The organic food market in Switzerland experienced slower growth in 2021 than the previous year. However, consumers are spending more than ever on organic products. According to annual figures released by the organic food association Bio Suisse on Wednesday, the market for organic products grew 0.6% in 2021 to reach a share of 10.9% of the total market. In 2020, the association recorded a 4% growth in organic sales. One of the reasons for the slower growth is that...

Read More »And Now for a Really Bad Response to Political Calamity: Autarky

The invasion of Ukraine, the spike in inflation and the risks of supply shortages have made some politicians dust off some of the worst economic ideas in history: autarky and protectionism. Some believe that if our nation produced everything we needed we would all be better off because we would not depend on others. The idea comes from a deep lack of understanding of economics. There is no such thing as autarky. There is no such thing as covering all the needs of a...

Read More »Equities Finding a Bid in Europe After Sliding in Asia Pacific

Overview: The capital markets are calmer today. The market is digesting the FOMC minutes, where officials tipped an aggressive path to shrink the balance sheet and confirmed an “expeditious” campaign to lift the Fed funds rate to neutrality. Benchmark 10-year yields are softer, with the US off a couple basis points to 2.58%. European yields are 1-3 bp lower. After the equity losses in the US yesterday, including a 2.2% drop in the NASDAQ, Asia Pacific equities...

Read More »Meta plant Implementierung von Cryptocoins

Unter dem Namen „Meta“ hat Mark Zuckerberg erst vor kurzem sein Unternehmen neu aufgestellt. Das mit dem Unternehmen verbundene Metaverse soll nicht nur die Social Media Plattform Facebook beinhalten, sondern einer ganzen Familie an Apps ein Zuhause bieten. Für die Finanzabwicklung im Metaverse wird offenbar sogar an einem eigenen Cryptocoin gearbeitet. Crypto News: Meta plant Implementierung von Cryptocoins Unter dem Arbeitstitel “Zuck Buck” wird derzeit eine...

Read More »Goldilocks And The Three Central Banks

This isn’t going to be like the tale of Goldilocks, at least not how it’s usually told. There are three central banks, sure, call them bears if you wish, each pursuing a different set of fuzzy policies. One is clearly hot, the other quite cold, the final almost certainly won’t be “just right.” Rather, this one in the middle simply finds itself…in the middle of the other two. Running red-hot to the point of near-horror, that’s “our” Federal Reserve. The FOMC minutes...

Read More »75 percent of Swiss citizens living abroad have more than one nationality

07.04.2022 – At the end of 2021, more than one in ten Swiss citizens lived abroad. This was a 1.5% increase compared with 2020. Most of these citizens lived in Europe. Regardless of the continent in which they lived, the majority were aged between 18 and 64. Reflecting Switzerland’s multicultural nature, many of them also had more than one nationality, according to the results of the statistics on the Swiss abroad from the Federal Statistical Office (FSO). In 2021,...

Read More »Ukraine war no threat to Swiss banks, says financial watchdog

Angehrn (left) and Amstad stressed that stability of the Swiss financial institutions is key for digitalisation and sustainability of the banking sector. © Keystone/Anthony Anex Switzerland’s financial market supervisor FINMA says the Russian invasion of Ukraine isn’t a wide-scale threat to Swiss financial firms’ business ties to Russia. FINMAExternal link’s chief executive Urban Angehrn said that, overall, the immediate effects of risks to the financial centre were...

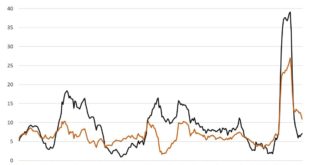

Read More »Money Supply Growth Heads Back Up: February Growth Up to 7 Percent

Money supply growth rose for the third month in a row in February, continuing ongoing growth from October’s twenty-one-month low. Even with February’s rise, though, money supply growth remains far below the unprecedented highs experienced during much of the past two years. During thirteen months between April 2020 and April 2021, money supply growth in the United States often climbed above 35 percent, well above even the “high” levels experienced from 2009 to 2013....

Read More »Cantillon effect: Who’s paying the highest price?

Every time we hear government officials announce their big spending plans, their new welfare programs and their ambitious “job creating” schemes, they always present them as being in defense of the poorest and the most marginalized members of our societies. In coordination with their central bankers, they print and spend new money at will, claiming that it is all for the benefit of the weakest among us and that all the freshly created funds will support them...

Read More »UBS-Präsident Axel Weber verabschiedet sich mit Genugtuung

“Ich habe vor zehn Jahren die Nachfolge von Kaspar Villiger angetreten, der die Bank in den Wirren der Finanzkrise übernahm”, sagte Axel Weber am Mittwoch in einer Abschiedsrede an seiner letzten UBS-Generalversammlung zu den Aktionären. Damals habe er sich gesagt, die UBS müsse wieder als eine Ikone der Schweizer Wirtschaft wahrgenommen werden. “Ich darf heute mit Genugtuung feststellen, dass wir dies auch geschafft haben: UBS ist wieder eine starke Säule der...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org