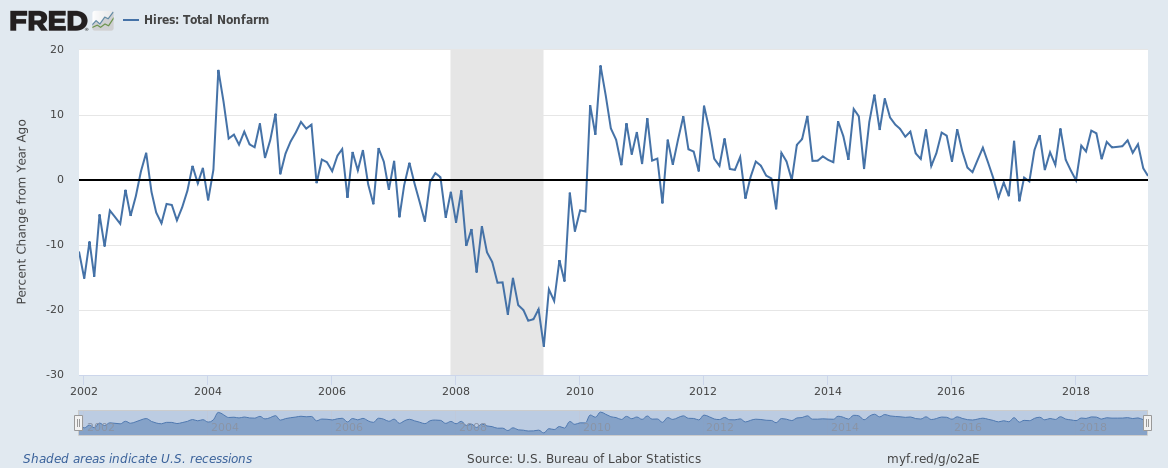

| Hiring has been and remains steady – if not spectacular – in this expansion. |

Hires: Total Nonfarm, 2002-2018 |

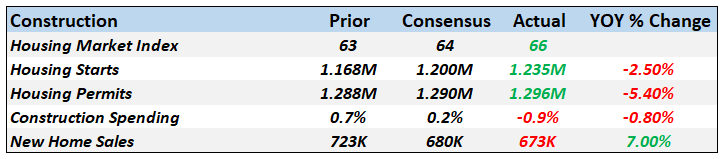

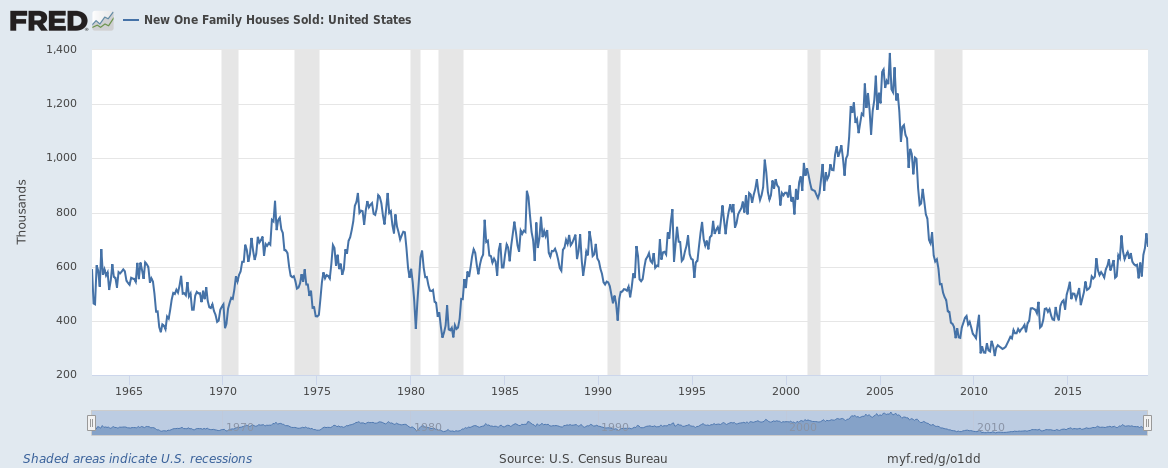

| New home sales offer one bright spot in the recent data, re-accelerating to near the highs for the cycle. |

New One Family Houses Sold, 1965-2015 |

| Small business and consumer sentiment remains strong which some have characterized as surprising in the face of tariffs. I think that is a misreading of the mood of the country. There are plenty of people who view the administration’s hard line on trade as long overdue. In fact, it is a rare and scary area of bipartisan agreement. I think tariffs are like someone telling their enemy to “stop or I’ll hurt myself again” but those who support a hard line on trade would characterize policy pre-Trump as “stop…or I’ll say stop again”. I don’t think the bully approach to trade will work but I can see why people like it. |

We are in an economic slowdown. That’s the only concrete conclusion we can draw right now from the economic data and our market indicators. Will it turn into a recession? I don’t know and neither does anyone else. But right now, the trends are mostly down and the administration seems intent on testing the limits of our ability to absorb new tariffs. Tariffs are taxes and the latest ones on Mexico will land mostly on US companies or their subsidiaries. How they respond is hard to say and we can hope that the administration comes to its senses – or gets some – before June 10th. If they don’t, Trump may get his rate cut out of the Fed sooner rather than later.

Tags: Alhambra Research,cfnai,economic growth,economic sentiment,economy,employment,Featured,Housing,inflation,investment,job openings,Markets,Monthly Macro Monitor,newsletter,Population growth,productivity,Real Estate,recession