Interview with Alasdair Macleod: The past few months have been an exciting time for gold investors, as the precious metal has seen a spike in demand after serious economic concerns and geopolitical tensions unsettled the markets. Many mainstream analysts have pointed to a number of recent events, from the US-China trade war escalations to the inverted yield curve, to explain the recent gold rally. Although these developments certainly play a part in short-term price moves and are of...

Read More »“The Eurozone faces the worst combination of economic and systemic risk”

Interview with Alasdair Macleod: The past few months have been an exciting time for gold investors, as the precious metal has seen a spike in demand after serious economic concerns and geopolitical tensions unsettled the markets. Many mainstream analysts have pointed to a number of recent events, from the US-China trade war escalations to the inverted yield curve, to explain the recent gold rally. Although these developments certainly play a part in short-term price moves and are of...

Read More »Big Difference Which Kind of Hedge It Truly Is

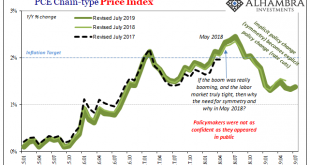

It isn’t inflation which is driving gold higher, at least not the current levels of inflation. According to the latest update from the Bureau of Economic Analysis, the Federal Reserve’s preferred inflation calculation, the PCE Deflator, continues to significantly undershoot. Monetary policy explicitly calls for that rate to be consistent around 2%, an outcome policymakers keep saying they expect but one that never happens. For the month of July 2019, the index...

Read More »Monthly Macro Monitor: Market Indicators Review

This is a companion piece to last week’s Monthly Macro report found here. The Treasury market continues to price in lower nominal and real growth. The stress, the urgency, I see in some of these markets is certainly concerning and consistent with what we have seen in the past at the onset of recession. The move in Treasuries is by some measures, as extreme as the fall of 2008 when we were in a full blown panic. That to me, is evidence that this move is overly...

Read More »The Fed’s Capitulation: What It Means For Gold Investors

“Perhaps they think that they will exercise power for the general good, but that is what all those with power have believed. Power is evil in itself, regardless of who exercises it.” – Ludwig von Mises, Nation, State, and Economy After the Federal Reserve’s monetary policy U-turn earlier this year and the central bank’s decision to cut interest rates for the first time in a decade, mainstream investors and analysts believe that holding rates lower and for longer will help keep...

Read More »THE FED’S CAPITULATION: WHAT IT MEANS FOR GOLD INVESTORS

“Perhaps they think that they will exercise power for the generall good, but that is what all those with power have believed. Power is evil in itself, regardless of who exercises it.” – Ludwig von Mises, Nation, State, and Economy After the Federal Reserve’s monetary policy U-turn earlier this year and the central bank’s decision to cut interest rates for the first time in a decade, mainstream investors and analysts believe that holding rates lower and for longer will help keep...

Read More »THE FED’S CAPITULATION: WHAT IT MEANS FOR GOLD INVESTORS

“Perhaps they think that they will exercise power for the generall good, but that is what all those with power have believed. Power is evil in itself, regardless of who exercises it.” – Ludwig von Mises, Nation, State, and Economy After the Federal Reserve’s monetary policy U-turn earlier this year and the central bank’s decision to cut interest rates for the first time in a decade, mainstream investors and analysts believe that holding rates lower and for...

Read More »“More of the same” at the ECB increases gold’s appeal

“The intellectual leaders of the peoples have produced and propagated the fallacies which are on the point of destroying liberty and Western civilization.” Ludwig von Mises, Planned Chaos It took multiple meetings and over 50 hours of official negotiations for EU leaders to reach an agreement on the appointments for the top jobs of the EU and the ECB, but in mid-July the results finally came in. The ECB was particularly in focus, as bad news keeps piling up for the Eurozone economy and...

Read More »“More of the same” at the ECB increases gold’s appeal

“The intellectual leaders of the peoples have produced and propagated the fallacies which are on the point of destroying liberty and Western civilization.” Ludwig von Mises, Planned Chaos It took multiple meetings and over 50 hours of official negotiations for EU leaders to reach an agreement on the appointments for the top jobs of the EU and the ECB, but in mid-July the results finally came in. The ECB was particularly in focus, as bad news keeps piling up for the...

Read More »New solutions to old problems: The CoreLedger Decentralized Token Economy Operating System

“Systems which are in an unnatural state, like our current financial system, only need a push to relax all the accumulated energy and evolve into something new.” Dr. Johannes Schweifer, Co-Founder and CEO of CoreLedger. Following the rise and fall of Bitcoin and the crypto rush-and-crash of 2017, words like “blockchain” and “tokenization” have entered the mainstream. However, as most people watching, or even participating, in the crypto-mania didn’t actually have a clear understanding...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org