Don’t waste your time worrying about things that are well worried. Well worried. One of the best turns of phrase I’ve ever heard in this business that has more than its fair share of adages and idioms. It is also one of the first – and best – lessons I learned from my original mentor in this business. The things you see in the headlines, the things everyone is already worried about, aren’t usually worth fretting...

Read More »Merger mania: Consolidation in the gold mining sector

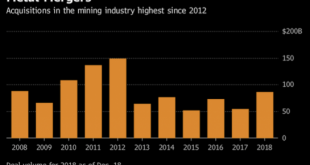

Late last year, Barrick Gold, the world’s largest gold miner in terms of reserves, made headlines when it announced its acquisition of Randgold Resources, in an $18bn mega-merger that marked a key moment for the mining industry. In January, United States gold giant Newmont and principal rival of Barrick, made public its own plans to buy Canada’s Goldcorp, the world’s third-largest bullion producer by market value, for...

Read More »Merger mania: Consolidation in the gold mining sector

Late last year, Barrick Gold, the world’s largest gold miner in terms of reserves, made headlines when it announced its acquisition of Randgold Resources, in an $18bn mega-merger that marked a key moment for the mining industry. In January, United States gold giant Newmont and principal rival of Barrick, made public its own plans to buy Canada’s Goldcorp, the world’s third-largest bullion producer by market value, for $10 billion. The deal, that is largely expected to go ahead and be...

Read More »“Today’s EU is the embodiment of bureaucratic hubris”

Interview with Dr. Markus Krall: When it comes to identifying and evaluating the key vulnerabilities and inherent risks of the banking and financial system, there are few who have the insights and practical experience that is required to truly understand the scale of the issue and its investing implications. This is precisely why Claudio Grass turned to Dr. Markus Krall, who graciously agreed to share his thoughts and observations, as well as his outlook on the future of the financial...

Read More »Claudio Grass – Sound Money & Human Liberty Are Inextricably Linked

SBTV speaks with Claudio Grass, an independent precious metals adviser based in Switzerland. A proponent of sound money and the Austrian School of Economics, Claudio shares his convictions on why human liberty and sound money are inextricably linked. Discussed in this interview: 02:39 Relationship between liberty and sound money 06:51 Keynesian view of money 09:58 Similarities between Austrian School and Keynesian economics? 14:00 Geopolitical issues clouding the near future 18:08...

Read More »ECB: running out of runway – Part II

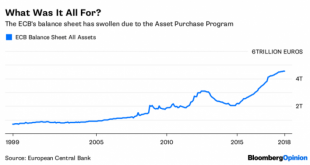

Knock-on effects Overall, under Mr. Draghi’s watch, the ECB’s balance sheet has ballooned to a previously unimaginable scale and aggressive policies like the extensive QE program and negative rates have encouraged the accumulation of debt and heavily distorted market mechanisms. Scores of “zombie” companies, that would have otherwise died off without the artificial life support of cheap credit, are now plaguing most...

Read More »ECB: running out of runway – Part II

Knock-on effects Overall, under Mr. Draghi’s watch, the ECB’s balance sheet has ballooned to a previously unimaginable scale and aggressive policies like the extensive QE program and negative rates have encouraged the accumulation of debt and heavily distorted market mechanisms. Scores of “zombie” companies, that would have otherwise died off without the artificial life support of cheap credit, are now plaguing most major economies. The encouragement and purposeful incentivization of...

Read More »ECB: running out of runway – Part I

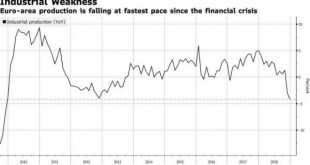

At the end of January, only a month after the official end of the QE program of the European Central Bank (ECB), its President Mario Draghi told the European Parliament’s committee that the central bank could resume its bond purchasing, in a questionable effort to assuage concerns over the impact of the policy change. As Europe’s economy flashes increasingly bright warning signs, doubts are multiplying over the...

Read More »ECB: running out of runway – Part I

At the end of January, only a month after the official end of the QE program of the European Central Bank (ECB), its President Mario Draghi told the European Parliament’s committee that the central bank could resume its bond purchasing, in a questionable effort to assuage concerns over the impact of the policy change. As Europe’s economy flashes increasingly bright warning signs, doubts are multiplying over the sustainability of the ECB’s plans, the efficacy of its measures and its...

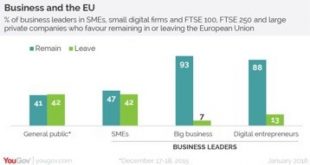

Read More »Brexit: A country divided

One of the most commonly cited arguments initially against Brexit, and now against a no-deal scenario, is the towering threat of businesses leaving the UK. A great many campaigners and leading figures of the Remain camp have warned voters time and time again of the dangers to British industry and ultimately to their jobs. They will often point to early evidence of such a shift, to companies moving either their headquarters or part of their operations to Germany, the Netherlands or other...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org