The BOJ confounded market expectations by just tinkering with policy on the margins in July. As a result, the yen should hold on to its recent gains. The Bank of Japan (BoJ) did not significantly change monetary policy at its Monetary Policy Meeting held on 28-29 July, contrary to market expectations. While the BOJ did announce an increase in its annual purchases of ETFs (from ¥3.3 trn to ¥6 trn), it kept the annual increase of the monetary base at ¥80 trn and did not cut interest rates...

Read More »Blades Whirring Over Japan?

Japanese central bankers are not in an enviable position. The year-over-year growth rate of the country’s core consumer price index was -0.4 percent in May, marking the third consecutive monthly decline—and this after three years of Abenomics. Brexit certainly hasn’t helped. The yen has strengthened from ¥121 to the dollar in February 2016 to ¥105 in late July. That’s had the effect of reducing import prices, but it has also put downward pressure on inflation. Japan economists on...

Read More »The Central Planning Virus Mutates

Chopper Pilot Descends on Nippon Readers are probably aware of recent events in Japan, the global laboratory for interventionist experiments. The theories of assorted fiscal and monetary cranks have been implemented in spades for more than a quarter of a century in the country, to appropriately catastrophic effect. Amid stubbornly stagnating economic output, Japan has amassed a debt pile so vast since the bursting of...

Read More »“Geldpolitik soll eigenständig bleiben (Monetary Policy Independence),” FuW, 2016

Finanz und Wirtschaft, July 20, 2016. PDF. In a perfect world, monetary and fiscal policy are coordinated. In the real world with its political frictions they are not. So much on helicopter money.

Read More »FX Daily, July 14: Will BOE Ease on May Day?

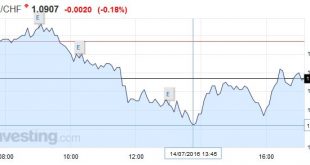

Swiss Franc The euro-Swiss is moving back to reality, after the risk-on run in the beginning of the week. The continued yen weakening is slightly negative for the franc given that some algorithms correlate the two safe-haven currencies. Click to enlarge. United Kingdom After a nearly three weeks of turmoil following the UK referendum, there is now a sense of order returning to UK politics. Two elements of the new...

Read More »“It’s Prohibited By Law” – A Problem Emerges For Japan’s “Helicopter Money” Plans

Over the past four days, risk assets have been on a tear, led by the collapsing Yen and soaring Nikkei, as the market has digested daily news that – as we predicted last week – Bernanke has been urging Japan to become the first developed country to unleash the monetary helicopter, in which the central banks directly funds government fiscal spending, most recently with an overnight report that Bernanke has pushed...

Read More »Fearing Confiscation, Japanese Savers Rush To Buy Gold And Store It In Switzerland

Japan has pushed further away from being the nation that embraces “Krugman Era” economics and deeper into the new “Bernanke Era” economics of helicopter money. As a result Japan’s citizens have been on a blitz to save what little purchasing power they still possess, before hyperinflation finally arrives. The gold price is up double digits in the past month and as we said last night, something big is coming as Japan...

Read More »Next Up for Central Banks: Infrastructure Investments?

In the years following the global financial crisis, the world’s leading economies have found relief through aggressive monetary policy. But with interest rates slashed to historic lows and central bank balance sheets significantly larger as a percent of GDP than they were before the financial crisis, policymakers will need alternatives to interest rate cuts and conventional quantitative easing when the next recession comes along. U.S. central bankers have cut real interest rates between...

Read More »In Gold We Trust, 2016

The 10th Anniversary Edition of the “In Gold We Trust” Report As every year at the end of June, our good friends Ronald Stoeferle and Mark Valek, the managers of the Incrementum funds, have released the In Gold We Trust report, one of the most comprehensive and most widely read gold reports in the world. The report can be downloaded further below. The report celebrates its 10th anniversary this year. As always, a...

Read More »ECB policy meeting: different things to worry about

While we expect the ECB to remain on hold at its next policy meeting on April 21, a number of issues are coming steadily into focus Read the full report here The ECB is facing a complex, albeit not completely negative, macro-financial environment following its impressive policy package announcement on 10 March. Nevertheless, barring some new shock, beyond some fine-tuning measures, the ECB should remain on hold at its next policy meeting on 21 April. Instead, we expect different aspects...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org