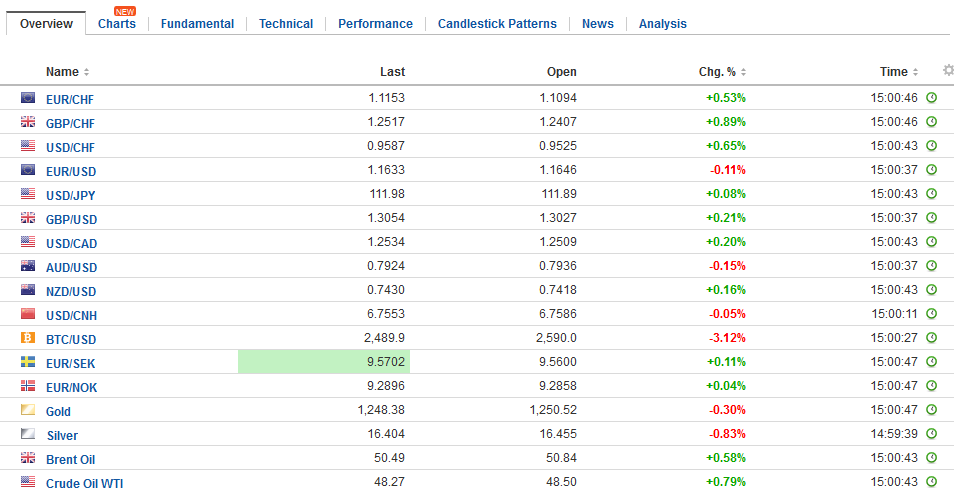

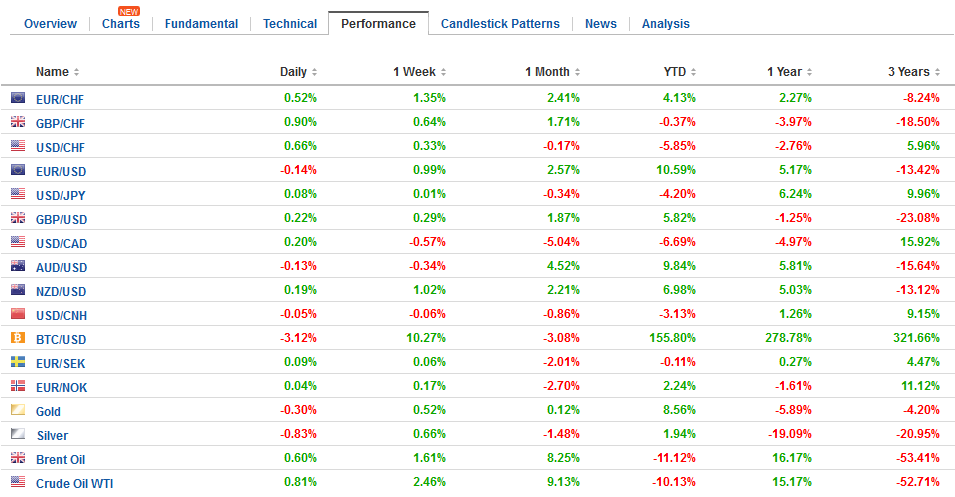

Swiss Franc The euro is up by 0.56% to 1.1152 CHF EUR/CHF and USD/CHF, July 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates By definition, the Federal Reserve Open Market Committee meeting is the highlight of the day. Without a press conference, and following last month’s rate hike, there is practically no chance of a new policy initiative either on the balance sheet or the Fed funds target. Market participants will be most sensitive to how the FOMC statement discusses inflation. In June, the FOMC recognized that inflation had declined and the core was below target. It expected inflation to remain below 2% in the near-term, but stabilize around 2% in the medium

Topics:

Marc Chandler considers the following as important: AUD, Australia Consumer Price Index, EUR, Featured, Federal Reserve, FX Trends, GBP, JPY, newslettersent, Oil, TLT, U.K. Gross Domestic Product, U.S. Crude Oil Inventories, U.S. New Home Sales, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

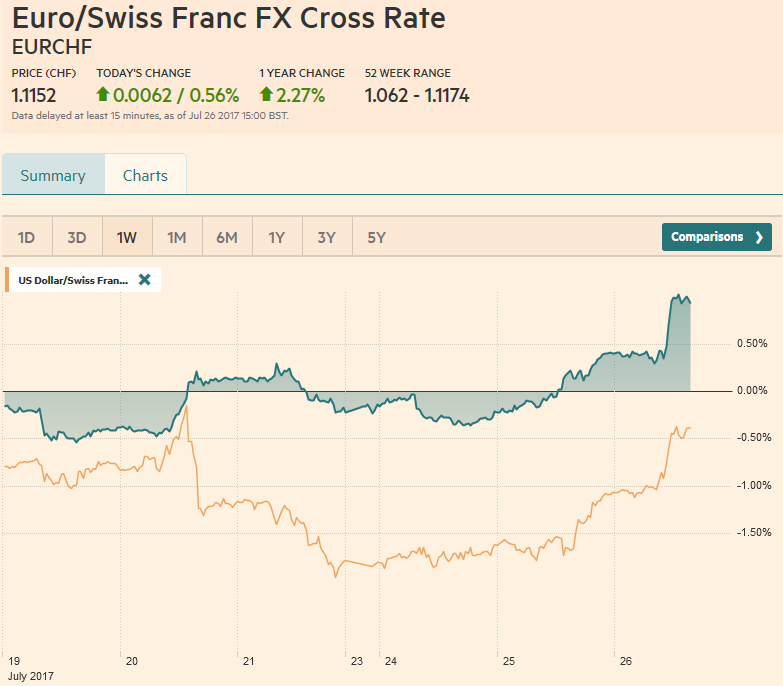

Swiss FrancThe euro is up by 0.56% to 1.1152 CHF |

EUR/CHF and USD/CHF, July 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesBy definition, the Federal Reserve Open Market Committee meeting is the highlight of the day. Without a press conference, and following last month’s rate hike, there is practically no chance of a new policy initiative either on the balance sheet or the Fed funds target. Market participants will be most sensitive to how the FOMC statement discusses inflation. In June, the FOMC recognized that inflation had declined and the core was below target. It expected inflation to remain below 2% in the near-term, but stabilize around 2% in the medium term. Lastly, as the Chair noted in her testimony before Congress, the FOMC statement also indicated that it would monitor inflation closely. There has not been sufficient data to require a significant change in the Fed’s statement. The Fed can show patience. There is no rush. After declining from February through May, core inflation needs to not only stabilize, as core CPI did last month but needs to rise for perhaps a few months before a cautious central banker may feel confident that the spot patch has passed. The scenario we painted after the last FOMC meeting, which sees the Fed announcing the beginning of its balance sheet operations at the September meeting to start in October, and to pause in its rate hikes, after hiking quarterly for three-quarters is gaining adherents. By December, the trajectory of prices, and the economy will be clearer. In this way, the Federal Reserve can achieve a number of its objectives, including beginning the slow reduction of its balance sheet and distancing it from the conduct of monetary policy. The Fed funds target range, with the yield on reserves (not just excess reserves, a point that is not fully appreciated) and reverse repo operations. |

FX Daily Rates, July 26 |

| The rise in the US (and European) yields yesterday helped push the yen lower, but yields softer today and the yen has stopped falling. After dipping below JPY111 on Monday and early Tuesday, the dollar jumped t0 JPY112 yesterday. Poked through it earlier today but is consolidating now. Support is seen in the JPY111.40-JPY111.60. There is a $1 bln option struck near JPY111.30 expiring tomorrow.

The euro spiked nearly $1.1715 yesterday but quickly came off, spurring some talk of a false break. The euro is trading heavily today and made a new four-day low a little below $1.1615. A break of the $1.1600 area could see a quick move to $1.1570. A break of this latter level would likely be seen as a signal that the consolidation is folding into a correction. The technical indicators have not yet turned down, but could on another day decline. There are 620 mln euros struck at $1.16 that will be cut today, and another 520 mln euros struck at $1.1650 that expire. |

FX Performance, July 26 |

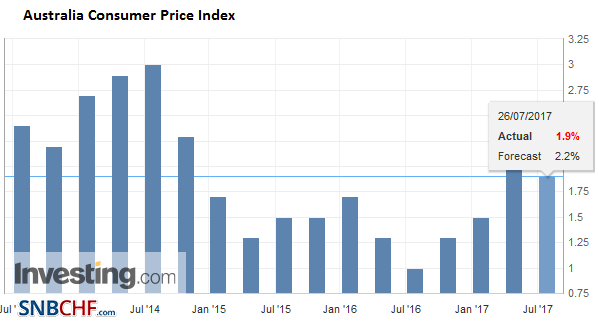

AustraliaThe US dollar is sporting a slightly firmer bias. The biggest loser today is the Australian dollar, which is off nearly 0.5% following a soft headline inflation figure and comments from the central bank governor indicating a lack of urgency to change interest rates. Consumer prices rose 0.2% in Q2, half the pace the economists expected in the Bloomberg survey. The year-over-year pace slipped to 1.9% from 2.1%. The median expectation was for a small uptick. Nevertheless, the trimmed mean and weighted median measures were spot on with a 0.5% increase. Shortly afterward, RBA Governor Lowe underscored the official argument that because the central bank did not ease as much as many other central banks, it needn’t follow them so closely in removing the accommodation. He argued that keeping rates low is helping the economy adjust and underpinning the labor market. Lowe also noted that it would be better if the currency were lower. The Australian dollar approached $0.8000 on July 20 and backed off to $0.7875 before last weekend. It rose in the past two sessions but stalled near $0.7970. Today’s set back help above the $0.7875 low, keeping the consolidative tone intact. The technical indicators are beginning to deteriorate for the Australian dollar, which warns that the consolidation may morph into an outright correction unless the $0.7920 level can be overcome. On the downside, the near-term potential exists toward $0.7780-$0.7800. |

Australia Consumer Price Index (CPI) YoY, Q2 2017(see more posts on Australia Consumer Price Index, ) Source: Investing.com - Click to enlarge |

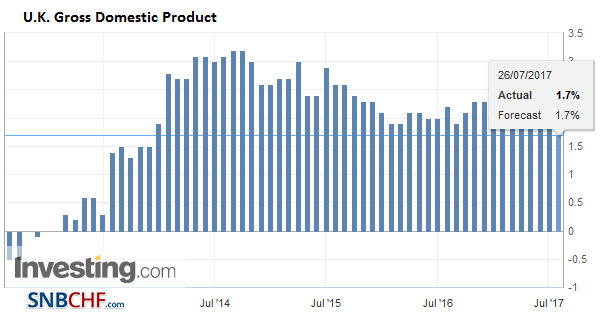

United KingdomThe UK is the first G7 country to report its first estimate of Q2 GDP. It was in line with expectations, rising 0.3% for a 1.7% year-over-year rate. In Q1 the UK economy expanded by 0.2% for a 2.0% year-over-year pace. Services rose 0.5%, while construction fell 0.9% and production fell 0.4% (manufacturing was off 0.5%). If the estimate holds, it points to the weakest six month period since Q4 12-Q1 13. Economists do not expect the UK economy to accelerate, but grow to expand by 0.3% a quarter in H2. Sterling is also consolidating. Like the other major currencies, it has pulled back from yesterday’s high (~$1.3080) but is finding a bid near $1.30 and ahead of Monday’s low near $1.2985. Each of those levels has about GBP300 mln options that expire today. |

U.K. Gross Domestic Product (GDP) YoY, Q2 2017(see more posts on U.K. Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

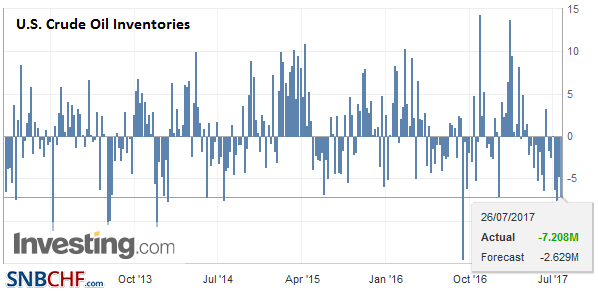

United StatesMeanwhile, oil is building on yesterday’s rally. The 3.35% rally in the September light sweet crude oil futures appears to be the largest of the year. Reports suggest that Saudi Arabia will cut its oil exports by 100k barrels in August and UAE will cut its exports in September. There are also some signs of a potential slowing of production in the US as the rig count build is losing momentum. US oil inventories have been falling sharply according to the Department of Energy estimates. The industry assessment has not shown as dramatic of a draw down, but yesterday it reported a 10.2 mln barrel decline in the week ending July 21. This draw is nearly five times larger than expected. The DoE is expected to estimate a 3.1 mln barrel draw down. |

U.S. Crude Oil Inventories, July 26 2017(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

| Yesterday’s US markets shaped Asia’s performance today. US 10-year yields rose eight basis points yesterday to 2.33%. This dragged Asia-Pacific yields higher today. The US equity rally helped the MSCI Asia Pacific Index to eke out a small gain for the first time this week. Korean and Taiwanese shares fell, but most of the other markets gained. European equities snapped a three-day slide yesterday and are building on that recovery today, with a 0.6% gain. It is being led by consumer staples and utilities, but all industries are participating. |

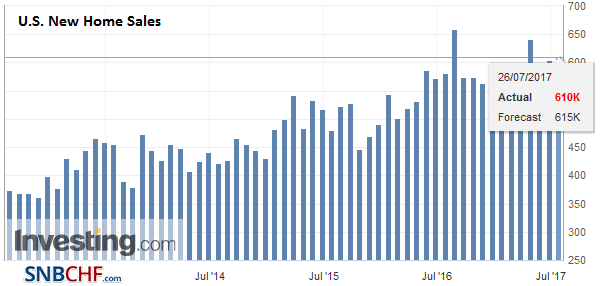

U.S. New Home Sales, June 2017(see more posts on U.S. New Home Sales, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$EUR,$JPY,$TLT,Australia Consumer Price Index,Featured,Federal Reserve,newslettersent,OIL,U.K. Gross Domestic Product,U.S. Crude Oil Inventories,U.S. New Home Sales