Late 2014/early 2015 will perhaps be the closest to a real recovery from the Great “Recession” we shall see in this cycle. Q1 2015 marked the peak year over year growth rate of GDP in this recovery at 3.76%. That rate compares quite unfavorably with even the feeble post dot com crash recovery high of 4.41% in Q1 2004. It doesn’t even come close to the routine 4-5% year over year growth rates we saw in the late 90s....

Read More »FX Weekly Preview: Moving Toward September

Summary: The technical and fundamental case for the euro has weakened. Rate differentials have begun moving back in the US favor. France’s Macron and Japan’s Abe have sunk in the polls lower than Trump. The release of the US employment data before the weekend ushers in a three-week period before the Jackson Hole confab at the end of the month that will start the new phase. In September, the FOMC is likely to...

Read More »FOMC Sticks to Script: Balance Sheet Unwind to Begin “Relatively Soon” and USD Retreats

Summary: Little new in FOMC statement. Seems consistent with a Sept announcement to begin reducing the balance sheet in Oct. USD sold off as if reflecting sentiment held in bay until the statement was out of the way. The FOMC statement reads very much like the June statement. There were some minor tweaks in the first paragraph that discusses the broad economic performance since the last FOMC statement. There...

Read More »FX Daily, July 26: Quiet Fed Day without Yellen

Swiss Franc The euro is up by 0.56% to 1.1152 CHF EUR/CHF and USD/CHF, July 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates By definition, the Federal Reserve Open Market Committee meeting is the highlight of the day. Without a press conference, and following last month’s rate hike, there is practically no chance of a new policy initiative either on the balance sheet...

Read More »FX Weekly Preview: Don’t Be Confused by the Facts or Why Neither the Data nor the Fed Will Alter Market Trends

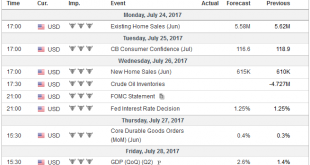

Summary: FOMC is the highlight of the week. Early look at July inflation in Europe may see less pressure. Overall household consumption in Japan is rising, helped by robust labor market, but little new price pressures. The data this week is expected to confirm what many investors have come to assume. The US economy accelerated in Q2. The eurozone economy is enjoying steady growth, but the momentum appears to...

Read More »Fighting inflation with FX, a real traders market

(GLOBALINTELHUB.COM) Dover, DE — 7/18/2017 — Hidden in plain site, as the Trump administration finally released something of substance regarding the so called promised “Trade Negotiation” we see FX take center stage in the global drama unfolding. As noted on a Zero Hedge article: The much anticipated document (press release and link to full document) released by U.S. Trade Representative Robert Lighthizer said the...

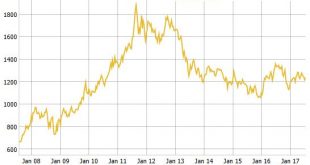

Read More »“Time To Position In Gold Is Right Now” – Rickards

“Time To Position In Gold Is Right Now” – Rickards - "Time to position in gold is right now” - James Rickards- Fed has hit the ‘pause’ button; No more rate hikes for foreseeable future- Fed’s theories "bear no relation to reality" and has "blundered by raising rates"- Growth is weak, inflation is weak, retail sales and real incomes are weak- Tight money, weak economy & stock bubble classic recipe for market crash- Reduce allocations to stocks and reallocate to...

Read More »US S&P 500 Index, Federal Funds Target, Manufacturing Payrolls, US Imports and US Banking Data: All Conundrums Matter

Since we are this week hypocritically obsessing over monetary policy, particularly the federal funds rate end of it, it’s as good a time as any to review the full history of 21st century “conundrum.” Janet Yellen’s Fed has run itself afoul of the bond market, just as Alan Greenspan’s Fed did in the middle 2000’s. But that latter example wasn’t truly the first conundrum for monetary policy. There remain a great many...

Read More »Fighting inflation with FX, a real traders market

(GLOBALINTELHUB.COM) Dover, DE — 7/18/2017 — Hidden in plain site, as the Trump administration finally released something of substance regarding the so called promised “Trade Negotiation” we see FX take center stage in the global drama unfolding. As noted on a Zero Hedge article: The much anticipated document (press release and link to full document) released by U.S. Trade Representative Robert Lighthizer said the Trump administration aimed to reduce the U.S. trade deficit by...

Read More »Arguments Against Strict Monetary Policy Rules

In its July 2017 Monetary Policy Report, the Board of Governors of the Federal Reserve System discusses monetary policy rules. On pp. 36–38, the Board argues that [t]he small number of variables involved in policy rules makes them easy to use. However, the U.S. economy is highly complex, and these rules, by their very nature, do not capture that complexity. … Another issue related to the implementation of rules involves the measurement of the variables that drive the prescriptions...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org