The states of Europe have more than enough wealth and military potential to deal with a second-rate power like Russia. The American taxpayers, on the other hand, deserve a break from Europe’s grifting. Original Article: “NATO: Our International Welfare Queens” American policy makers have shown a surprising amount of sanity so far in response to Russia’s invasion of Ukraine. While some war enthusiasts among the American punditry have certainly been agitating for...

Read More »Swiss health insurance could jump by 9 percent next year

According to the newspaper Le Matin Swiss health insurance premiums could rise by 7% to 9%, reported RTS. Photo by Karolina Grabowska on Pexels.comThe future rise in the cost of health insurance is estimated based on data on the rising healthcare costs being passed on to health insurance companies. According to the data, costs rose during the second half of 2021. Across all of 2021 costs were up by 5.1% and the trend appears to have continued. Several politicians...

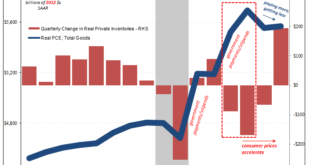

Read More »It Was the Lockdowns, Not the Pandemic That Created the Havoc

It may be years before we fully realize the ramifications of the lockdown policies governments around the world have imposed on their citizens in response to covid-19, but evidence of the costs is starting to trickle in. A recent study conducted by the Centers for Disease Control and Prevention (CDC) surveyed thousands of high school students on the effects of the pandemic. “Since the beginning of the pandemic,” the study reports, “more than half of students found it...

Read More »Honduras akzeptiert Bitcoin als legales Zahlungsmittel

Noch wurde Bitcoin nicht im ganzen Land als legales Zahlungsmittel akzeptiert, doch auf einer Insel vor der Küste Honduras hat nun ein lokales Gericht diese Deklarierung bekanntgegeben. Damit stellt sich das lokale Gericht sogar gegen die Zentralbank das Landes. Bitcoin News: Honduras akzeptiert Bitcoin als legales ZahlungsmittelDie Insel ist Teil einer sogenannten „Economic Zone“, die als „Honduras Prospera“ bezeichnet wird. Erst 2020 gegründet, hat es sich die Zone...

Read More »Worry Walls Don’t Explain Repeated Falls

Someone once said that the stock market is always climbing a wall of worry. Maybe that had been true in some long-ago day, but whether or not it might nowadays is beside the point. The nugget of truth which makes the prosaism memorable is the wall rather than the climber. There’s always something going on somewhere to get worked up over. And it matters to far more than financial actors, the entire global economy must surmount what can seem like an unending series of...

Read More »Do “Inflationary Expectations” Cause Inflation? Contra Krugman, the Answer Is No

In the New York Times article “How High Inflation Will Come Down,” Paul Krugman suggests that the key for future inflation is inflation expectations. Krugman does not think that currently inflation expectations are comparable to the 1980s. According to him: Forty years ago, as many economists will tell you, inflation was “entrenched” in the economy. That is, businesses, workers and consumers were making decisions based on the belief that high inflation would continue...

Read More »Hazlitt, Hayek and How the Fed Made Itself into the World’s Biggest Savings & Loan

The Henry Hazlitt Memorial Lecture, March 18, 20221 Many thanks to the Mises Institute and to sponsor Yousif Almoayyed for this opportunity to be with you all today as we consider one of the truly remarkable developments in the history of American central banking, money printing, and credit inflation. On a personal note, “the pursuit of clarity” has long been a goal of mine, and it’s a particular pleasure to present a lecture in honor of Henry Hazlitt, whose work is...

Read More »New Swiss bank pitches itself as digital, but not robotic

Switzerland’s shrinking banking universe has been bolstered by a new wealth management entrant, Alpian, which is aiming for the sweet spot between digital and human-centric services. Alpian has just secured a Swiss banking license along with a CHF19 million ($20.5 million) capital boost from the Italian banking group Intesa Sanpaolo. Looking at the bare figures, Switzerland could do with some reinforcements. The number of separate banking entities in the Alpine state...

Read More »Switzerland has frozen CHF7.5bn in assets under Russia sanctions

Residents walk through rubble in the Ukrainian city of Bucha on Wednesday. Hundreds of tortured and murdered civilians have been found in Bucha and other parts of the Kyiv region after the Russian army retreated from those areas. Keystone / Roman Pilipey Switzerland has so far frozen some CHF7.5 billion ($8 billion) in funds and assets under sanctions against Russians to punish Moscow’s invasion of Ukraine. These are funds in frozen accounts and properties in four...

Read More »For Freak’s Sake, People, Even the Crash Test Dummies Are Nervous

Those trusting the Fed to be visibly weak, corrupt and incompetent forever might be in for an unwelcome surprise. When even the crash test dummies are nervous, it pays to pay attention. Being in a mild crash isn’t too bad if all the protective devices inflate as intended. But in a horrific crash where nothing goes as planned, it’s like speeding in a ready-to-explode Pinto and being side-swiped by a semi on Dead Man’s Curve. The stock market is in the Pinto, and the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org