We’re the first to admit that investing in gold can be pretty boring. Don’t get us wrong, when you first decide to buy gold then the newness of it is exciting, as you choose which gold bullion dealer to use then it is interesting and when you actually see the gold bars or coins appear in your account then it’s really exciting. But then what? There aren’t any major price moves, it’s not like you see any huge crashes or major leaps to keep you on your toes, not like with crypto. But, as you’ll read below, boring really is the best way to be. Well, when it comes to investments that is. Gold V/S Crypto The gold price is hovering around US,800 per ounce, where it has averaged since the beginning of 2021. Your feelings about the gold price likely are similar to

Topics:

Stephen Flood considers the following as important: 6a.) GoldCore, 6a) Gold & Monetary Metals, Commentary, Economics, Featured, Geopolitics, Gold, gold and silver, gold forecast, gold price, gold price prediction, gold price today, gold prices, inflation, News, newsletter, Precious Metals, silver, silver price, silver prices, Stock markets

This could be interesting, too:

finews.ch writes Zinsgeschäft trübt das Ergebnis der Freiburger Kantonalbank

finews.ch writes Bank Frick erweitert Verwaltungsrat

finews.ch writes «Wir werden schon bald wieder einige wegziehen sehen»

finews.ch writes Paukenschlag im Asset Management: Nuveen übernimmt Schroders

| We’re the first to admit that investing in gold can be pretty boring. Don’t get us wrong, when you first decide to buy gold then the newness of it is exciting, as you choose which gold bullion dealer to use then it is interesting and when you actually see the gold bars or coins appear in your account then it’s really exciting.

But then what? There aren’t any major price moves, it’s not like you see any huge crashes or major leaps to keep you on your toes, not like with crypto. But, as you’ll read below, boring really is the best way to be. Well, when it comes to investments that is. |

|

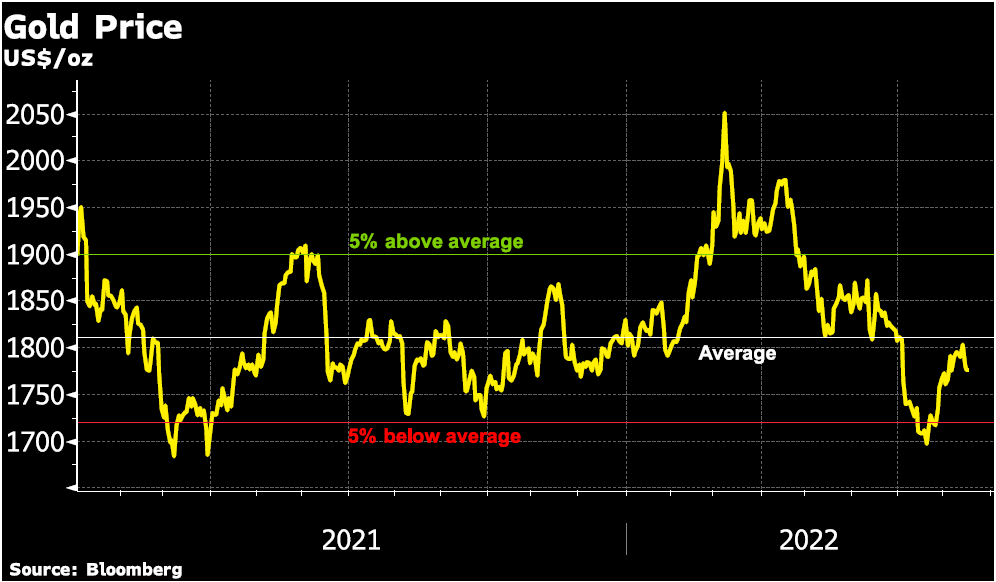

Gold V/S CryptoThe gold price is hovering around US$1,800 per ounce, where it has averaged since the beginning of 2021. Your feelings about the gold price likely are similar to ours: gold has been boring compared to stocks and crypto. Since the beginning of last year the gold price, with the exception of a rise of around 14% when Russia invaded Ukraine (note that the safe-haven demand due to the invasion which resulted in this rise was in contrast to the decline in cryptocurrencies and equity markets), has oscillated around 5% of the average just over US$1800. |

|

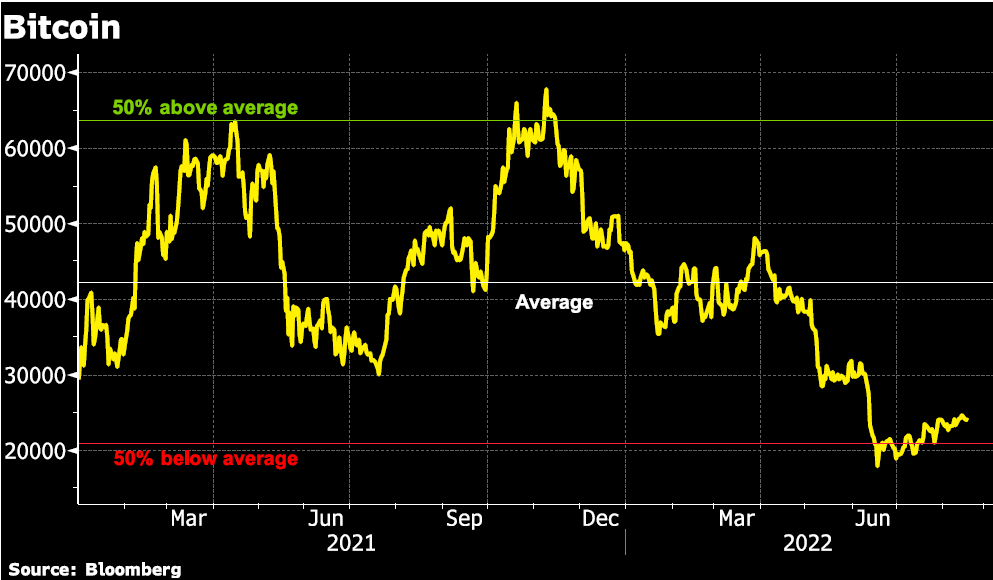

| In contrast Cryptos oscillate 50% above and below Bitcoin’s average of 42,700 since the beginning of 2021. Most coins have had large runups and then sharp declines over the last year and a half. Some cryptos have moved 100% down. Bitcoin remains close to 50% below its average since the beginning of 2021.

Equity markets have had swings in the middle; more swing than physical metals but less swing than Bitcoin, oscillating around 20% from their respective averages since 2021 began. The above shows the store of value of gold and gold’s low volatility. Both qualities help to stabilize an investment portfolio in times of turmoil. Therefore, no matter how “boring” gold has been in recent months – the alternatives have had worse performances. Adding to the store of value is the fact that counterparty risk is avoided by holding physical metals. This factor has gained importance versus paper contracts and versus investing in cryptocurrencies of late. |

|

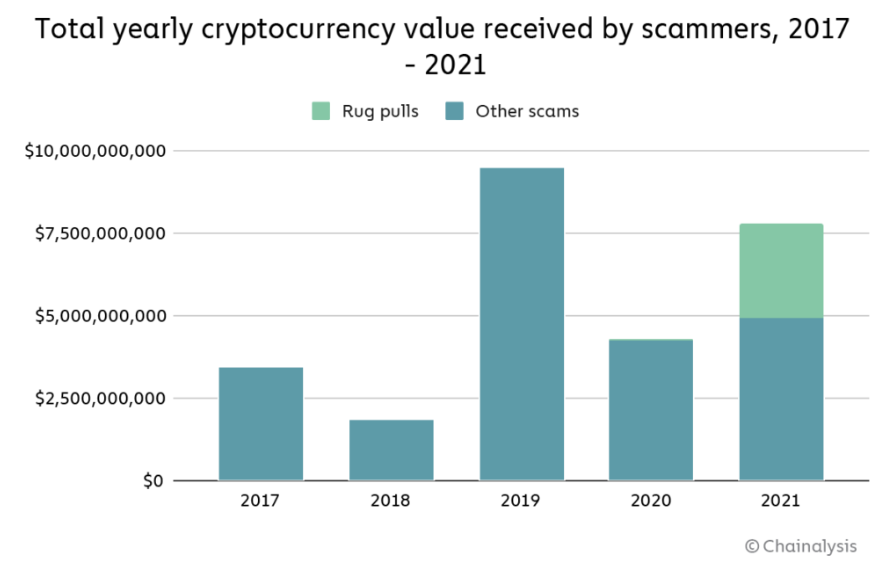

Versus paper contracts:This is a follow-up to our July 14 post titled Gold traders on trial: Only buy physical where we discussed the trial of former JP Morgan traders for manipulating trades. Last week the traders were convicted on charges of fraud, spoofing, and market manipulation of markets for more than a decade. The oversized position of JP Morgan in the futures market gave the traders the power to move prices and manipulate the worldwide price. The criminal case against the former JP Morgan traders is only one example of many scams and manipulation of markets. And this example shows manipulation in regulated markets, while the scams in cryptocurrency markets are even more blatant and expensive. Versus investing in cryptosThe second point is growing cryptocurrency scams. One of these scams is called a digital ‘rug pull’. According to cryptowallet.com: A rug pull is a term used in the crypto community to refer to cryptocurrency projects that turned out to be exit scams. A rug pull is said to have occurred if the developers of a crypto project abscond with investors’ money. There are several types of digital rug pull in the crypto space, which include a form of Ponzi scheme where the project manager convinces investors to buy specific crypto and then flees with the funds. There are also cases where the head of a crypto exchange claims the exchange has been hacked and then takes off with the assets in the exchange wallets. The prevalence of ‘rug pulls’ is growing and there have been digital ‘rug pulls’ every month so far in 2022. Chainalysis reports the total loss to scam victims was over $7.7 billion worldwide in 2021. The chart below from chainalysis.com shows the estimated total value of scams from 2017-2021. |

|

| With the increasing prevalence of ‘rug pulls’ 2022 will likely be worse than 2021 when measured by dollars stolen.

Total Yearly Cryptocurrency value received by scammers, 2017-2021 ChartIt is important to recall that emotions and exciting movements can cause trouble for investors. Therefore boring is beautiful … investors hold onto boring investments far longer than the next new creation, which could turn out to be a scam or decline significantly after a ‘bubble’ run-up in price. The store of value of gold has been demonstrated repeatedly. Long-term investments give better results because they are easier to buy and hold…which makes boring investments into better investments. All of this reinforces our belief in physical metals and that is why Goldcore stays true to the physical metals. Next week we will be interviewing Jim Rogers on GoldCore TV. Recently Jim issued some stark warnings about cryptos and security. For Jim, right now is a great time to own precious metals, and he recommends we all buy silver. Make sure you are subscribed to GoldCore TV so you don’t miss it! If you can’t wait for Jim’s interview then why not head to GoldCore TV now for a new offering, a dinner party with Jim Rickards, Marc Faber and David Morgan. If you’ve ever wondered what Marc Faber’s biggest investment regret is, or maybe what books Jim Rickards would recommend then now is your chance. |

Tags: Commentary,Economics,Featured,Geopolitics,Gold,gold and silver,gold forecast,gold price,gold price prediction,gold price today,Gold prices,inflation,News,newsletter,Precious Metals,silver,silver price,silver prices,Stock markets