Don’t let “traditional biases” stop you from diversifying into gold – Dalio on Linkedin “Risks are now rising and do not appear appropriately priced in” warns founder of world’s largest hedge fund Geo-political risk from North Korea & “risk of hellacious war” Risk that U.S. debt ceiling not raised; technical US default Safe haven gold likely to benefit by more than dollar, treasuries Investors should allocate at least 5% to 10% of assets to gold “If you don’t have 5-10% of your assets in gold as a hedge, we’d suggest that you relook at this” “If you do have an excellent analysis of why you shouldn’t have such an allocation to gold, we’d appreciate you sharing it with us …” There are returns, and there are risks. We

Topics:

Mark O'Byrne considers the following as important: Alpha, B+, Bitcoin, Business, Congress, Debt Ceiling, default, Featured, Finance, Financial risk, Funding Gap, Gold and its price, Gold as an investment, Gundlach, Hedge, Hong Kong, Investment, Market risk, Mathematical finance, Money, newsletter, North Korea, Precious Metals, Ray Dalio, Reuters, risk, S&P 500, S&P 500, Silver as an investment, Smithsonian, Sovereigns, stagflation, Switzerland, Volatility, Yen

This could be interesting, too:

investrends.ch writes Bitcoin nach Kurseinbruch mit fulminantem Comeback

investrends.ch writes Welche Rolle spielen gehebelte Produkte beim jüngsten Einbruch der Krypto-Währungen?

investrends.ch writes «Die Nerven liegen derzeit blank»

investrends.ch writes Bitcoin fällt unter 90 000 US-Dollar

- Don’t let “traditional biases” stop you from diversifying into gold – Dalio on Linkedin

- “Risks are now rising and do not appear appropriately priced in” warns founder of world’s largest hedge fund

- Geo-political risk from North Korea & “risk of hellacious war”

- Risk that U.S. debt ceiling not raised; technical US default

- Safe haven gold likely to benefit by more than dollar, treasuries

- Investors should allocate at least 5% to 10% of assets to gold

- “If you don’t have 5-10% of your assets in gold as a hedge, we’d suggest that you relook at this”

- “If you do have an excellent analysis of why you shouldn’t have such an allocation to gold, we’d appreciate you sharing it with us …”

There are returns, and there are risks. We think of them individually, and then we combine them into a portfolio.

We think of returns and opportunities as coming from those things we’d bet on, and we think of risks as the adverse market consequences of us being wrong due to our being out of balance. We start with our balanced beta portfolio—i.e., that portfolio that would most certainly fund our intended uses of the money.

Everyone should have their own based on their own projected uses of money, though more generally, it’s our All Weather portfolio.

We then create a balanced portfolio of opportunity/alpha bets based on what we think is likely to happen. We then combine them.

We bet on the events/outcomes that we think we have an edge in understanding. For events/outcomes where we don’t think we have a particular edge—e.g., political events—we aim to construct our portfolio to be relatively neutral or balanced to those risks.

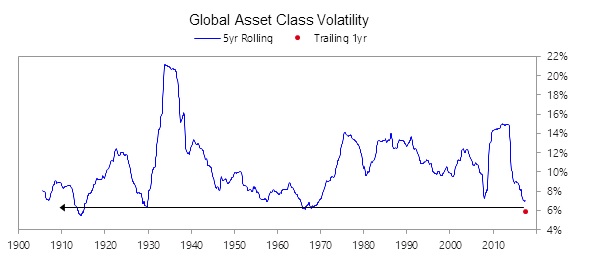

Risk and VolatilityAs a rule, periods of lower risk/volatility tend to lead to periods of greater risk/volatility. That is reflected in our aggregate market volatility gauge (see below), and markets are pricing in volatility to remain low next year too. As a related rule, people adapt to the circumstances they have experienced and are then surprised when the future is different than the past. In other words, most people are inclined to assume that the circumstances they have recently encountered will persist, which leads them to change what they are doing to be consistent with that recently experienced environment. For example, low-volatility periods in which credit is readily available tend to lead people to assume that it’s safe to borrow more, which leads them to lever up their positions, which contributes to greater volatility and hurts them when things change. That appears to be the case now—i.e., prospective risks are now rising and do not appear appropriately priced in because of a) a backward looking at risk and b) corporate leveraging up has been high because interest rates are low relative to many companies’ projected ROEs and because past risks have been low. The emerging risks appear more political than economic, which makes them especially challenging to price in. |

Global Asset Class Volatility, 1900 - 2017 |

| Most immediately, during the calm of the August vacation season, we are seeing

1) two confrontational, nationalistic, and militaristic leaders playing chicken with each other, while the world is watching to see which one will be caught bluffing, or if there will be a hellacious war, and 2) the odds of Congress failing to raise the debt ceiling (leading to a technical default, a temporary government shutdown, and increased loss of faith in the effectiveness of our political system) rising. It’s hard to bet on such things, one way or another, so the best that one can do is be neutral to such possibilities. When it comes to assessing political matters (especially global geopolitics like the North Korea matter), we are very humble. We know that we don’t have a unique insight that we’d choose to bet on. Most importantly, we aim to stay liquid, stay diversified, and not be overly exposed to any particular economic outcomes. We like to hedge our bets, though we are never completely hedged. We can also say that if the above things go badly, it would seem that gold (more than other safe haven assets like the dollar, yen, and treasuries) would benefit, so if you don’t have 5-10% of your assets in gold as a hedge, we’d suggest that you relook at this. Don’t let traditional biases, rather than an excellent analysis, stand in the way of you doing this (and if you do have an excellent analysis of why you shouldn’t have such an allocation to gold, we’d appreciate you sharing it with us). |

Spot Gold Price, Sep 2016 - Aug 2017(see more posts on gold price, ) Source: Bloomberg.com - Click to enlarge |

Tags: Alpha,B+,Bitcoin,Business,Congress,Debt Ceiling,default,Featured,Finance,Financial risk,Funding Gap,Gold as an investment,Gundlach,Hedge,Hong Kong,investment,Market risk,Mathematical finance,money,newsletter,North Korea,Precious Metals,Ray Dalio,Reuters,Risk,S&P 500,Silver as an investment,Smithsonian,Sovereigns,stagflation,Switzerland,Volatility,Yen