Interview with Godfrey Bloom: Part II of II (click on this link for Part I) Claudio Grass (CG): With everything that’s been going on, it could be argued that very few of Liz Truss’s predecessors had worse luck in their first month in office. The Queen’s death dominated international mainstream media for weeks and it reignited a lot of old debates about Britain’s past and about the monarchy itself. What is your own view on the monarchy? Is it just a...

Read More »“The British people are politically homeless – Part I”

Interview with Godfrey Bloom: Part I of II A lot has been said and written about Britain’s political and economic woes since Brexit, and even more so over the last two years. Overwhelmingly, mainstream media coverage has been negative and many of the nation’s problems have been blamed on Brexit itself. The role of the lockdowns, the forced business closures and especially of the extreme fiscal and monetary interventions during the Covid crisis has been downplayed, or often gone...

Read More »“The British people are politically homeless – Part I”

Interview with Godfrey Bloom: Part I of II A lot has been said and written about Britain’s political and economic woes since Brexit, and even more so over the last two years. Overwhelmingly, mainstream media coverage has been negative and many of the nation’s problems have been blamed on Brexit itself. The role of the lockdowns, the forced business closures and especially of the extreme fiscal and monetary interventions during the Covid crisis has been downplayed,...

Read More »Physical Gold & Why I Hold it – Bubba Horwitz

Founder and CEO Todd Bubba Horwitz joins GoldCore TV’s Dave Russell to discuss the Great Reset, physical gold investment forthcoming stagflation . This is Bubba’s first appearance on GoldCore TV , and we’re delighted to welcome him. When Dave spoke to Bubba, they covered a lot of ground: from the rock and a hard place that the Fed finds itself in, to the impact on the housing market, the Green New Deal, the oil price and, of course, the price of both gold and...

Read More »Were the UK pension funds just the canary in the gold mine?

This week we ask if the wobble experienced by UK pension funds, last week, was just the canary in the gold mine for the global economy. If not for other central banks then this was certainly a reminder for individuals, who were prompted to ask about the levels of counterparty risk their savings and pensions were exposed to, and how they might better protect themselves in the coming months and years. UK pension funds’ lack of liquidity is only the first fault line in...

Read More »Fernando del Pino Calvo-Sotelo: The decline of Reason in the West

by Claudio Grass, Hünenberg, Switzerland It will come as no surprise to friends and regular readers that I hold but a handful of contemporary intellects in high esteem, given the present Zeitgeist, the current state of state education and the level of public discourse. It will be even less surprising that Fernando del Pino Calvo-Sotelo is one of them. He is a free and independent thinker, whose original, unshackled and unadulterated ideas I have often found inspiring and...

Read More »Fernando del Pino Calvo-Sotelo: The decline of Reason in the West

by Claudio Grass, Hünenberg, Switzerland It will come as no surprise to friends and regular readers that I hold but a handful of contemporary intellects in high esteem, given the present Zeitgeist, the current state of state education and the level of public discourse. It will be even less surprising that Fernando del Pino Calvo-Sotelo is one of them. He is a free and independent thinker, whose original, unshackled and unadulterated ideas I have often...

Read More »Ed Steer Gold And Silver – We Ain’t Seen Nothing Yet!

Our guest this week is Ed Steer, expert gold and market analyst and author of the Gold & Silver Digest. We invited Ed onto GoldCore TV to get his take on what is concerning him most in financial markets, movements in SLV and sanctions against Russia. He also draws our attention to central bank purchases of gold. Ed’s interview serves as a reminder that those who currently do own gold and silver are just the tip of the iceberg when it comes to the number of people...

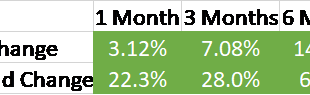

Read More »Weekly Market Pulse: Peak Pessimism?

Goodbye and good riddance to the third quarter of 2022. That was one of the wildest 3 months I’ve experienced in my 40 years of trading and investing. The quarter started off great with the S&P 500 rising 14% from July 1 to August 16 but ended with a 17% swan dive into the end of the quarter. And we closed on the low of the year. The 10-year Treasury yield rose from 2.97% to 4% just a few days before the end of the quarter. The 3-7 year Treasury index – our...

Read More »Ross Geller inspires Bank of England policy

This morning the UK pound slumped as one of the world’s oldest central banks pressed hard on the panic button. The Bank of England was seen to be shouting ‘Pivot! Pivot! Pivaat!’ as they announced they would temporarily suspend their programme to sell gilts and will instead buy long-dated bonds. In a statement, the bank said that they would be embarking on a “temporary and targeted” bond buying operation. Although we expect it to be about as temporary and as...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org