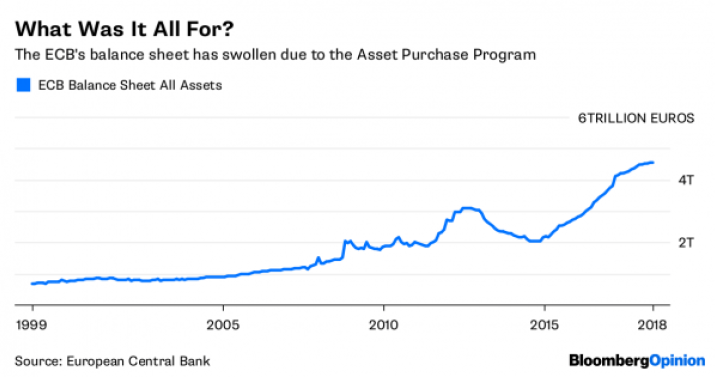

Knock-on effects Overall, under Mr. Draghi’s watch, the ECB’s balance sheet has ballooned to a previously unimaginable scale and aggressive policies like the extensive QE program and negative rates have encouraged the accumulation of debt and heavily distorted market mechanisms. Scores of “zombie” companies, that would have otherwise died off without the artificial life support of cheap credit, are now plaguing most major economies. The encouragement and purposeful incentivization of debt over saving or prudent, long-term investing has created a toxic pile of bad loans, of a potentially catastrophic scale. Should a default avalanche be triggered, the already ailing and highly vulnerable banking sector is unlikely to

Topics:

Claudio Grass considers the following as important: 2) Swiss and European Macro, Economics, Finance, Gold, Gold price performance, Monetary, Politics

This could be interesting, too:

Investec writes The Swiss houses that must be demolished

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Investec writes Swiss milk producers demand 1 franc a litre

Knock-on effectsOverall, under Mr. Draghi’s watch, the ECB’s balance sheet has ballooned to a previously unimaginable scale and aggressive policies like the extensive QE program and negative rates have encouraged the accumulation of debt and heavily distorted market mechanisms. Scores of “zombie” companies, that would have otherwise died off without the artificial life support of cheap credit, are now plaguing most major economies. The encouragement and purposeful incentivization of debt over saving or prudent, long-term investing has created a toxic pile of bad loans, of a potentially catastrophic scale. Should a default avalanche be triggered, the already ailing and highly vulnerable banking sector is unlikely to be able to absorb the shock. At the same time, key European countries are drowning in government debt and are in no position to use fiscal measures and stimulus programs to resuscitate their economies. Also, millions of pensioners and savers have been consistently penalized for responsible financial management and long-term thinking, while reckless corporate spending sprees with borrowed money have been encouraged. Additionally, as returns vanished from investment vehicles that were once considered slow, steady and safe options for those with low-risk tolerance, even responsible investors were forced into riskier areas of the market in the pursuit of healthy performances. Apart from an adverse economic impact, these policies also fuelled social divisions. As those at the top of the pyramid saw the value of their assets artificially increase, the vast majority of the population, that does not benefit from climbing stock prices, was also denied the chance to benefit from saving. As the gap grew, such unfair advantages boiled over and contributed significantly to the political tensions we see today. To a large extent, the rise of populism all over the globe can trace its roots to the disparities that were encouraged by these policies and to the widening of the socioeconomic divide that they contributed to. What is even more worrying, is the toxic and unpredictable escalation of this toxic friction and internal conflict in the event of a crisis. As there is plenty of fuel already spread throughout many European nations, the match that another recession would light is a sobering thought indeed. All in all, at this stage, with the current environment primed and ready for a recession, simply ending the monthly bond purchases can hardly be expected to make a difference. Any attempt by the ECB for a meaningful reversal of these policies is not just bound to fail, but also risks triggering an economic meltdown. |

ECB Balance Sheet All Assets, 1999 - 2018 |

Implications for investorsAfter the latest developments in a long series of bad news, the downward revisions of forecasts and the spiking concerns over the economic slowdown both in Europe and globally, investors, quite predictably, have started to shift towards risk-off approaches and to gravitate towards safe haven assets. The gold price has benefited considerably already, as the precious metal appears to have decisively entered a new phase, leaving behind its multi-year rout. In late January, the gold price finally broke through the $1300 barrier and it continues to hover above it since. This recent uptick in investor interest is, of course, welcome news for gold owners, yet it will likely pale by comparison to the surge in demand that would follow the onset of a recession. Most analysts and forecasts are already positive on the precious metal for this year, even though the potential for a severe downturn hasn’t been widely factored in. Thus, merely from a performance outlook point of view, now is a very good time to expand one’s precious metals holdings. However, gold is bound to play a much more essential role in a portfolio in the years ahead. With an increasing number of analysts, investors and economists anticipating a recession by 2020, bracing and preparing for worst-case scenarios is a wise choice. Unlike the 2008 crisis, when central banks still had cards up their sleeves, the next meltdown will find them woefully underprepared. If massive QE and extremely low-interest rates were then criticized as radical, overzealous and dangerously aggressive measures, the central banks’ reaction to the coming recession will likely be even more reckless. Given such a grim outlook, it is likely that the ECB, having learned nothing from past mistakes, will jump in once again and try to avert disaster by printing more money and using cheap credit as a panacea. Of course, this would be very beneficial for gold especially in Euro terms. As for the US, we can’t know yet just how much money is going to be pumped into the market in such a scenario and we have to observe the pressure that the USD could exert on gold. Nevertheless, the US is not too keen on a strong USD and thus from a certain point onwards, we can expect the FED to start printing as well. |

Gold Price Performance, 2004 - 2019(see more posts on Gold price performance, ) |

Overall, as the risk of a recession intensifies, it becomes increasingly clear that this time it will be different. With only a few and severely weakened tools left at their disposal, “coming to the rescue” is bound to push central bankers further into experimental territory, with unpredictable and perilous results. Thus, for the prudent investor, planning ahead for such eventualities is key to protecting and preserving their wealth. Physical precious metals, safely stored in a stable jurisdiction and outside the baking system, will play an essential role in achieving this.

Claudio Grass, Hünenberg See, Switzerland

www.claudiograss.ch

This article has been published in the Newsroom of pro aurum, the leading precious metals company in Europe with an independent subsidiary in Switzerland. All rights remain with the author and pro aurum.

Always up to date: Follow pro aurum on Social Media

So, you won’t miss a thing! Information and chart analyses, gold and silver news, market reports, as well as our discount campaigns and events.

Tags: Economics,Finance,Gold,Gold price performance,Monetary,Politics