Silver Analysts Forecast In Bloomberg Silver Price Survey - Bloomberg silver price survey - Large majority bullish on silver- Silver median "12 month-forecast" of - Precious metal analysts see silver "24 percent rally from current levels"- Investors are pouring money into silver ETFs- Speculative funds bearish even as ETF assets rise to record- Spec funds being ...

Topics:

GoldCore considers the following as important: 8.5%, Bank of England, Bond, Bullion, Business, China, Commodity Futures Trading Commission, currency, Empire State Manufacturing, Finance, Gold, Gold as an investment, Hong Kong, India, Investment, Ireland, London bullion market, Market Conditions, Money, Morgan Stanley, Precious Metals, Real estate, Reuters, Silver as an investment, Silver coin, Silver ETFs, Silver exchange-traded product, Sovereigns, Switzerland, U.S. Commodity Futures Trading Commission, United States dollar, Zurich

This could be interesting, too:

investrends.ch writes Neuzugang im Schweizer Vertriebsteam von Morgan Stanley

Claudio Grass writes The Case Against Fordism

Fintechnews Switzerland writes Top 12 Fintech Courses and Certifications in Switzerland in 2025

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Silver Analysts Forecast $20 In Bloomberg Silver Price Survey

- Bloomberg silver price survey - Large majority bullish on silver

- Silver median "12 month-forecast" of $20

- Precious metal analysts see silver "24 percent rally from current levels"

- Investors are pouring money into silver ETFs

- Speculative funds bearish even as ETF assets rise to record

- Spec funds being bearish is bullish as frequently signals bottom

- Important to focus not just on silver price but on silver value

- "Important to note that all portfolios under all conditions actually perform better with exposure to gold and silver" - David Morgan (see video)

From Bloomberg:

In a Bloomberg survey of 13 traders and analysts, the majority were bullish. 11 people said silver prices would rise and two predicted declines.

Among the seven respondents that provided estimates, the median 12-month forecast was $20 -- indicating a 24 percent rally from current levels.

Assets in exchange-trade funds backed by silver have risen 6.6 percent since April 24 to 21,211 tons, according to data compiled by Bloomberg.

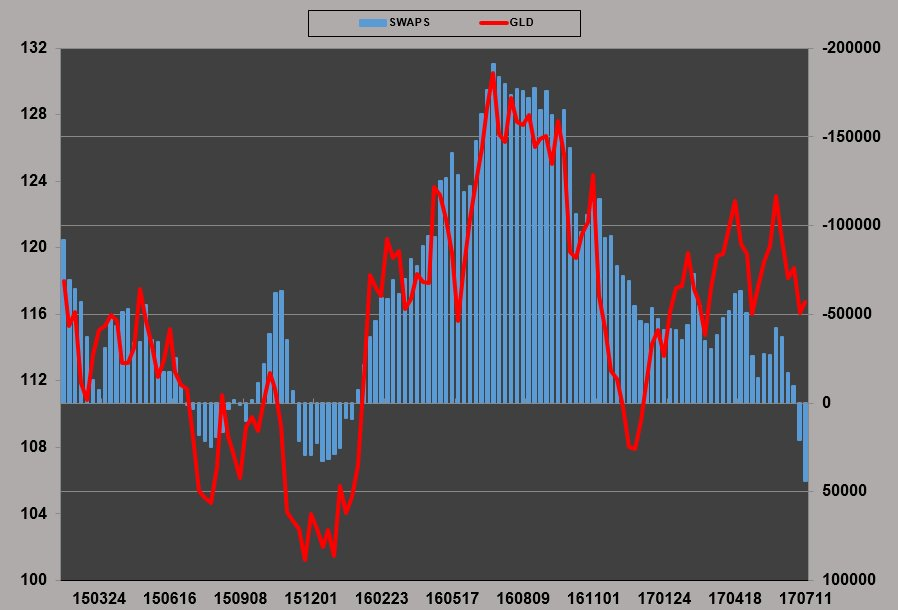

In the same time, hedge funds turned negative as prices tumbled. In the week ended July 11, hedge funds were net short by 5,402 contracts, according to U.S. Commodity Futures Trading Commission data. Short positions have tripled since the week of April 25 to 60,775 contracts.

From GoldCore:

We continue to see silver as undervalued vis a vis gold but more especially vis a vis stocks, bonds and many property markets. Rather than selling the financial insurance that is gold, we would advise reducing allocations to stocks, bonds and property and allocating to silver.

If one is very overweight gold in a portfolio and has no allocation to silver than there is of course a case for selling some gold and reweighting a portfolio in order to diversify into silver.

With the gold to silver ratio at 76 ($1235/$16.20/oz), the silver price is attractive at these levels and has the potential to be the surprise out performer in H2, 2017.

Silver’s industrial uses and coin and bar demand should see the gold/silver ratio gradually revert to the mean average in the last 100 hundred years which is close to 35:1. This was seen again in April, 2011 when the gold silver ratio fell to 32.4 with silver at $48/oz and gold at over $1,500/oz.

If the small silver market sees high net worth or institutional funds enter it, then the ratio could return closer to the long term, historical average of 15:1 as it did in 1980. We this as likely in the coming months given how cheap silver has become and the degree of risk in stock, bond and property markets today.

Silver prices back at $20 per ounce seems quite possible in the coming months and we believe we will see a significant rally from today's depressed prices. Longer term we see silver returning to the record nominal high of just below $50 per ounce - which was seen in 1980 and came very close to again in April 2011.

Silver remains a valuable diversification in a portfolio in that it tends to rise sharply when traditional assets like stocks and bonds are falling.

History shows this, as did the recent global financial crisis when silver surged from $12/oz (not far above the depressed levels of today at $16) in 2007 to nearly $50 at the height of the crisis in 2011.

Recent research has confirmed this that both gold and silver are safe haven assets. They tend to rise sharply when there is uncertainty and in economic crisis. The research shows a 10% allocation to gold is optimal and 1% to 5% allocation to silver is optimal in normal market conditions but a 10% allocation to silver is optimal in a financial crisis - See Lessons from gold and silver: Reviewing the research by Dr Brian Lucey.

In a recent note to subscribers David Morgan, the Silver Guru, underlined the importance of not viewing silver simply as a speculative asset to make a return on and to focus on silver's diversification benefit:

"It is important to note that all portfolios under all conditions actually perform better with exposure to gold and silver" - David Morgan

We recently had the pleasure of David's company in GoldCore's head office in Dublin, Ireland.

In the short video above, David speaks briefly about the importance of owning silver bullion coins and bars as financial insurance in an uncertain world. He speaks about GoldCore Secure Storage and how he recommends GoldCore's ultra secure allocated and segregated gold, silver, platinum and palladium bullion storage (Zurich, London, Singapore and Hong Kong) to his retail and high net worth clients.

Related Content

Why Silver Bullion Is Set To Soar - GoldCore Interview on YouTube

News and Commentary

Gold steady as cloudy U.S. rate hike outlook drags on dollar (Reuters.com)

Palladium prices seen hitting record average high in 2017: Reuters poll (Reuters.com)

Dollar Drops With Stocks as U.S. Reform Hopes Fade (Bloomberg.com)

Empire State manufacturing index retreats in July from two-year high (MarketWatch.com)

Stocks Flat, Metals Rise as Markets Await Earnings (Bloomberg.com)

Bullion banks closed huge number of short positions last week (AveryBGoodMan.com)

COT Report Gets Even More Favorable For Gold And Silver (DollarCollapse.com)

Single most important rule for buying investment real estate (StansBerryChurcHouse.com)

Who’s responsible for the mess the world is in? Somerset Webb (MoneyWeek.com)

Passive investing boom is creating a 'frightening' risk for markets - Morgan Stanley (CNBC.com)

Gold Prices (LBMA AM)

18 Jul: USD 1,237.10, GBP 949.47 & EUR 1,071.82 per ounce

17 Jul: USD 1,229.85, GBP 940.71 & EUR 1,074.03 per ounce

14 Jul: USD 1,218.95, GBP 940.54 & EUR 1,067.92 per ounce

13 Jul: USD 1,221.40, GBP 944.51 & EUR 1,071.05 per ounce

12 Jul: USD 1,219.40, GBP 947.60 & EUR 1,064.29 per ounce

11 Jul: USD 1,211.90, GBP 938.98 & EUR 1,063.68 per ounce

10 Jul: USD 1,207.55, GBP 938.63 & EUR 1,060.11 per ounce

Silver Prices (LBMA)

18 Jul: USD 16.17, GBP 12.41 & EUR 13.99 per ounce

17 Jul: USD 16.07, GBP 12.30 & EUR 14.02 per ounce

14 Jul: USD 15.71, GBP 12.11 & EUR 13.76 per ounce

13 Jul: USD 15.95, GBP 12.34 & EUR 14.00 per ounce

12 Jul: USD 15.83, GBP 12.31 & EUR 13.82 per ounce

11 Jul: USD 15.51, GBP 12.02 & EUR 13.61 per ounce

10 Jul: USD 15.22, GBP 11.82 & EUR 13.36 per ounce

Recent Market Updates

- “Bigger Systemic Risk” Now Than 2008 – Bank of England

- “Financial Crisis” Coming By End Of 2018 – Prepare Urgently

- Video – “Gold Should Probably Be $5000” – CME Chairman

- India Gold Imports Surge To 5 Year High – 220 Tons In May Alone

- “Silver’s Plunge Is Nearing Completion”

- China, Russia Alliance Deepens Against American Overstretch

- Silver Prices Bounce Higher After Futures Manipulated 7% Lower In Minute

- Precious Metals Are “Best Defence” Against Bail-ins In Economic Crisis

- Buy Gold Near $1,200 “As Insurance” – UBS Wealth

- UK House Prices ‘On Brink’ Of Massive 40% Collapse

- Gold Up 8% In First Half 2017; Builds On 8.5% Gain In 2016

- Pensions Timebomb In America – “National Crisis” Cometh

- London Property Bubble Bursting? UK In Unchartered Territory On Brexit and Election Mess

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Special Offer - Gold Sovereigns at 3% Premium - London Storage

We have a very special offer on Sovereigns for London Storage today. Own one of the most popular and liquid of all bullion coins - Gold Sovereigns - at the lowest rates in the market for storage.

- Limited Gold Sovereigns (0.2354 oz) available

- Pricing at spot + 3.0% premium

- Allocated, segregated storage in London

- Normally sell at spot gold plus 6.75% to 10%

- One of most sought after bullion coins in the world

- Mixed year, circulated bullion coins

- Minimum order size is 20 coins

These coins are at a very low price and with limited amounts at these record low prices we expect them to sell out very fast.

Call our office today

UK +44 (0)203 086 9200

IRL +353 (0)1 632 5010

US +1 (302)635 1160