USD/CHF The USDCHF pair trading settles below the previously broken support that appears in the image, while stochastic provides negative overlapping signal on the four hours time frame, which supports the continuation of our bearish trend expectations in the upcoming sessions, reminding you that our next target at 0.9254. Therefore, the decline will remain preferred on the intraday basis unless breaching 0.9424 level...

Read More »CNY, Not Imports

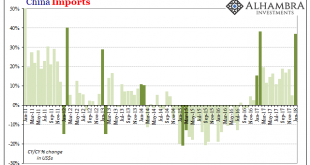

In February 2013, the Chinese Golden Week fell late in the calendar. The year before, 2012, New Year was January 23rd, meaning that the entire Spring festival holiday was taken with the month of January. The following year, China’s New Year was placed on February 10, with the Golden Week taking up the entire middle month of February. For economic statistics, that meant extreme difficulty translating year-over-year...

Read More »Global Asset Allocation Update:

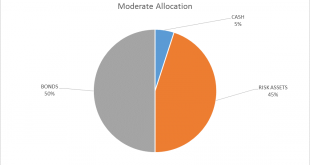

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. Despite the selloff of the last week I don’t believe any portfolio action is warranted. While the overbought condition has largely been corrected now, the S&P 500 is far from the opposite condition, oversold. At the lows this morning, the S&P 500 was officially in...

Read More »Weekly Technical Analysis: 05/02/2018 – USD/JPY, EUR/USD, GBP/USD, AUD/USD, USD/CHF

USD/CHF The USDCHF pair traded with clear negativity yesterday to approach our waited target at 0.9418, to keep the bullish trend scenario active until now, being away that it is important to monitor the price behavior when touching the mentioned level, as breaching it will push the price to extend its gains and head towards 0.9530 as a next station, while its stability will push the price to decline again. We should...

Read More »Weekly Technical Analysis: 29/01/2018 – USDJPY, EURUSD, GBPUSD, GBPJPY

USD/CHF The USDCHF pair shows some bullish bias to approach retesting the previously broken support that turns into key resistance now at 0.9418, noticing that stochastic loses its bullish momentum clearly to reach the overbought areas, while the EMA50 forms continuous negative pressure against the price. Therefore, our bearish overview will remain active for today unless breaching 0.9418 level and holding above it,...

Read More »Bi-Weekly Economic Review: Markets At Extremes

Economic Reports Production Production ended the year on a strong note but early readings from January are not as positive. The December industrial production report headline was strong at a 0.9% gain but a lot of that strength was in the mining (oil drilling) and utility sectors. Mining has actually led the way the last year as rig count has risen with drilling activity. I’d love to see our economy less dependent on...

Read More »Weekly Technical Analysis: 22/01/2018 – USD/JPY, EUR/USD, GBP/USD, USD/CHF

USD/CHF The USDCHF pair found solid support at 0.9564 barrier, which forced the price to rebound bullishly to approach testing the key resistance 0.9655, met by the EMA50 to add more strength to it, while stochastic shows clear overbought signals now. Therefore, these factors encourage us to continue suggesting the bearish trend in the upcoming sessions, as our next main target is located at 0.9420, noting that the...

Read More »Weekly Technical Analysis: 15/01/2018 – USDJPY, EURUSD, GBPUSD, WTI Oil Futures

USD/CHF The USDCHF pair succeeded to break 0.9656 level and hold with a daily close below it, which confirms opening the way to extend the bearish wave towards our yesterday’s mentioned next target at 0.9566, noticing that the price approaches retesting the broken level now. Therefore, we are waiting for more decline in the upcoming sessions, noting that breaching 0.9656 might push the price to achieve some intraday...

Read More »Bi-Weekly Economic Review: A Weak Dollar Stirs A Toxic Stew

Economic Reports Employment We received several employment related reports in the first two weeks of the year. The rate of growth in employment has been slowing for some time – slowly – and these reports continue that trend. The JOLTS report showed a drop in job openings, hires and quits. The Fed has been talking about a tight labor market but this report peaked last July so that may not be as much a concern as they...

Read More »Global Asset Allocation Update

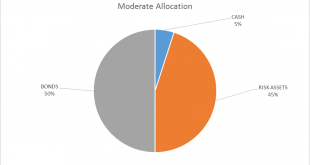

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market persists so I will continue to hold a modest amount of cash. There are some minor changes within the portfolios but the overall allocation is unchanged. - Click to enlarge There have been two major developments since...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org