Precious metals analyst and expert Claudio Grass returns to SGT Report to discuss the World Economic Forum and the New World Order. Click on the below link – the content is too much for YouTube and therefore we have to protect on rumble to avoid the “spin-doctors” from the “Ministry of Truth”. Enjoy and stay free Claudio Grass, Hünenberg See, Switzerland https://rumble.com/v1i6fwx-humanity-rising-destroying-the-nwo-with-truth-claudio-grass.html This work is licensed...

Read More »Conversation with Sean from SGT

Precious metals analyst and expert Claudio Grass returns to SGT Report to discuss the World Economic Forum and the New World Order. Click on the below link – the content is too much for YouTube and therefore we have to protect on rumble to avoid the “spin-doctors” from the “Ministry of Truth”. Enjoy and stay free Claudio Grass, Hünenberg See, Switzerland https://rumble.com/v1i6fwx-humanity-rising-destroying-the-nwo-with-truth-claudio-grass.html...

Read More »US CPI Data Release Update

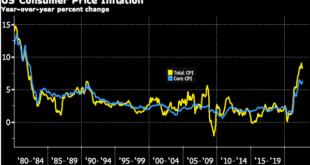

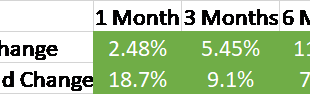

It is easy to get caught up in data releases. The media is keen to read a lot into them, hoping it will offer some sense of what is really going on, so often the news is about numbers just announced or expectations for what one economic measure will show from one month to the next. However, as we outline below, many of the numbers that are released on a frequent and regular basis (CPI and employment, for example) can be misleading. Whether it’s down to the inputs or...

Read More »The many perils of “Stockholm syndrome” politics

It’s been a tumultuous couple of months in UK politics. After a troubled time in office, plagued by scandal, internal party frictions and much public embarrassment, Boris Johnson exited the stage leaving behind a big old mess for his successor to clean up. An economy in tatters, inflation at record highs and an energy crisis the likes of which this generation hasn’t seen before. It’s a miracle that anyone in the kingdom could be found that would be...

Read More »The many perils of “Stockholm syndrome” politics

It’s been a tumultuous couple of months in UK politics. After a troubled time in office, plagued by scandal, internal party frictions and much public embarrassment, Boris Johnson exited the stage leaving behind a big old mess for his successor to clean up. An economy in tatters, inflation at record highs and an energy crisis the likes of which this generation hasn’t seen before. It’s a miracle that anyone in the kingdom could be found that would be willing to assume the...

Read More »What Problem Does Gold Solve?

Realising that you need to protect your portfolio from financial systemic risks is a tricky thing. Because, not only have you identified that all is not well in the economy but you now need to make a decision about how best to protect your investments. In all likelihood, this is why you own or are thinking about owning gold bullion. Have you ever asked yourself? What problem does gold solve in today’s environment? Should I own gold ETFs or gold bullion? What is and...

Read More »Weekly Market Pulse: No News Is…

Nothing happened last week. Stocks and bonds and commodities continued to trade and move around in price but there was no news to which those movements could be attributed. The economic news was a trifle and what there was told us exactly nothing new about the economy. A report that wholesale inventories rose 0.6% cannot be turned into market moving news no matter how hard the newsletter sellers try. Jobless claims fell 8,000? Yawn. Exports rose $500 million? In a...

Read More »We Didn’t Print Money… Honest We Didn’t And More Baseless ClapTrap from Central Banks

One of the reasons people choose to invest in gold bullion or to buy silver coins is because they are simple and they are finite; basically the opposite of fiat currency. The complexity of fiat-driven markets and infinite possibilities to create money works to the advantage of central banks. . And they particularly like to take advantage when asked by the general public a very obvious question… Central banks are on the defensive over printing too much money during...

Read More »Ep 40 – Dan Oliver Jr: Markets Will Force the Fed to Balance

Dan Oliver of Myrmikan Capital joins Keith and Dickson on the Gold Exchange Podcast to talk about the history of credit bubbles, the inevitability of central bank failings, and what history can tell us about the Fed’s current trajectory. Connect with Dan on Twitter: @Myrmikan and at Myrmikan.com Connect with Keith Weiner and Monetary Metals on Twitter: @RealKeithWeiner@Monetary_Metals [embedded content] Additional Resources CMRE.org Myrmikan.com Gold Backwardation...

Read More »Eat or heat

Europeans are already facing previously unthinkable dilemmas As the citizens of the Eurozone and the UK are increasingly struggling to make ends meet due to record levels of inflation, and as the winter draws closer, a serious cost of living crisis is set to spiral out of control. Skyrocketing energy costs, combined with galloping prices for food and other essential goods and services are bound to erase whatever was left of the “middle class”. Households that were once...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org