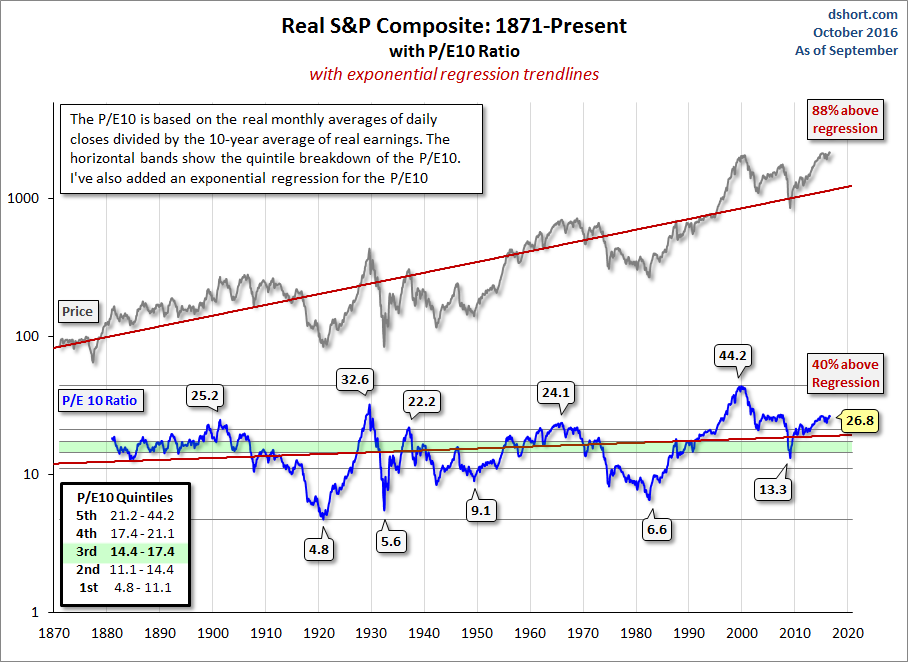

Newfangled “Stimulus” In time, everything goes away. We are confident, for example, that it won’t be too long before the market cracks (please don’t hold us to this forecast, but don’t forget if it turns out to be correct!). U.S. corporate profits are falling. GDP is sinking. Productivity has slumped for the longest period since the 1970s. And going by the CAPE ratio, which looks at stock prices relative to the past 10 years of earnings, only three times in the last 100 years (in 1929, 2000, and 2007) have stocks been this expensive. The crack, when it comes, will produce new demands of fiscal stimulus and money from helicopters. Just to keep our terms straight, fiscal stimulus comes from government borrowing and spending. It shows up in the deficit. “Helicopter money” is spending directly financed by central bank money creation. It happens without a single dollar being added to the deficit. They are very similar; what matters is how they are financed. When it comes, the next recession will provoke calls for spending on infrastructure projects. These will be accompanied by estimates of how much the projects will return. The numbers are pure nonsense. Without a real cost of capital and a way to price the output or figure out the profit from a project, all the calculations are fiction.

Topics:

Bill Bonner considers the following as important: Featured, Helicopter Money, Jeffrey Miron, newsletter, On Economy, On Politics

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Newfangled “Stimulus”In time, everything goes away. We are confident, for example, that it won’t be too long before the market cracks (please don’t hold us to this forecast, but don’t forget if it turns out to be correct!). U.S. corporate profits are falling. GDP is sinking. Productivity has slumped for the longest period since the 1970s. And going by the CAPE ratio, which looks at stock prices relative to the past 10 years of earnings, only three times in the last 100 years (in 1929, 2000, and 2007) have stocks been this expensive. The crack, when it comes, will produce new demands of fiscal stimulus and money from helicopters. Just to keep our terms straight, fiscal stimulus comes from government borrowing and spending. It shows up in the deficit. “Helicopter money” is spending directly financed by central bank money creation. It happens without a single dollar being added to the deficit. They are very similar; what matters is how they are financed. When it comes, the next recession will provoke calls for spending on infrastructure projects. These will be accompanied by estimates of how much the projects will return. The numbers are pure nonsense. Without a real cost of capital and a way to price the output or figure out the profit from a project, all the calculations are fiction. But we are getting ahead of ourselves. |

Real S&P Composite |

Fake WarsSo far, so good. Hillary is the frontrunner. If she wins, nothing will change. If Donald wins, nothing much will change, either. But he may rattle investors. Who knows? One of the hardest things to understand about our present situation is the way in which things are not what they seem. We have written frequently about how today’s money is fake. How interest rates are fake. How statistics are fake (take the “unemployment rate”… Please!). Our “wars” are now fake, too. When the feds announce a new war, we naturally assume their goal is to beat the enemy. Not so. Instead, they want to keep the war going. That means NOT beating the enemy. That way BOTH sides win. |

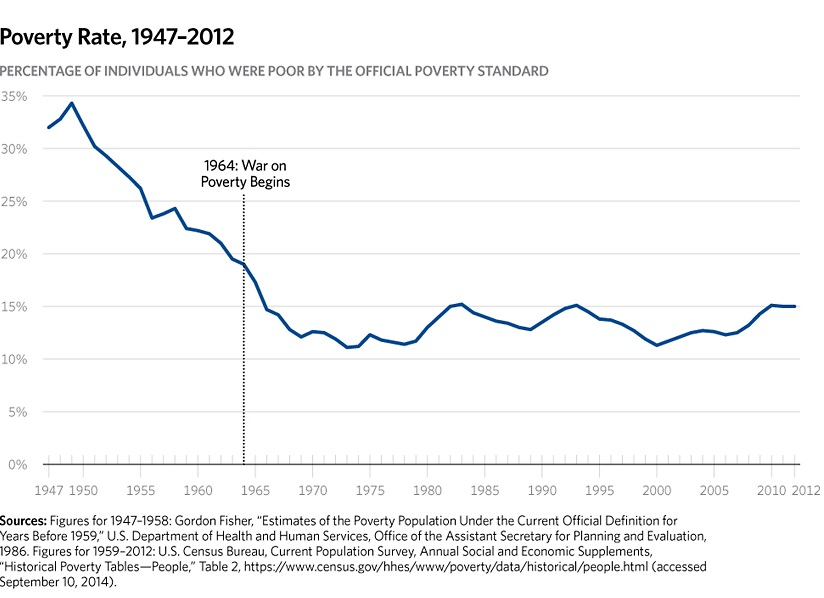

Poverty Rate, 1947 - 2012 |

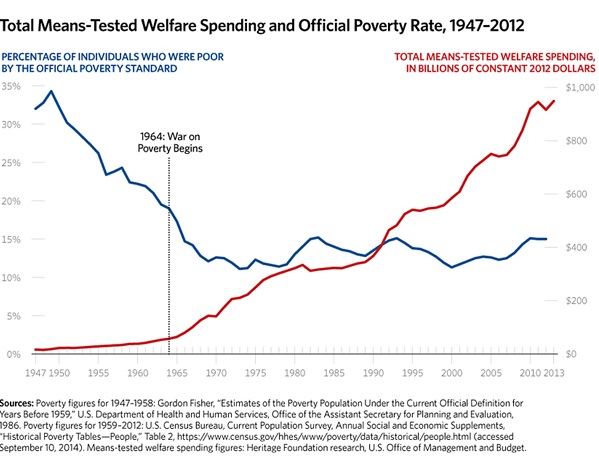

| The War on Poverty was the first of our fake “wars.” It was a nice collusion between poor people and an entire industry – 92 government programs – that received and spent money on their behalf. Set up in 1964, the War on Poverty has already cost $22 trillion – and it goes on. Why?

Because poor people get money. And because the “elite” who control the cash flow get the support of poor voters… and a substantial part of the money, too. For every dollar distributed, the poverty-fighting insiders keep 72 cents (a figure widely discussed, but far from certain). If that figure is correct, the insiders have pulled in more than $15 trillion over the last 50 years – by pretending to fight poverty! |

Total Means - Tested Welfare Spending and Official Poverty Rate, 1947 - 2012 |

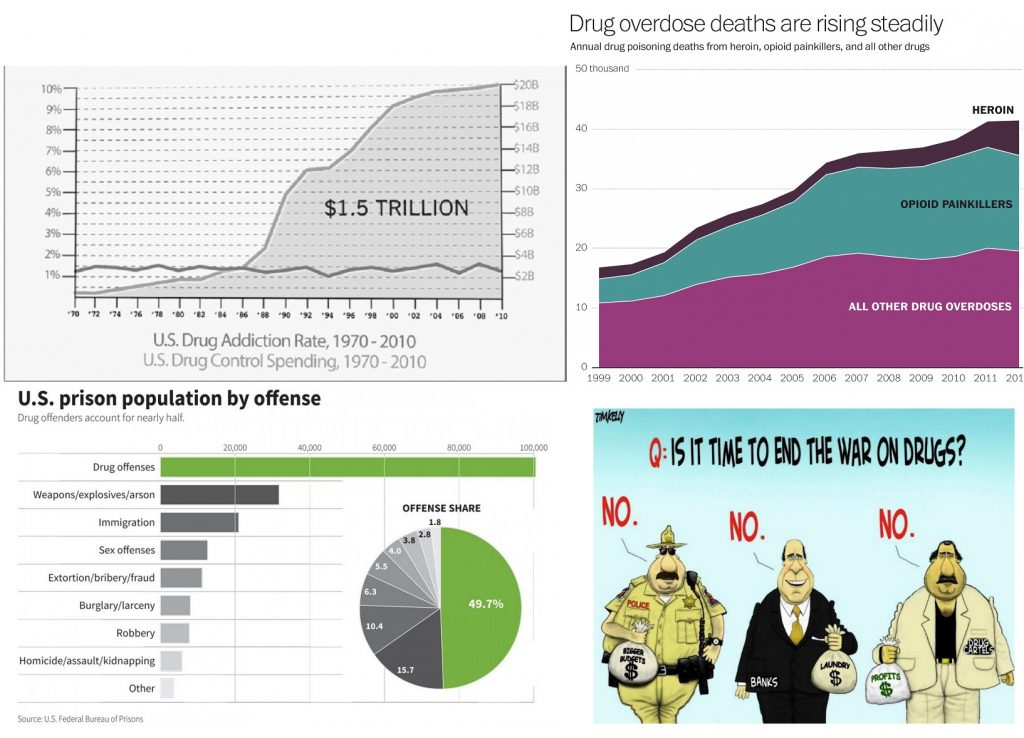

Drug KingpinsThe War on Drugs came in 1971. Harvard economist Jeffrey Miron says it costs taxpayers a trivial $41 billion [ed note: that’s what it costs per year, as of 2010 – link to Miron White Paper]. The “war” is best understood as a public-private partnership – between the illegal drug business and the drug-fighting agencies. After all, where would former addict and now America’s “Drug Czar” Michael Botticelli be without the drug pushers? And without the DEA, where would the drug kingpins be? |

Drug War |

| Suppose they had to compete on price, quality, and service, instead of on drive-by shootings. They’d soon be put out of business by guys with PowerPoint slides and spreadsheets.

Giant tobacco and liquor companies – with decades of experience, distribution networks, retail channels, and marketing know-how – would eat their lunches immediately. Instead, the illegal drug industry – the drug fighters at the BATF, DEA, FBI, local police, the prisons, the courts, and a whole subculture of criminals – stays in business. More on our fake wars, including the biggest of them all… next time. |

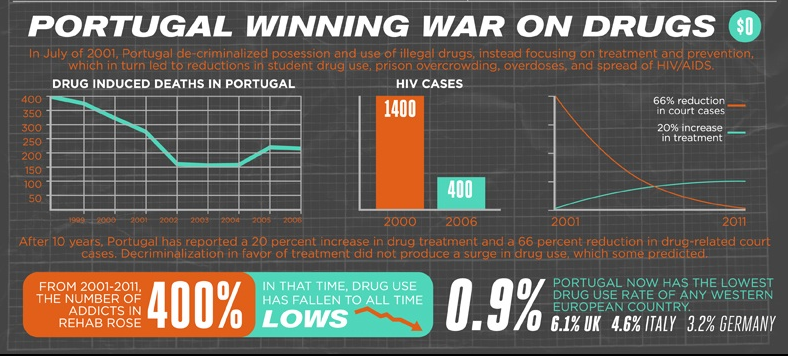

Portugal War on Drugs |

Charts by: Doug Short/ Advisorperspectives, Heritage Foundation, Reason, Washington Post, US Federal Bureau of Prisons, prweb

Chart and image captions by PT

The above article originally appeared at the Diary of a Rogue Economist, written for Bonner & Partners.