World stocks eased back from record highs and fell for the first time in eight days, as jitters about Catalonia’s independence push returned while bets on higher U.S. interest rates sent the dollar to its highest since mid August; S&P 500 futures were modestly in the red – as they have been every day this week before levitating to record highs – ahead of hurricane-distorted nonfarm payrolls data (full preview here)....

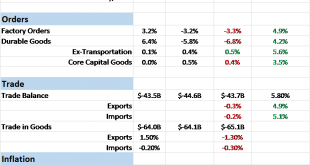

Read More »US: Reflation Check

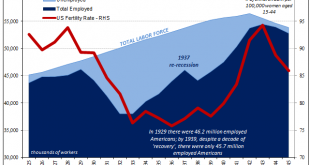

There is a difference between reflation and recovery. The terms are similar and relate to the same things, but in many ways the latter requires first the former. To get to recovery, the economy must reflate if in contraction it was beaten down in money as well as cyclical forces. In the Great Crash of 1929 and after, reflation was required because of the wholesale devastation of the money supply. By pumping up new...

Read More »FX Daily, October 04: Consolidative Tone in FX Continues

Swiss Franc The Euro has risen by 0.10% to 1.1443 CHF. EUR/CHF and USD/CHF, October 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar has a softer tone today, and it was that way even for the European PMI. The greenback eased further after the upside momentum faded yesterday. The heavier tone in Asia seemed spurred by a hedge fund manager’s call that...

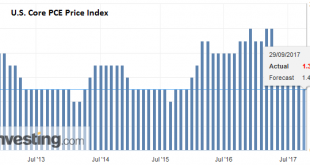

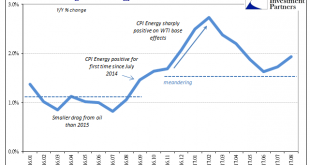

Read More »Evolving Thoughts on Inflation

In early 2005, Greenspan said that the fact that long-term rates were lower despite the Fed’s campaign to raise short-term rates was a “conundrum.” Many rushed to offer the Fed Chair an explanation of the conundrum, which given past cycles may not have been such an enigma in the first place. Be it as it may, at last week’s press conference, Yellen admitted that the decline in inflation was a “mystery.” She said, “I...

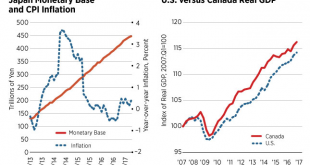

Read More »Why The Fed’s Balance Sheet Reduction Is As Irrelevant As Its Expansion

The FOMC is widely expected to vote in favor of reducing the system’s balance sheet this week. The possibility has been called historic and momentous, though it may be for reasons that aren’t very kind to these central bankers. Having started to swell almost ten years ago, it’s a big deal only in that after so much time here they still are having these kinds of discussions. My own view on the topic is the same as...

Read More »Bi-Weekly Economic Review: As Good As It Gets

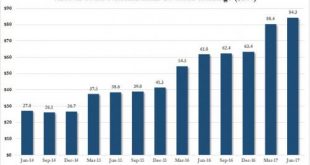

The incoming economic data hasn’t changed its tone all that much in the last several years. The US economy is growing but more slowly than it once did and we hope it does again. It is frustrating for economic bulls and bears, never fully satisfying either. Probably more important is the frustration of the average American, a dissatisfaction with the status quo that permeates the national debate. The housing bubble...

Read More »Commodities King Gartman Says Gold Soon Reach $1,400 As Drums of War Grow Louder

Commodities King Gartman Says Gold Soon Reach $1,400 As Drums of War Grow Louder - 'Commodities King' Gartman sees $1,400 gold surge in months- "Gold is the one currency that will do the best of all..."- Pullback below $1300 "is relatively inconsequential"- Use gold price weakness to be a buyer "no question"- Bullish on gold due to central banks and easy monetary policy and gold will be even higher in euro terms- Gold will be the best of all, as a result of QE and expansionary policies-...

Read More »Fed’s Asset Bubbles Now At The Mercy Of The Rest Of The World’s Central Bankers

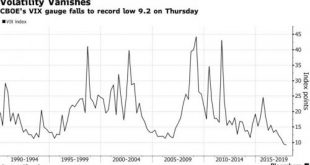

“Like watching paint dry,” is how The Fed describes the beginning of the end of its experiment with massively inflating its balance sheet to save the world. As former fund manager Richard Breslow notes, however, Yellen’s decision today means the risk-suppression boot is on the other foot (or feet) of The SNB, The ECB, and The BoJ; as he writes, “have no fear, The SNB knows what it’s doing.” As we reported previously, In...

Read More »The CPI Comes Home

There seems to be an intense if at times acrimonious debate raging inside the Federal Reserve right now. The differences go down to its very core philosophies. Just over a week ago, Vice Chairman Stanley Fischer abruptly resigned from the Board of Governors even though many believed he was a possible candidate to replace Chairman Yellen at the end of her term next year. His letter of resignation only cited “personal...

Read More »Key Events In The Coming Week: All Eyes On Fed Balance Sheet Announcement

This week attention will fall on US FOMC rate decision, BoJ policy rate announcement, German and NZ elections. Economic data releases include PMI in the Euro area, retail sales in the UK and existing home sales in US. In Emerging Markets, there are monetary policy meetings in South Africa, Indonesia, Hungary, Taiwan and Philippines. BofA highlights the week's key global events: Central bank meetings: US FOMC and BoJ The Fed will make policy announcement on Wednesday. Balance sheet...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org