Gregory (Scotland Yard detective): “Is there any other point to which you would wish to draw my attention?” Sherlock Holmes: “To the curious incident of the dog in the night-time.” Gregory: “The dog did nothing in the night-time.” Sherlock Holmes: “That was the curious incident.” From Silver Blaze by Arthur Conan Doyle, 1892 It is hard to determine sometimes what causes markets to move as they do. Take last Friday’s stock market selloff. The widely cited “reason”...

Read More »The Russian Gold Standard

It is becoming increasingly clear that UN Nations are realising that it is very difficult to isolate a country that is already a global power. And not just a global power in terms of the military but also in terms of the world’s dependence on its energy exports. However, Russia’s energy exports are not the only thing the West benefits from. One little known fact about Russia is that its highest non-energy export is gold, exporting around $15 billion of gold bullion...

Read More »The Week Ahead: Dollar Bulls Still in Charge

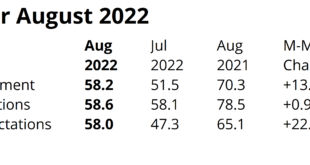

The poor preliminary PMI readings, the ongoing European energy crisis, and the recognized commitment of most major central banks to rein in prices through tighter financial conditions are risking a broad recession. These considerations are weighing on sentiment and shaping the investment climate. Most high-frequency data due in the days ahead will not change this, even if they pose some headline risk. What we have seen among some central bankers applies to market...

Read More »History Of Money and Evolution Suggests a Crash is Coming

Today’s guest is as much a historian and anthropologist as he is an expert on market events. Jon Forrest Little joins Dave Russell on GoldCore TV today and brings some fascinating insights into what we are currently seeing when it comes to political decisions, financial events and human reactions. From what we can learn from the Romans through to why we need to consider gold’s utility rather than its price, this is an interview bringing a new perspective as to why we...

Read More »Rate Hikes Are Working

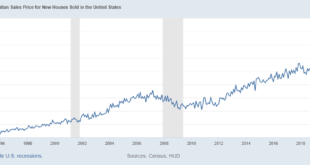

New home sales were reported for July as down nearly 13% to 511K, a number that is just about the average since 2010 (543k). But that doesn’t tell the whole story obviously. New home sales have fallen sharply since December of last year, down 39%. The drop from the peak in August 2020 is even more dramatic, down nearly 51%. Obviously, the fall this year is related to rising mortgage rates but that can’t be the reason sales have been falling for nearly two years....

Read More »Ep 39 – Tavi Costa: Breaking Down the Pressures on the Market

Tavi Costa of Crescat Capital joins Keith and Dickson on the Gold Exchange Podcast to talk about the current state of the market, investing in good times and bad, and what future indicators to watch. Connect with Tavi on Twitter: @TaviCosta Connect with Keith Weiner and Monetary Metals on Twitter: @RealKeithWeiner@Monetary_Metals [embedded content] Additional Resources Fed Zugzwang Germany Announcement Jerome Powell Nose Tweet Bloomberg Misery Index Zombie Company...

Read More »Why we couldn’t be happier that gold is boring

We’re the first to admit that investing in gold can be pretty boring. Don’t get us wrong, when you first decide to buy gold then the newness of it is exciting, as you choose which gold bullion dealer to use then it is interesting and when you actually see the gold bars or coins appear in your account then it’s really exciting. But then what? There aren’t any major price moves, it’s not like you see any huge crashes or major leaps to keep you on your toes, not like...

Read More »Weekly Market Pulse: Same As It Ever Was

History never repeats itself. Man always does. Voltaire Mark Twain is credited with a similar saying, that history doesn’t repeat but it rhymes. Of course, there is scant evidence that Clemens said anything of the sort just as Voltaire may or may not have penned the quote above. But both men were much wittier than I – than most – so I’ll take them both as being representative if not genuine. I have been a professional investor for now over 30 years and I have seen...

Read More »Flash PMI, Jackson Hole, and the Price Action

For many, this will be the last week of the summer. However, in an unusual twist of the calendar, the US August employment report will be released on September 2, the end of the following week, rather than after the US Labor Day holiday (September 5). The main economic report of the week ahead will be the preliminary estimate of the August PMI. The policy implications are not as obvious as they may seem. For example, in July, the eurozone composite PMI slipped...

Read More »Wie Schwellenländer mit der globalen Inflation umgehen

Die globale Inflation wirkt sich auch auf die die Schwellenmärkte aus. Doch unter Umständen seien die meisten von ihnen aufgrund ihrer jüngeren Erfahrung mit starken Preissteigerungen den Industrieländern in der Bekämpfung der Inflation voraus, meint Carlos de Sousa von Vontobel.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org