The ‘Fed put’ – gone until there’s blood in the streets Well, it’s happening. Bitcoin (and other cryptocurrencies are sharply down, along with equity markets in many advanced economies. And the Federal Reserve (the U.S. Central Bank) statement and press conference on Wednesday didn’t indicate any backing down from raising interest rates, maybe as soon as the March meeting. The Fed’s stance pivot from ‘the economy needs additional stimulus’ to ‘it is time to start...

Read More »Missing the forest for the tree

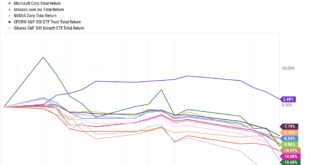

Over the second half of January, we witnessed a fresh wave of volatility in equity markets, culminating in a pullback that caused widespread concern and endless headlines in the mainstream financial press. There was speculation of a full blown correction, other “experts” disagreed and predicted that central bankers would never allow that to happen, while others still tried to account for the market’s moves by using the same explanations we’ve been hearing throughout the covid crisis...

Read More »Weekly Market Pulse: Fear Makes A Comeback

Fear tends to manifest itself much more quickly than greed, so volatile markets tend to be on the downside. In up markets, volatility tends to gradually decline. Philip Roth Be fearful when others are greedy and be greedy when others are fearful. Warren Buffett The new year hasn’t gotten off to a great start for growth stocks or any of the other speculative assets that have drawn so much attention over the last couple of years. Bitcoin is down 25% since the...

Read More »European Energy Crisis: 4 Things You MUST Know!

European Energy Crisis: 4 Reasons You MUST Know! European households are facing rising prices on many goods and services, but one particular standout is electricity and gas bills. According to Bank of America, European household gas bills are expected to rise to €1,850 in 2022 from €1,200 in 2020 (an ~55% increase). Natural gas prices have pulled back from the December peak. However, it remained high and it could get worse over the remainder of the winter months....

Read More »Central Banks’ record gold stockpiling

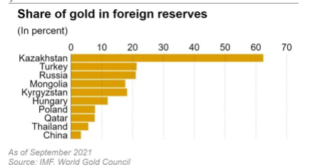

According to recently released data by the World Gold Council (WGC), as of September 2021, the total amount of gold held in reserves by central banks globally exceeded 36,000 tons for the first time since 1990. This 31-year record was the result of the world’s central banks adding more that 4,500 tons of the precious metal to their holdings over the last decade and it provides ample support for the investment case for gold, in both directly performance-related...

Read More »Central Banks’ record gold stockpiling

According to recently released data by the World Gold Council (WGC), as of September 2021, the total amount of gold held in reserves by central banks globally exceeded 36,000 tons for the first time since 1990. This 31-year record was the result of the world’s central banks adding more that 4,500 tons of the precious metal to their holdings over the last decade and it provides ample support for the investment case for gold, in both directly performance-related terms, but also from a...

Read More »Gold Price News: Gold Down 1% in Wake of More Hawkish Federal Reserve Meeting Minutes

Gold price fell to $1,808 an ounce in the wake of the release of the minutes of the December Federal Reserve meeting, having hit an intra-day high of $1,829. Silver price fell to $22.72 an ounce from an intra-day high of $23.26. Gold and silver have continued to sell off this morning with gold trading as low as $1,794 and silver trading down to $22.14. The FOMC minutes showed a much more hawkish Fed than markets had been expecting. The minute suggests that the Fed...

Read More »Planet Lockdown Film is coming on Jan 15th!

Short Trailer to the international documentary PLANET LOCKDOWN. WHERE ARE WE? Full release in multiple languages January 15th:PlanetLockdownFilm.com Subscribe to the email list for updates on the film and interviews:https://planetlockdownfilm.com/lists/?p=subscribe Watch more full interviews and educate yourself!https://planetlockdownfilm.com/full-interviews/

Read More »A conversation about life, the UN and the world we are in with my friend Rafi Farber

[embedded content]

Read More »Lessons from 2021: The rational way out

As we are all preparing to bid farewell to 2021, there is a general feeling that this year, much like its predecessor, will not be missed. To my mind, however, it is clear that even though the past 12 months didn’t really teach us anything new, they did help cement the lessons of 2020 and spread important ideas to people who might otherwise have never come to question anything about the status quo. To me, this is a crucial step forward and one that is absolutely...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org